- Different Methods to Download Your PAN Card

- How to Download PAN Card Online?

- Download PAN Card from NSDL (Protean)

- Download PAN Card from UTIITSL

- Download PAN Card Using Aadhaar Number

- How to Download the PAN Card PDF?

- How to Download PAN Card without PAN Number?

- Download PAN Card by Name and Date of Birth

- How to Download Duplicate PAN Card?

- PAN Card Customer Care Details

- Choose Visament for PAN Card Services

PAN Card stands for Permanent Account Number Card, and the Income Tax Department issues it to individual taxpayers. When you apply for a PAN card, you will receive it on your registered email ID and address. You can also apply for a digital copy of the PAN card online, and it will have the same value as the physical card. It is a much easier way to carry, and it also eliminates the risk of loss. The online process is quick, and you can download your e-PAN card in just a few seconds.

In this blog, we have presented a complete guide for PAN card download. We have discussed different portals and different methods that can be used. You can choose according to your needs and download your e-PAN card easily.

Key Highlights

- Download your e-PAN card instantly from NSDL, UTIITSL, Income Tax Portal, or DigiLocker.

- e-PAN is digitally valid and equal to the physical PAN card.

- Use your PAN/Acknowledgement Number, Aadhaar, and mobile OTP for verification.

- Free download within 30 days of allotment; a small fee applies afterwards.

- e-PAN PDF is password-protected (use DOB in DDMMYYYY format).

- Lost your PAN? Easily download a duplicate PAN card online.

Different Methods to Download Your PAN Card

- PAN Card Download from NSDL (Protean)

- PAN Card from the UTIITSL website

- Download PAN Card by Using Aadhaar Number

- Download the PAN Card PDF

- PAN Card by Name and Date of Birth

How to Download PAN Card Online?

If you want to download a PAN card online, there are many ways to do so. You can apply for a PAN card online on websites such as NSDL Protean, UTIITSL, or the Income Tax Website. The e-PAN card is considered the digital copy of your PAN card. You can only download the e-PAN from the websites where you have applied for the new PAN card or updated PAN card as soon as the Income Tax Department confirms it.

Things to Keep Handy While Downloading the e-PAN Card

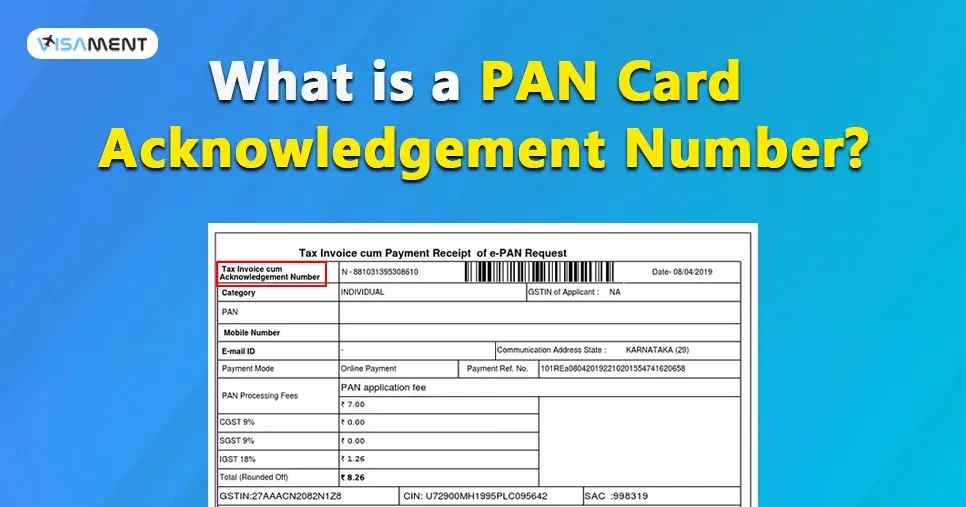

- Acknowledgement Number: You must know the PAN card number or PAN acknowledgment number to download the e-PAN card.

- Aadhaar Number: You must know the Aadhaar card number to download the e-PAN card.

- Mobile Number: You must enter the OTP to download your PAN card with your mobile number.

Download PAN Card from NSDL (Protean)

Applicants who have applied for a new PAN card or updated PAN card on the NSDL website can download the e-PAN card from there. If you download it within 30 days of allotment, the service is free. Otherwise, a small charge applies to download it after that period.

You can download the PAN card from the NSDL e-Gov portal in two ways:

- Using the PAN number, or

- Using the Acknowledgement number.

Steps to download your PAN card online from the NSDL portal

- Go to the official website of the NSDL.

- Scroll down and select the option “Request for e-PAN/e-PAN XML".

- Choose PAN or acknowledgement number option, then enter PAN or acknowledgement number, Aadhaar number, date of birth, and captcha code. Then click on the submit button.

- Choose the delivery method for receiving the OTP (SMS or Email ID), then click the generate OTP button.

- Enter the OTP and click on the validate button.

- If you have to pay a specific fee to download the PAN card, your free download has been exhausted. You will see a notification regarding that.

- Your e-PAN card will be sent to your email ID as a PDF. You can download the e-PAN card from there by clicking on the download icon.

Download PAN Card from UTIITSL

Applicants who have applied for the e-PAN card on UTIITSL's portal can download it only from that portal. You can also download any new PAN card or updated PAN card from this website within 30 days of the allotment of the PAN card. If you try to download it after 30 days, an additional charge of Rs 8.26 will apply.

Steps to Download PAN from UTIITSL Portal

- Visit the official UTIITSL portal.

- Scroll down, then under the Download e-PAN tab, click the download option.

- The new page opens, and you have to enter your date of birth, PAN number, GSTIN number (if required), and captcha code to download the e-PAN card by clicking submit.

- Select the method you want to receive the OTP, then click the "get OTP" button.

- Now, enter the OTP and click the Validate OTP option.

- If applicable, make the payment. Your e-PAN card will be sent to your registered email ID. Click on the link to download the e-PAN card.

Download PAN Card Using Aadhaar Number

You can download your PAN card by using your Aadhaar card number from the portal of the Income Tax Department. The facility to download the e-PAN card from the Income Tax e-filing websites is available to applicants who have applied for the instant e-PAN card on the same website. You can download an instant e-PAN card for free.

Steps to Download PAN Using Aadhaar

Step 1: Visit the official Income Tax e-filing portal.

Step 2: Under the "check status/ download PAN" tab, click on the continue button.

Step 3: Enter the Aadhaar number and click continue.

Step 4: Enter the OTP you received on the Aadhaar-registered mobile number, then click continue.

Step 5: The status of your e-PAN card will be displayed on the screen.

Step 6: In case of the new e-PAN allotment, click on the "download e-PAN" to download the e-PAN copy.

How to Download the PAN Card PDF?

When you download an e-PAN card, it is sent to your registered email ID as a PDF file from the NSDL Protean or UTIITSL website. The downloaded PDF file will contain your e-PAN card and be protected with a password. You can open this file by entering the PAN card password.

To open the downloaded e-PAN card PDF file, enter your date of birth or date of incorporation as the password. To open this file with the password, use the format: DDMMYYYY. Using this format, you can open the PDF and access your e-PAN card.

How to Download PAN Card without PAN Number?

You can download a PAN card without a PAN number when you apply for a new PAN card on the website. Both ways of downloading it are explained below.

A. Using NSDL Protean Website

- Visit the official portal of NSDL e-PAN download.

- Select the option "Acknowledgement number."

- Enter your date of birth, acknowledgement number, and the captcha code displayed on the screen.

- Choose the OTP delivery method, enter the OTP, and confirm your identity.

- After you are verified, proceed to make the payment (if applicable) and download your e-PAN card.

B. Using Income Tax e-Filing Portal

- Visit the official portal of Income Tax e-filing.

- On the homepage, you will find the "Check status/Download PAN" option under the Quick Links section. Click on that and continue.

- Enter your Aadhaar number in the space given and click on submit.

- Enter the OTP you received on your registered mobile number, and then click submit again.

- After verification, you will have the option to download the e-PAN card. Click on that option to download the e-PAN card.

Download PAN Card by Name and Date of Birth

You can download a PAN card by date of birth and name from two websites. In this section, we have made steps for both processes.

A. Using the NSDL Protean Website

- Visit the NSDL Protean website.

- Select "PAN or acknowledgement number" and enter this number, date of birth, Aadhaar number, and captcha code.

- Choose the way to receive the OTP, enter it, and make the payment.

- After making the payment successful, you can download your e-PAN card.

B. Using UTIITSL Website

- Visit the website of UTIITSL.

- Enter details such as PAN number, date of birth, GSTIN, and the captcha code.

- Choose how to receive the OTP, enter it, and make the payment.

- You can download your e-PAN card once the payment is successful.

How to Download Duplicate PAN Card?

If your PAN card is lost or misplaced, you can download a Duplicate PAN Card online.

- Visit the NSDL website.

- At the top of the page, there is a download e-PAN/ e-PAN XML tab; click it.

- Now choose one of the two options: an acknowledged number or PAN Number.

- Enter all the details, including the captcha code, and click the Submit button.

- To receive the OTP, select one option - email ID or mobile number — and click the Generate OTP button.

- Enter the OTP you received, then click Validate OTP.

- You will receive your duplicate PAN card on your registered email ID.

PAN Card Customer Care Details

If you are unable to see your PAN card after downloading it from these websites, you can seek assistance from their customer care executives. They will resolve your query and assist you in all possible ways. You can contact them via the mobile number and Email ID.

For NSDL (Protean)

- Phone Number: 020-27218080, 08069708080

- Email ID: [email protected]

For UTIITSL

- Phone Number: +91-33-40802999, 033-40802999

- Email ID: [email protected]

For Income Tax Department

- Phone Number: +91-20-27218080

Choose Visament for PAN Card Services

If you want to apply for a PAN card or update an existing one, visit Visament for the best services. It is an online platform where you can get all the PAN card services from the experts. You will get 24/7 assistance from our professionals, and you can also check the website for all the updates. Just visit the website and click the service you want. It is India's trusted platform, and you can apply from the comfort of your home. We eliminate the need to visit the offices physically. Choose what's best for you and your family, choose Visament.

Frequently Asked Questions

Whether you download your PAN card from NSDL, UTIITSL, or the Income Tax website, it is necessary to enter the OTP. So, you cannot download a PAN card online without an OTP.

Yes, e-PAN is considered a legal and valid proof of PAN, and it is accepted for all purposes whenever a physical PAN card is needed. It is issued by the income tax department and digitally signed in a PDF format.

You can download a digital PAN card by visiting the e-filing portal and clicking on the Instant e-PAN card. Enter all the details like Aadhaar number, PAN number, date of birth, etc., and write the captcha code displayed on the screen. After that, you will be able to download a digital PAN card.

Yes, you can download your PAN card PDF online from the official portals of NSDL, UTIITSL, or the Income Tax website by selecting "Request e-PAN card" or "Download PAN card."