A Permanent Account Number (PAN) card is a crucial document for taxpayers in India. The Income Tax Department, to keep a tab on financial transactions, uses them. In addition, you can also use them as an identity proof in India. However, any error or mistake in the PAN card can create problems related to income tax or other issues in the future.

Hence, it is vital to apply for a PAN card correction/ update in case of any errors. Are you also seeking guidance to make corrections in your PAN card? Then, you are in the right place. In this blog, we will provide you with information about how you can update your PAN card online and offline. In addition, the documents and fees are required for it. So, let's begin reading.

For any reason, such as mistakes in your parents' name, your name, or date of birth on your printed PAN card, you can apply for its correction. In addition, if you have changes to your address or contact number, then you can also update your PAN card, as not doing so can create issues in financial transactions.

There are two ways by which you can apply for PAN card correction/update, i.e., online and offline. Like the process, the steps of them are also different. Want to know more about them in detail? Read below and get your answers.

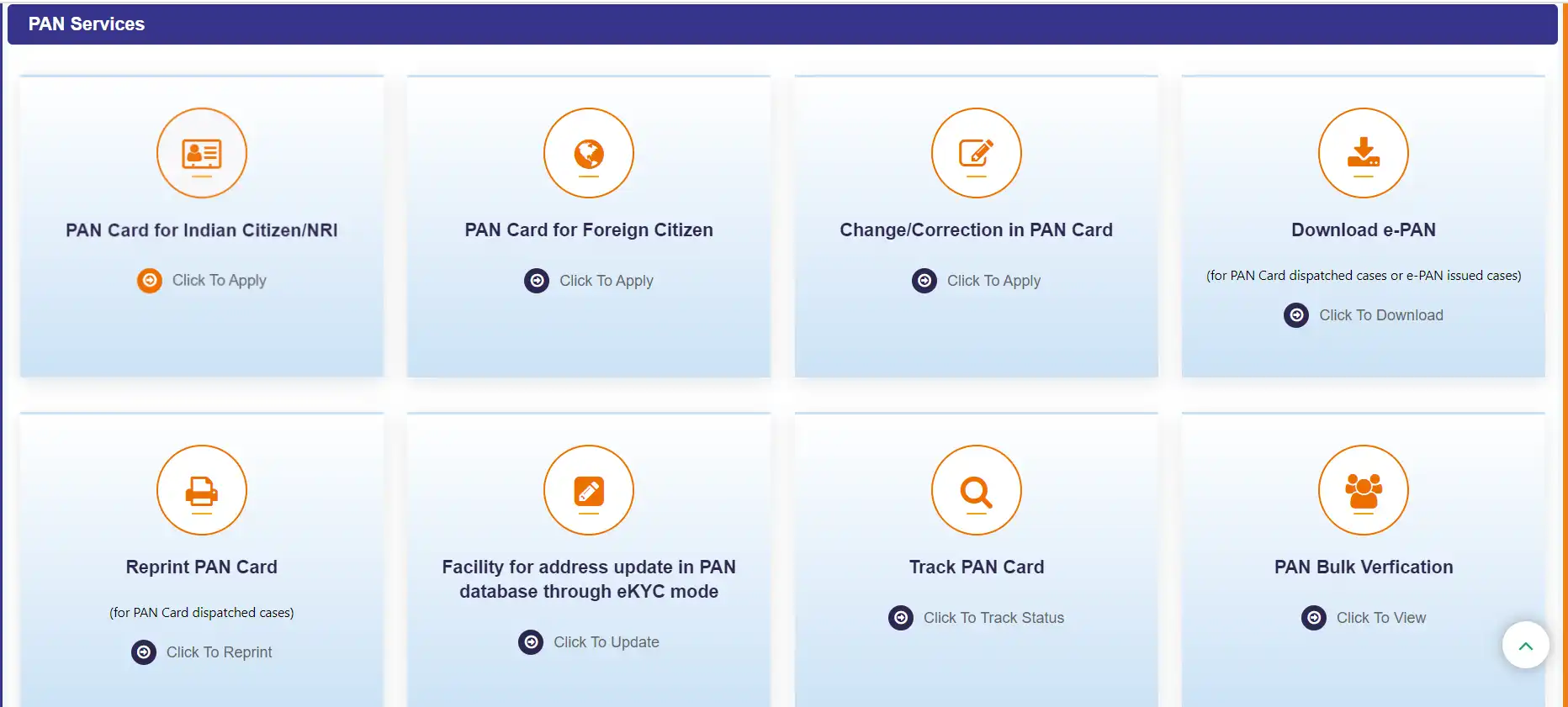

You can update the details on the PAN card online in two ways- the NSDL website or the UTIITSL website. You can use any of them to update your PAN card details; the steps for both of them are almost the same. However, if you applied for your PAN card on the NSDL website, then for the PAN card correction/ update should use that portal. Similarly, if you applied PAN card through the UTIITSL website, then update your PAN card details on that website.

This is how you can choose any of the websites to update PAN card online. Moving further, let's know the steps for making corrections in your PAN card details using these two sites.

To update or correct your PAN card details online using the NSDL portal, follow the steps below:

To start the PAN card update online process, through the Portean portal, go to the official site of NSDL (National Securities Depository Limited). It is one of the authorized government sites for PAN card issuance and updates.

Scroll down and look for the "Change/correction PAN data" heading and click on the "Apply now" option.

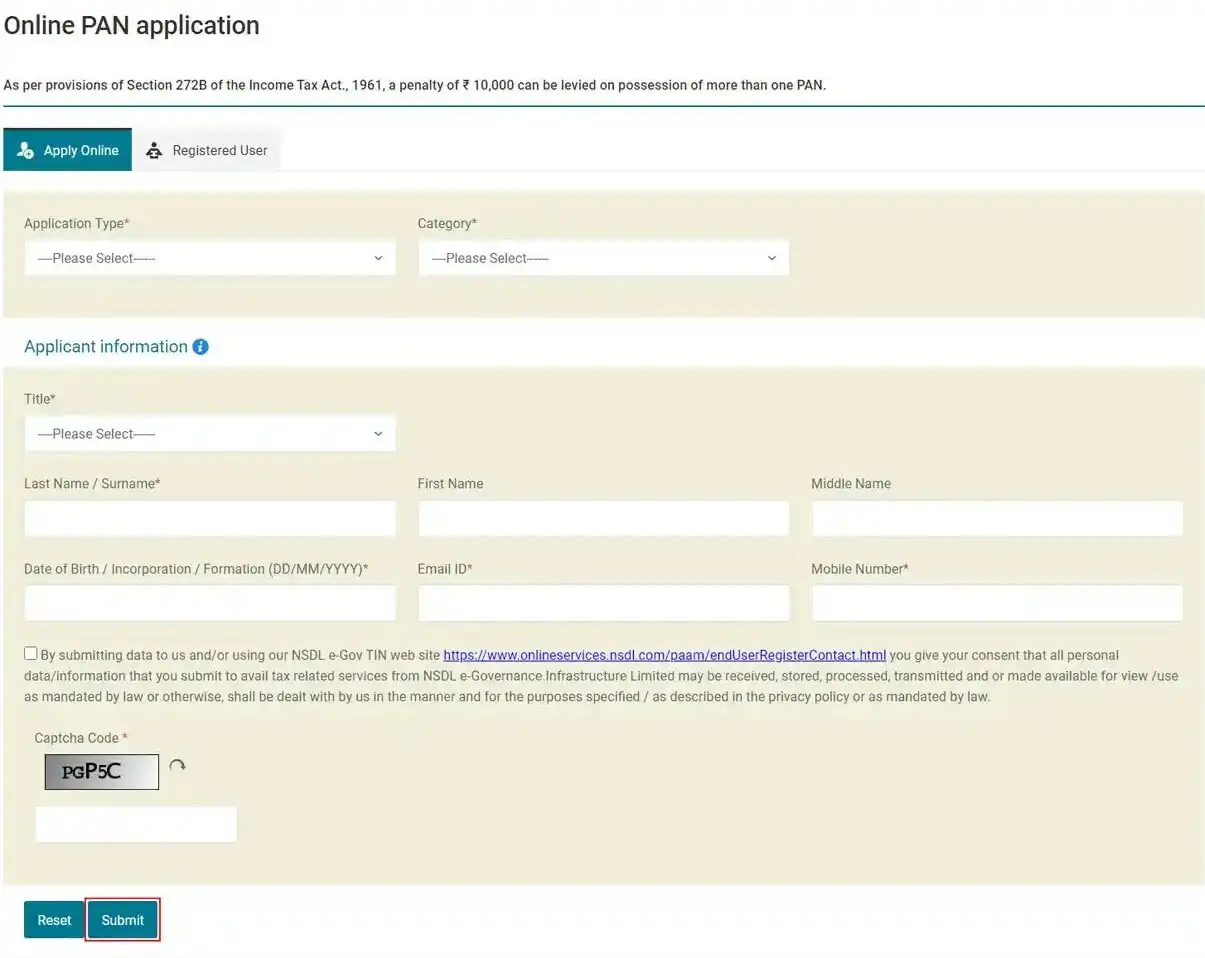

Fill out the PAN card application form online that appears on your screen. Let's know how to fill in the given particulars:

Application Type: Mention changes or corrections in existing PAN data/reprint of PAN card.

Category: From the drop-down menu, choose the relevant category.

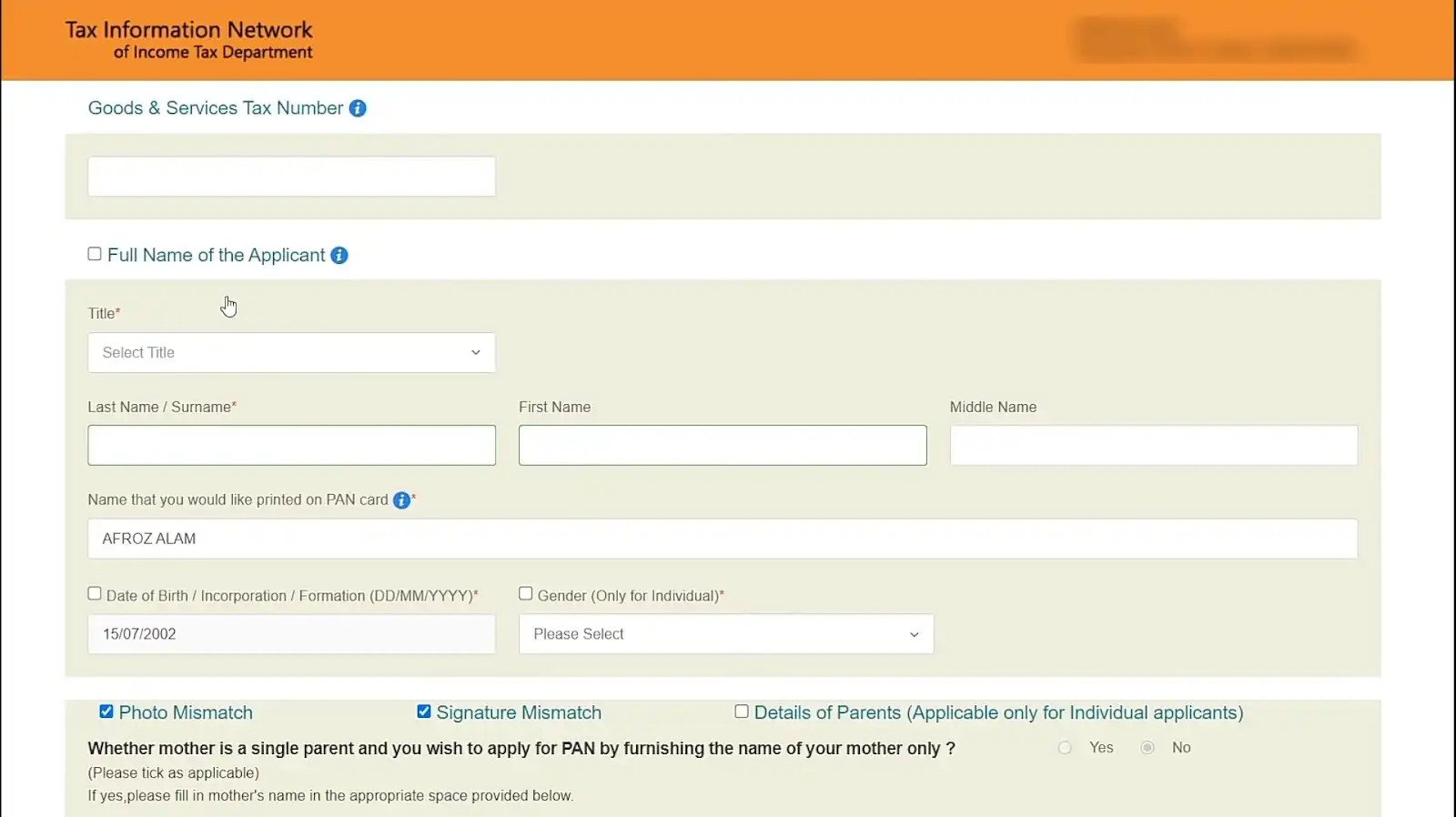

Other Information: Fill in other asked personal details like:

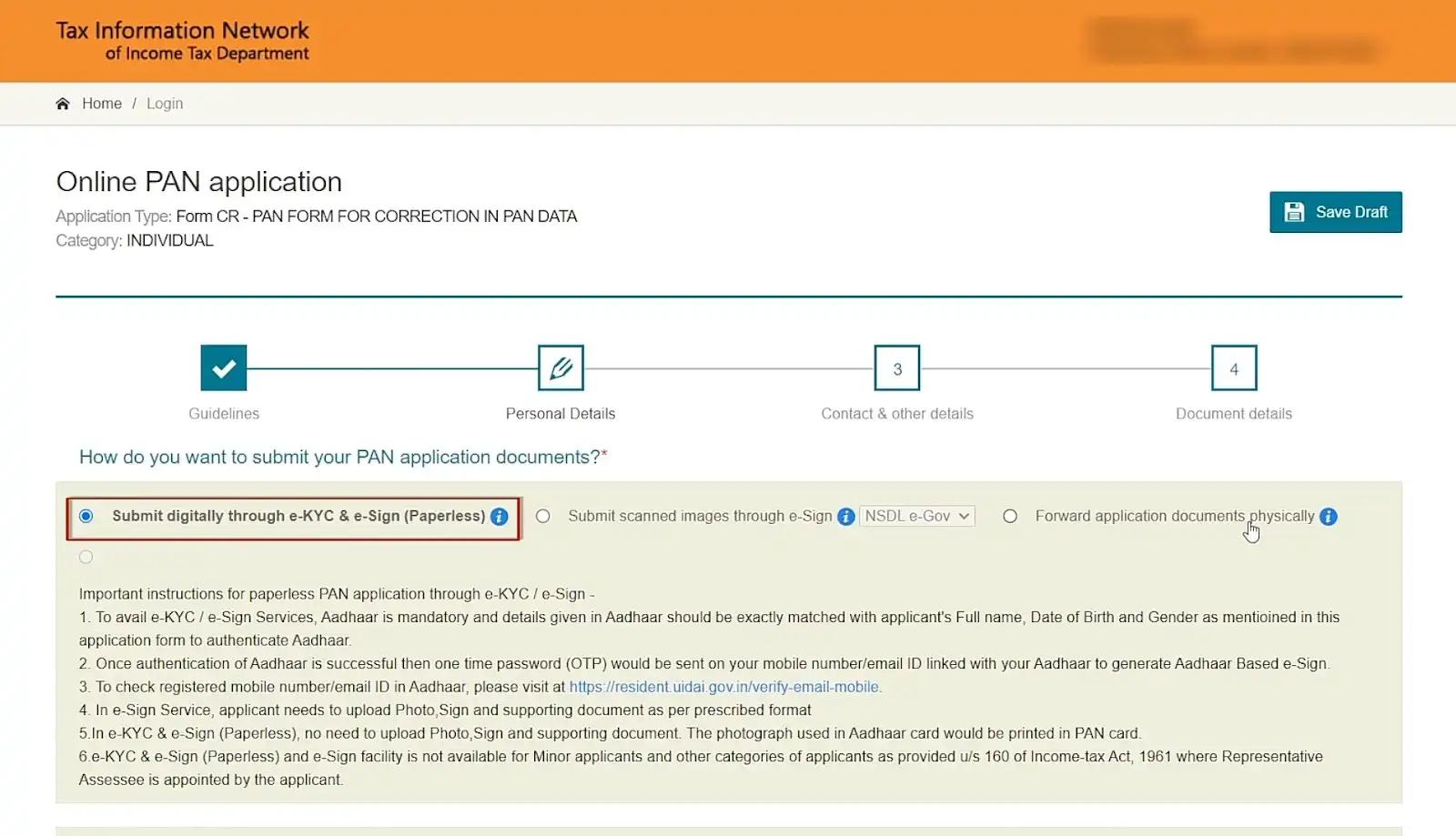

Submitting your application, on your mail ID, you will get a token number. You can use this token number to access the draft version of your application form in case the session times out. Click on "continue with PAN application form" to go to the PAN application correction form.

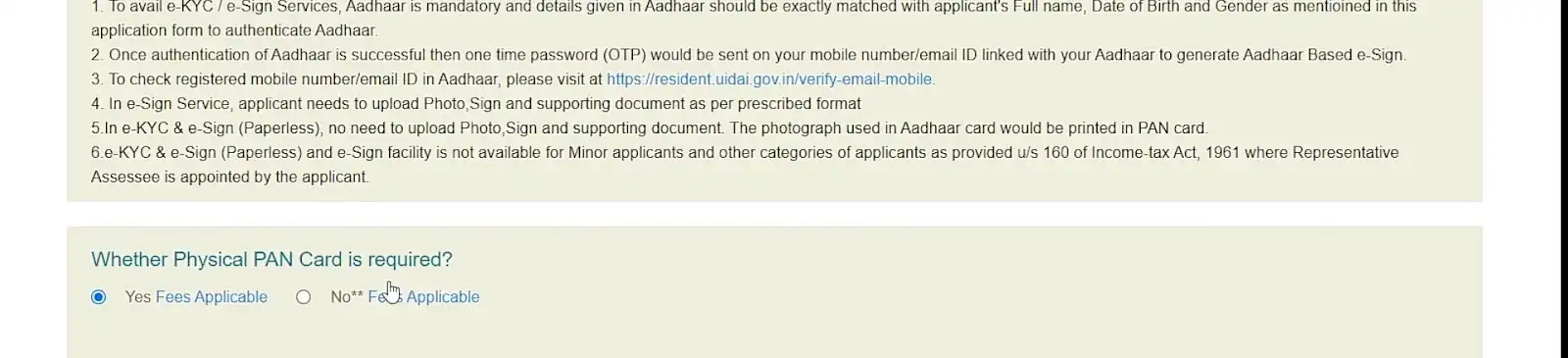

If you require a new physical photocopy of your updated PAN card, select 'yes.' For this, you need to pay the applicable nominal charges.

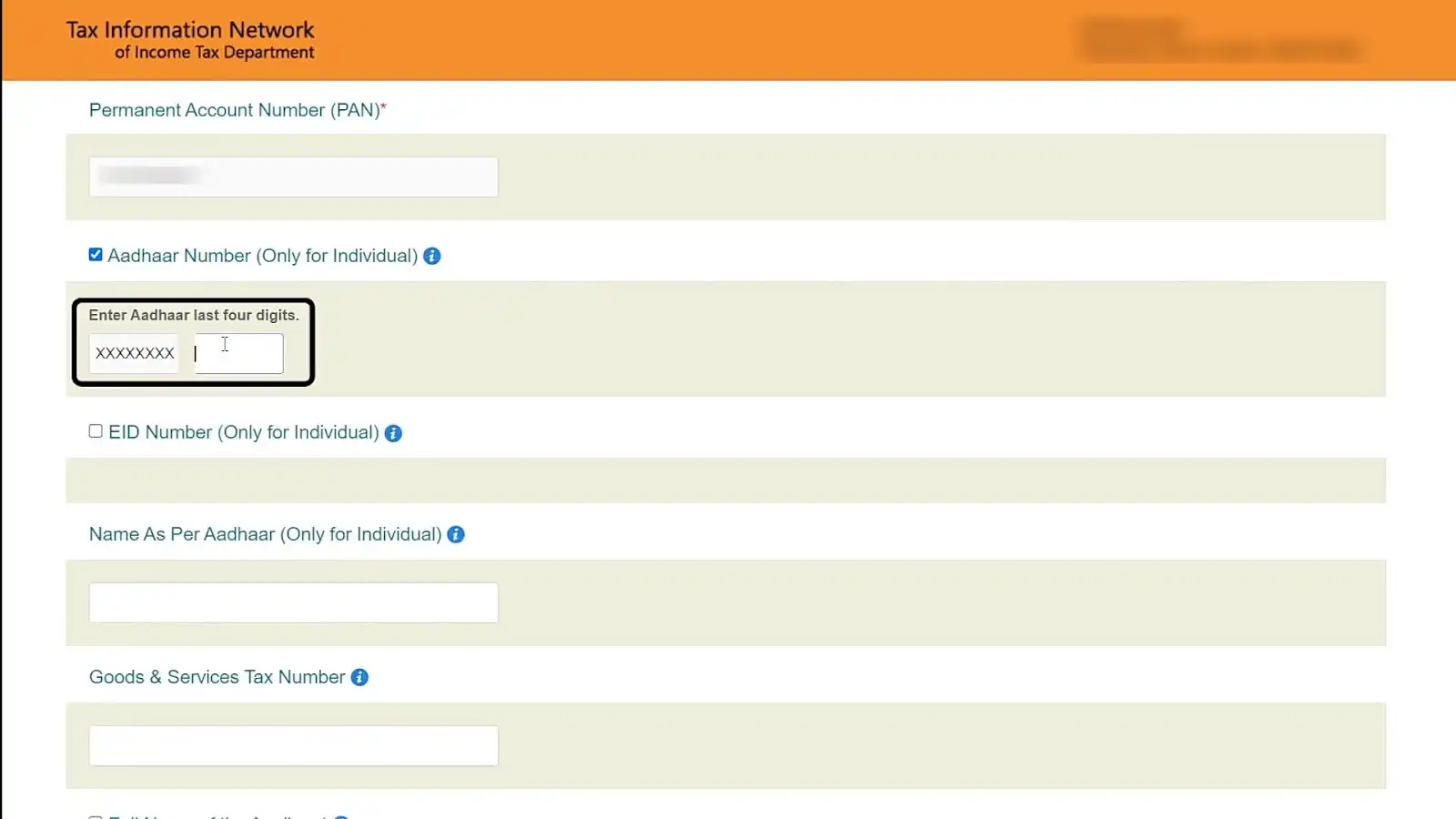

Now, scroll down and mention the last four digits of your Aadhaar card number.

After that, scroll down and mention the details you want to update. Remember to tick the given box for which update or correction is needed. Once you mention all the details, click on 'next' to proceed further to the 'contact and other details' page.

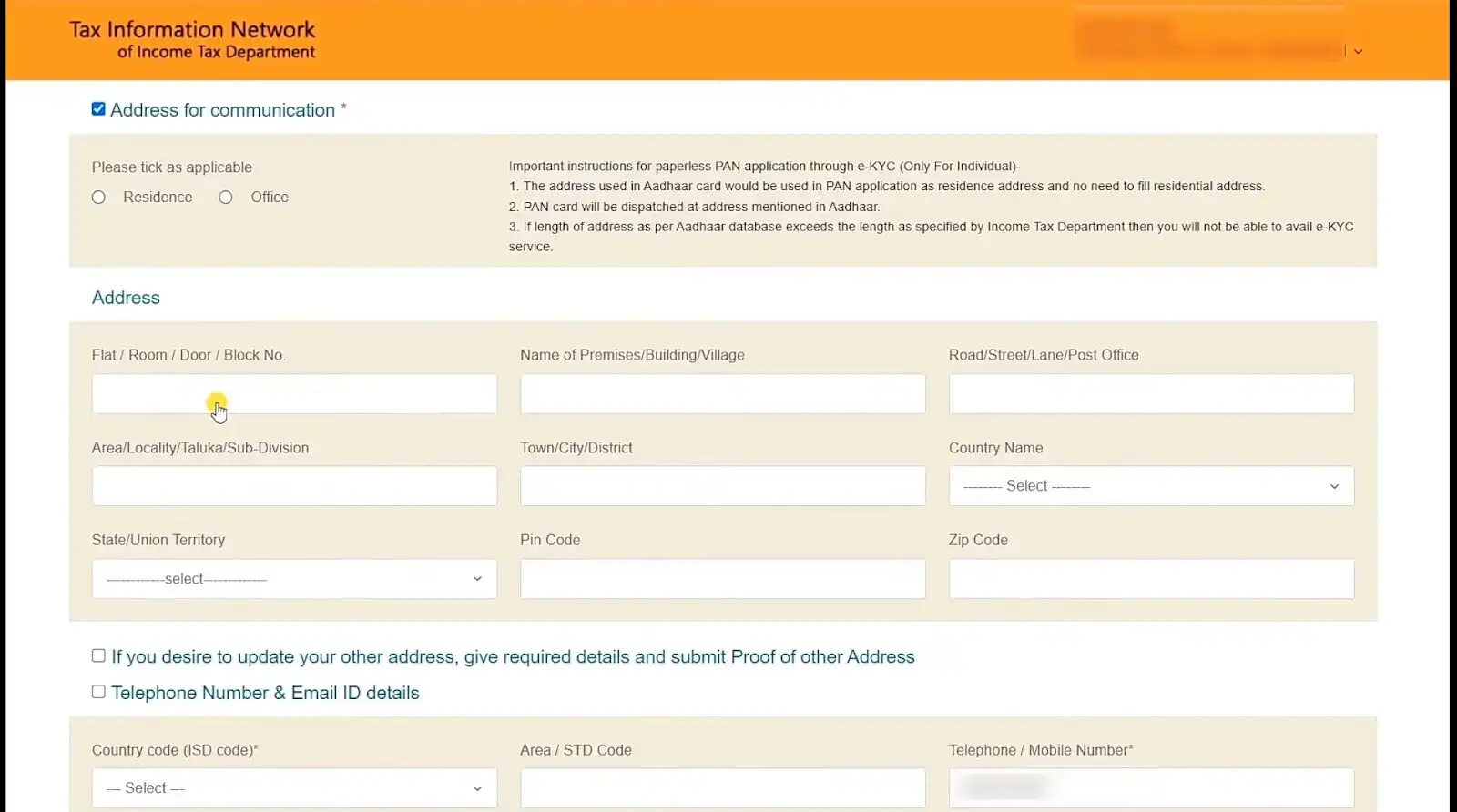

Here, mention the updated mobile or, email, or new address and move to the next page.

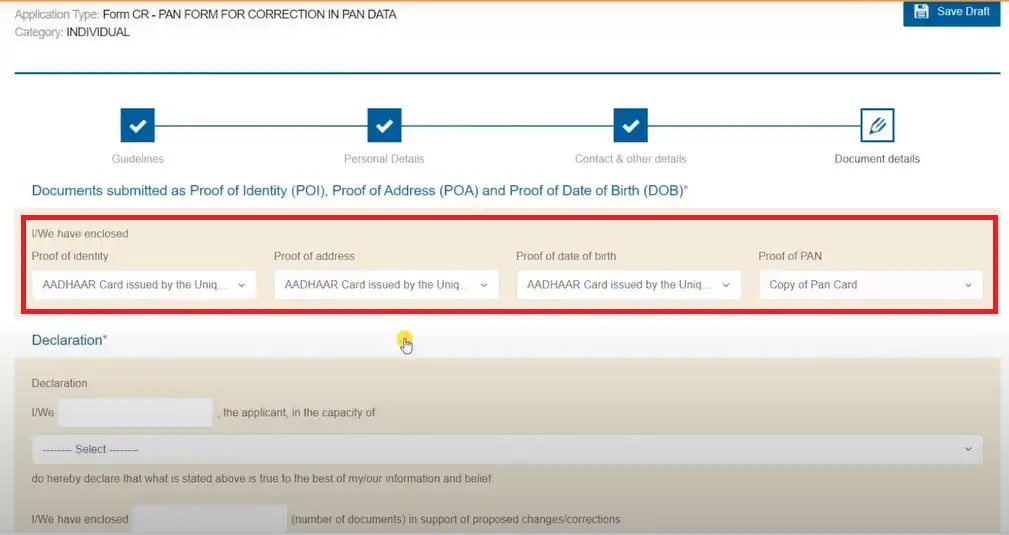

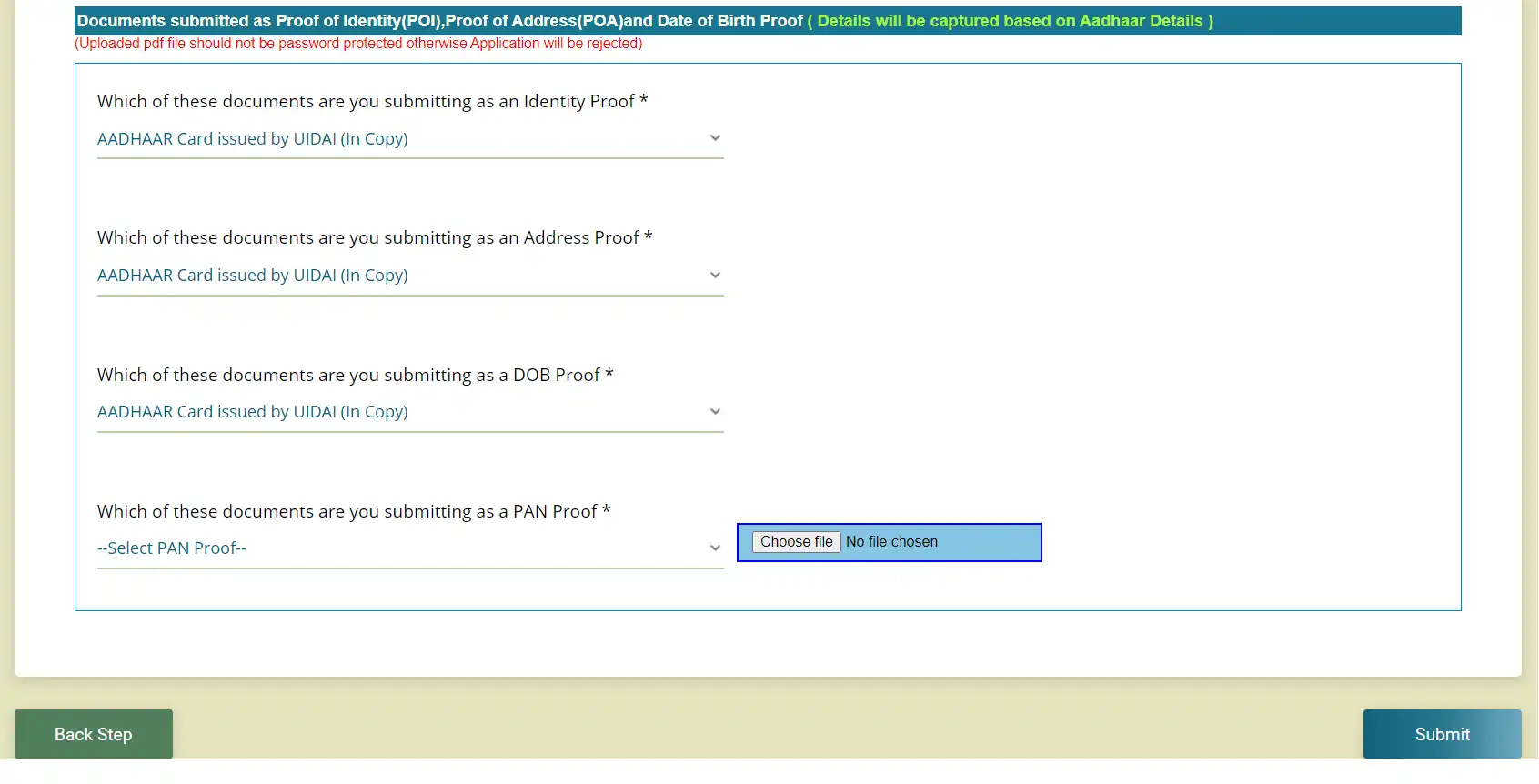

Based on the details you have updated, submit the requested documents with a photocopy of your current PAN card.

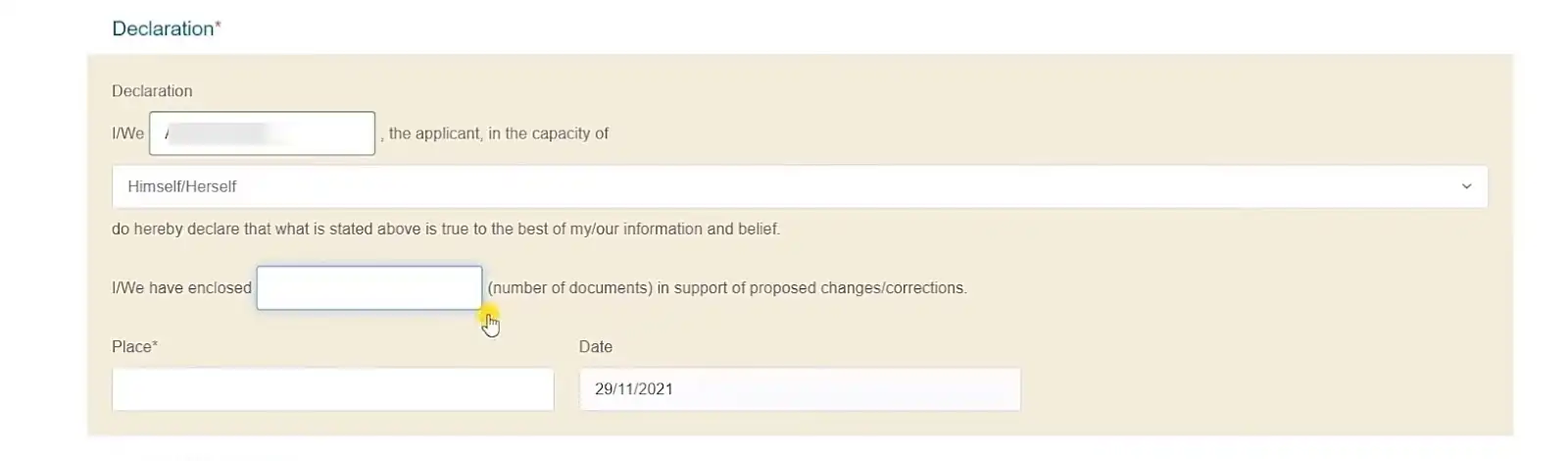

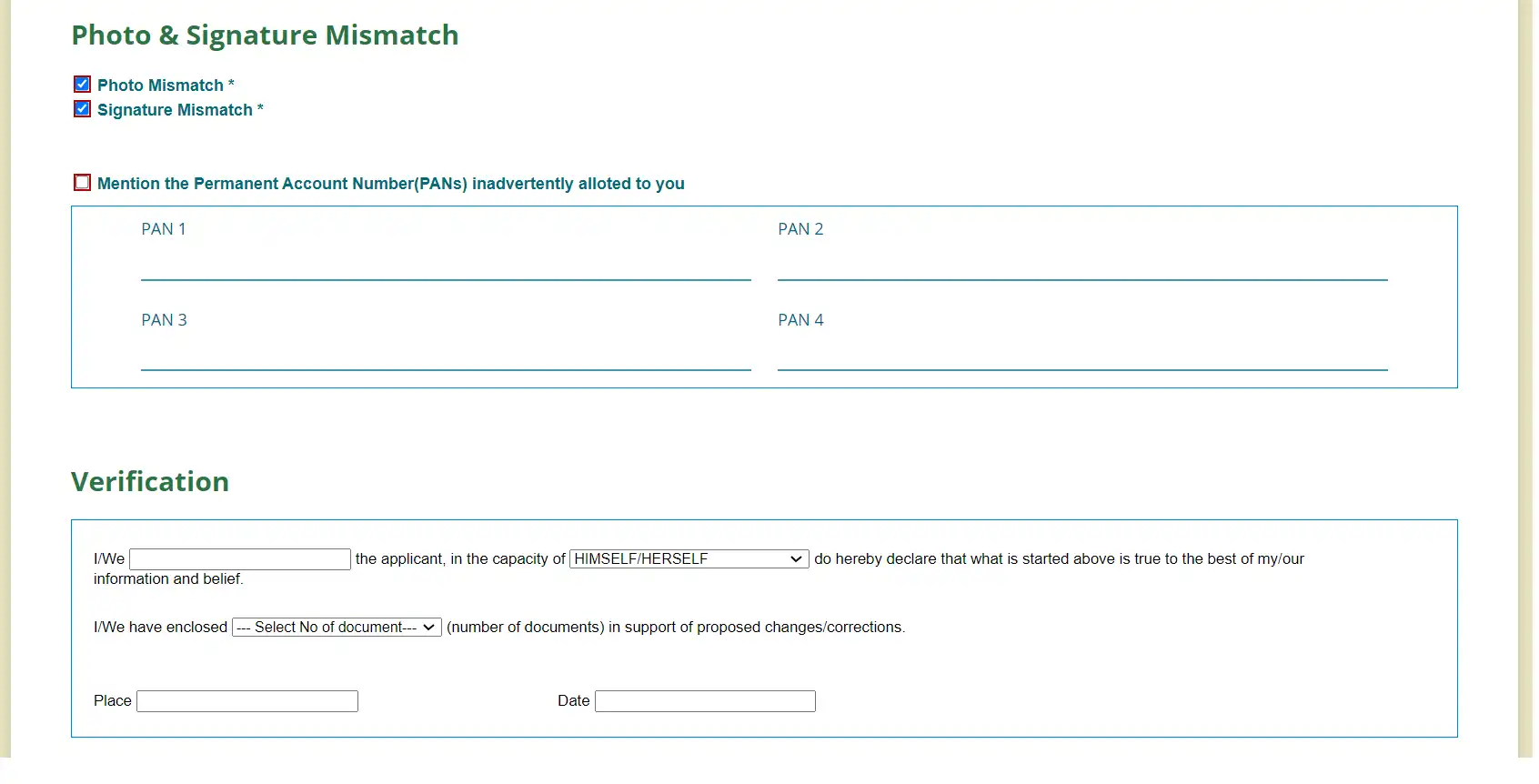

In the next section, i.e., declaration, fill out the following details:

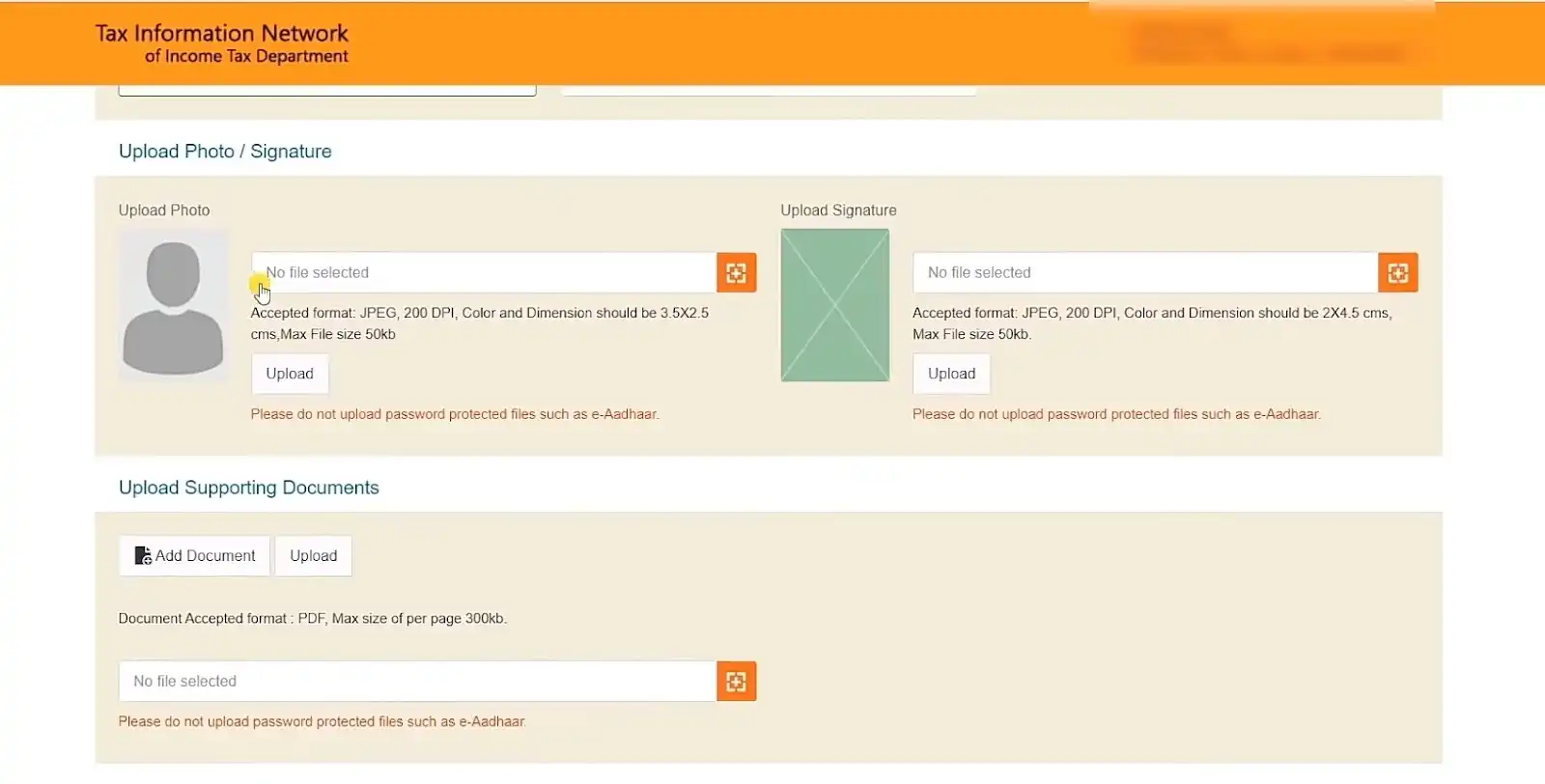

Now, scroll down and attach a photocopy of your passport-size photograph and signature. Ensure the uploaded images are as per the mentioned sizes and specifications. Once you've done all this, click on the 'submit' option.

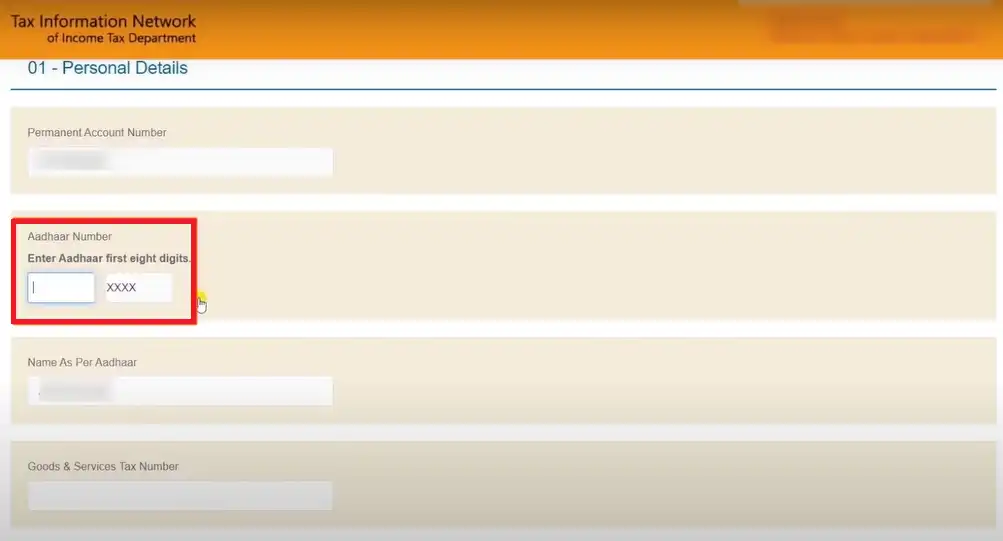

Now, you will see the preview of your filled form. Mention the starting eight digits of your Aadhaar card and ensure all the other mentioned information is correct.

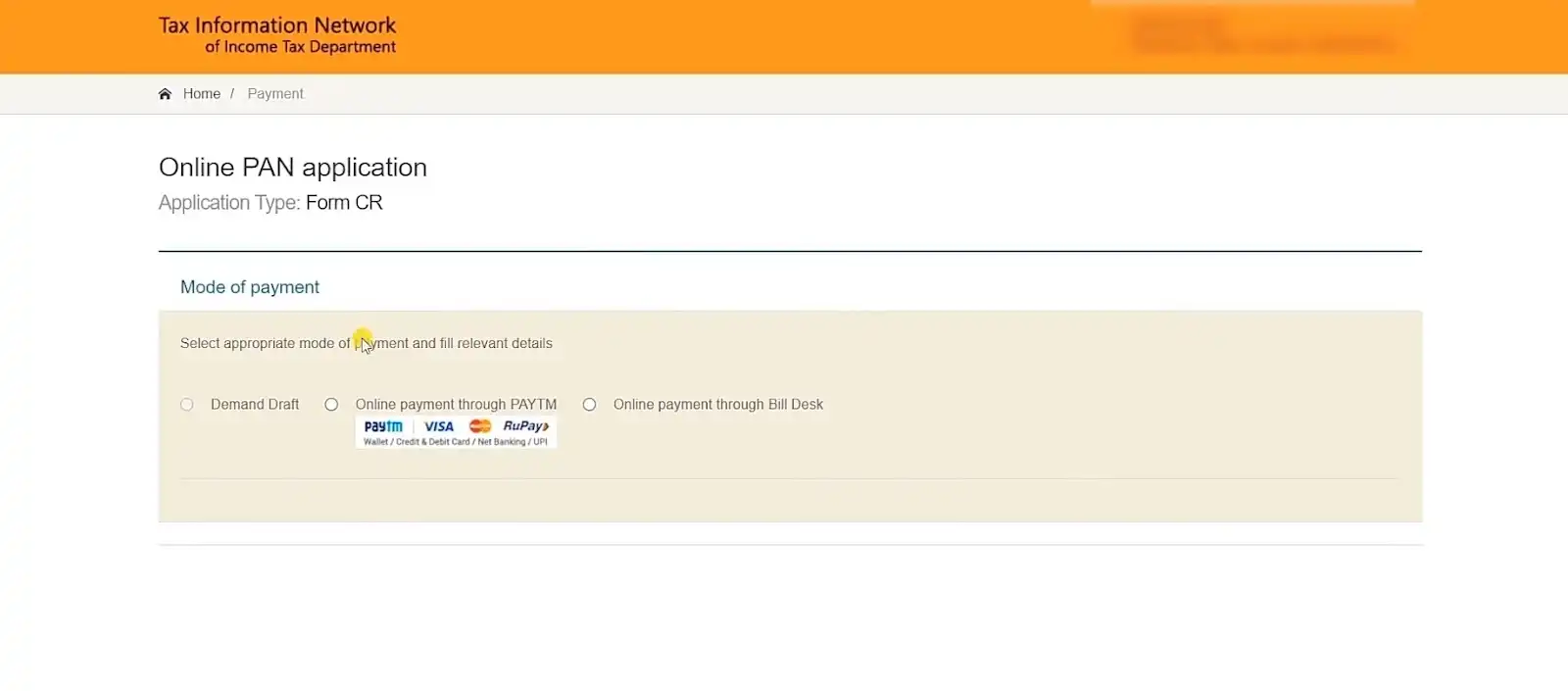

Once you submit your PAN card correction form, on your screen, the payment page will appear. You can pay the applicable payment fee using several available online payment options. After you make the payment, you will get a payment slip.

To further proceed with the PAN card update/correction process, click on the 'continue' option. Now, you will have to complete the KYC process. To accept the terms and conditions, tick the given check box and click on 'authenticate.'

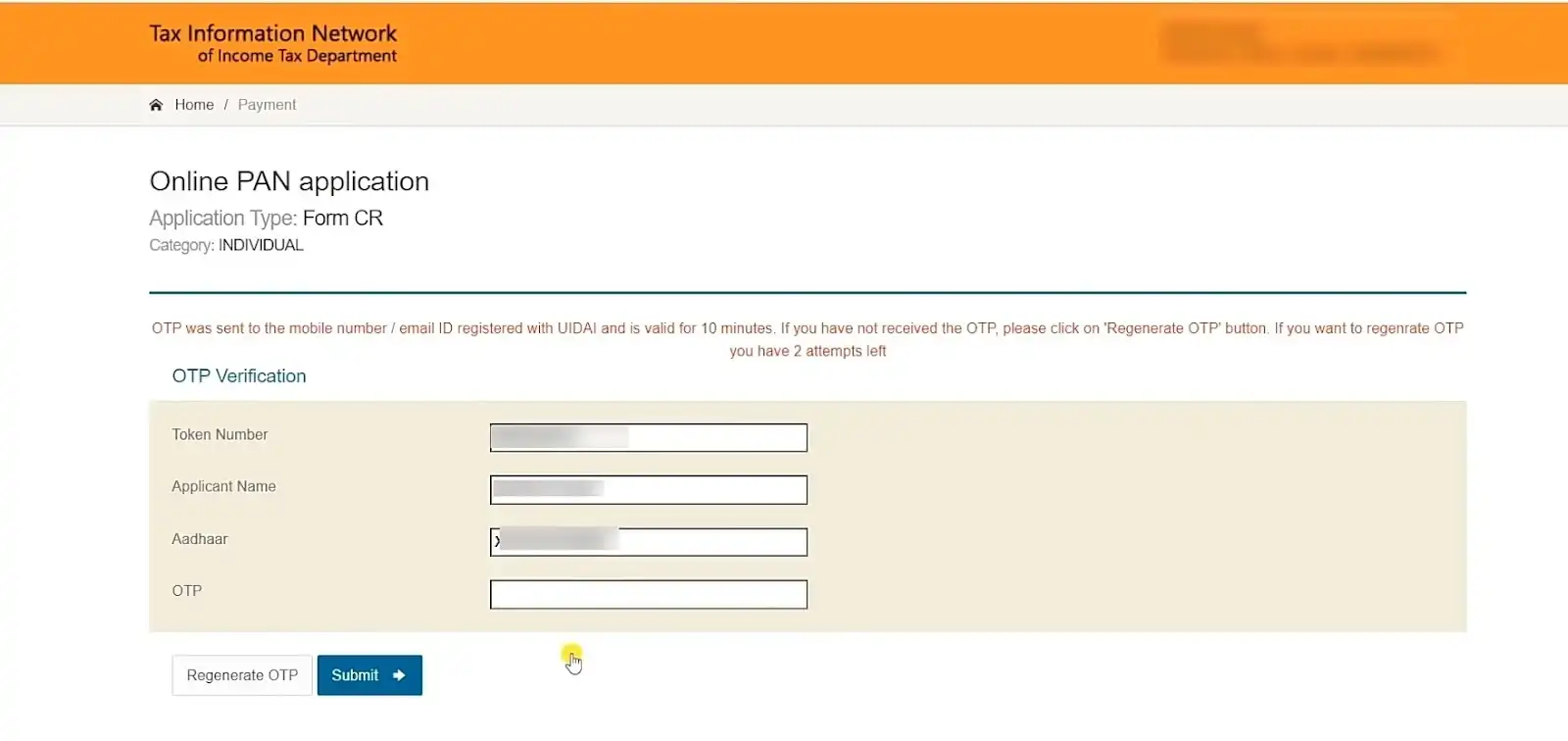

On your Aadhaar-registered mobile number, you will receive an OTP. Mention the sent OTP and submit your online PAN application form.

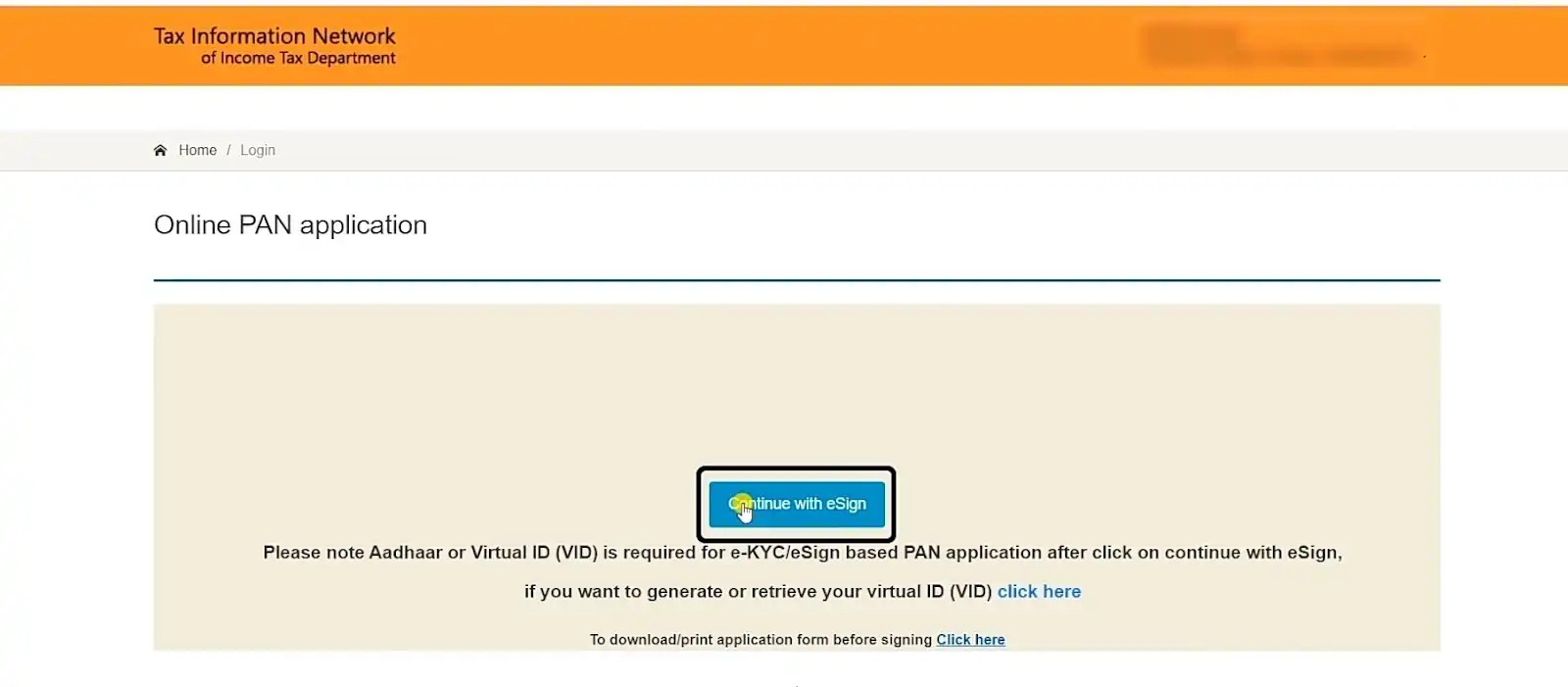

Now, on the next screen, click on the option 'continue' with e-sign.

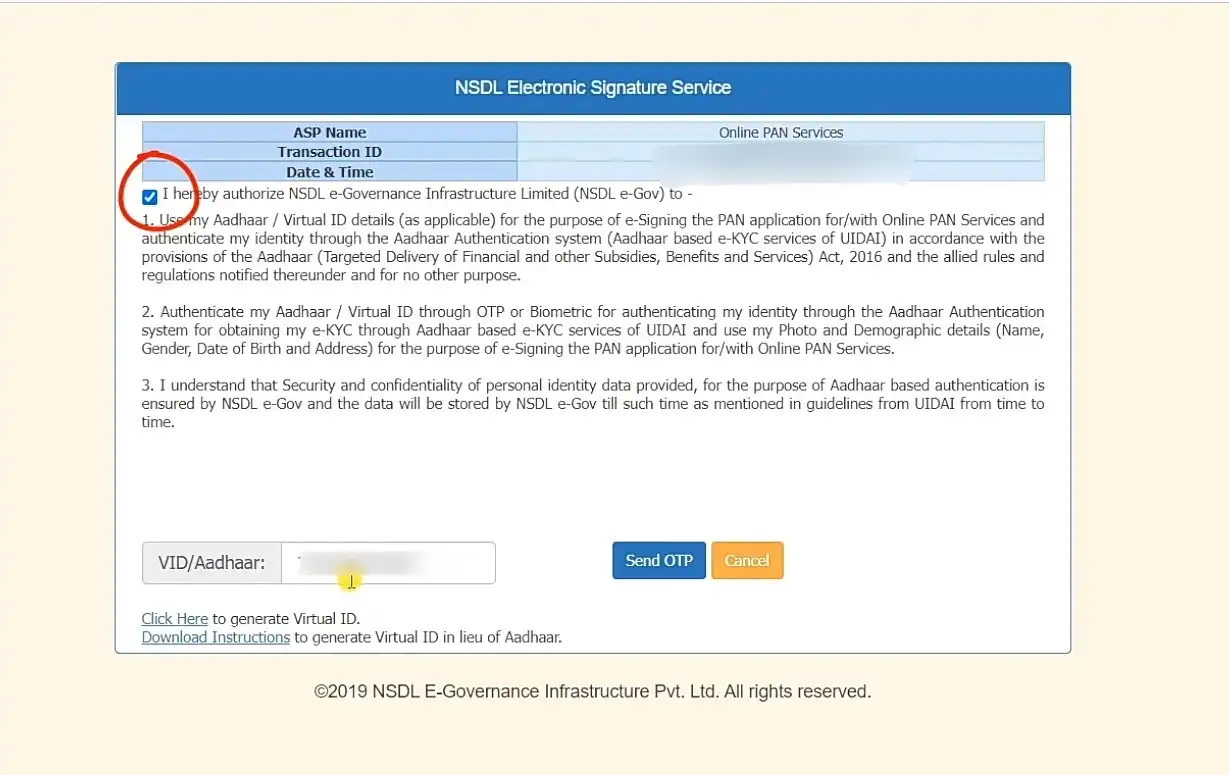

By ticking the given box, accept the terms and conditions. Mention your complete Aadhaar card number and click on the 'send OTP' option.

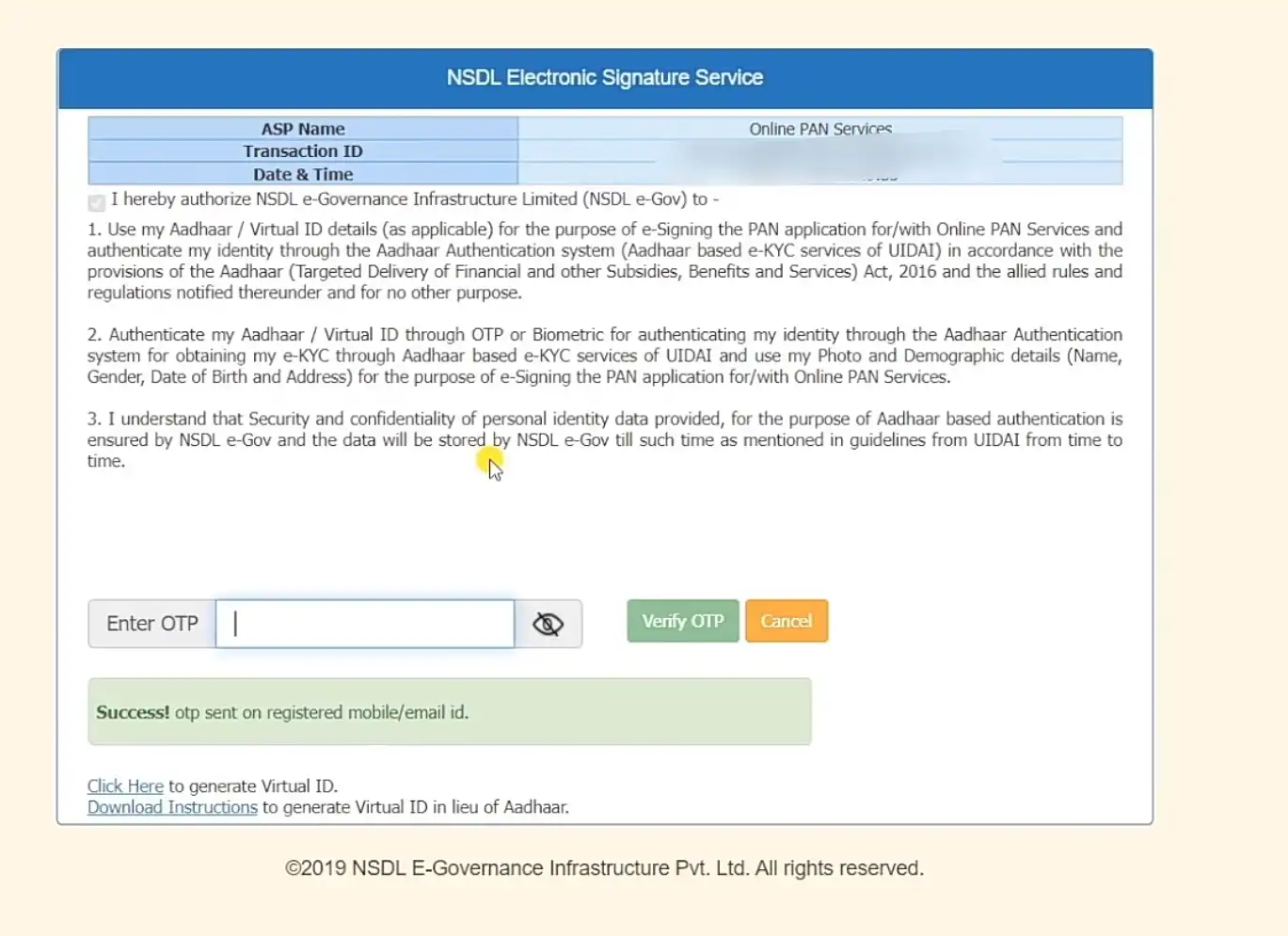

Mention the sent OTP you received on your Aadhaar-registered mobile number and verify. Now, you can download the acknowledgement form. Your date of birth is the password to open this file. You need to mention your DOB in the DD/MM/YYYY format.

This is how you can fill out the PAN correction/update form online using the NSDL website.

Note:- In the fifth step, if you select the 'forward application and submit documents physically', you need to take a printout of your acknowledgment form. After that, along with your acknowledgment form as per your application, attach the requested documents and send them by post to the mentioned address:

Income Tax PAN Services Unit

Protean eGOV Technologies Limited

4th floor, Sapphire Chambers,

Baner Road, Baner, Pune- 411045.

Stop worrying about delays. Apply now and get your PAN card on time with our expert service.

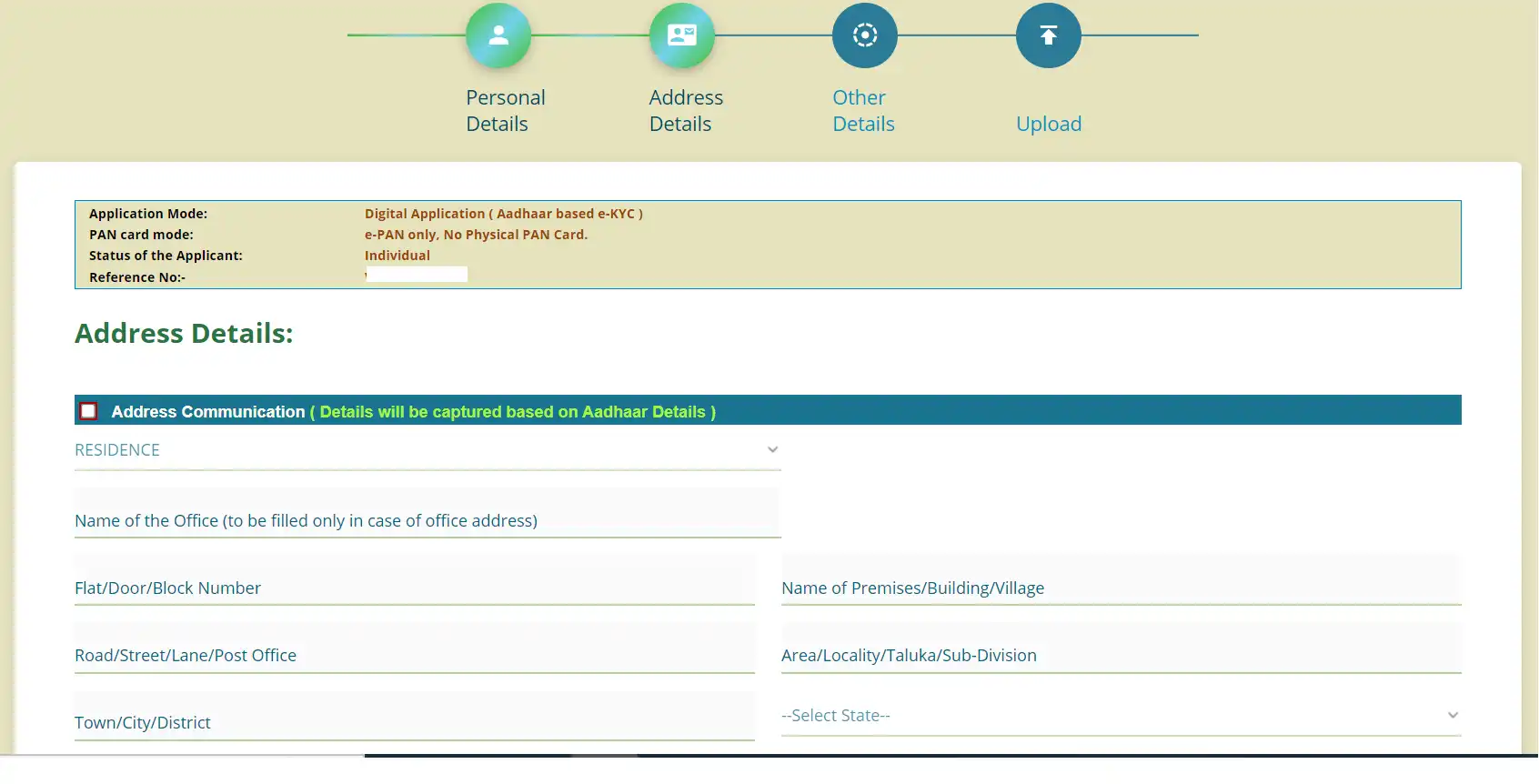

Follow the steps below to update or make corrections in your PAN card using the UTIITSL website:

Go to the official website of UTIITSL.

Under the "Change/ correction in PAN card" tab, click on the "apply now" option.

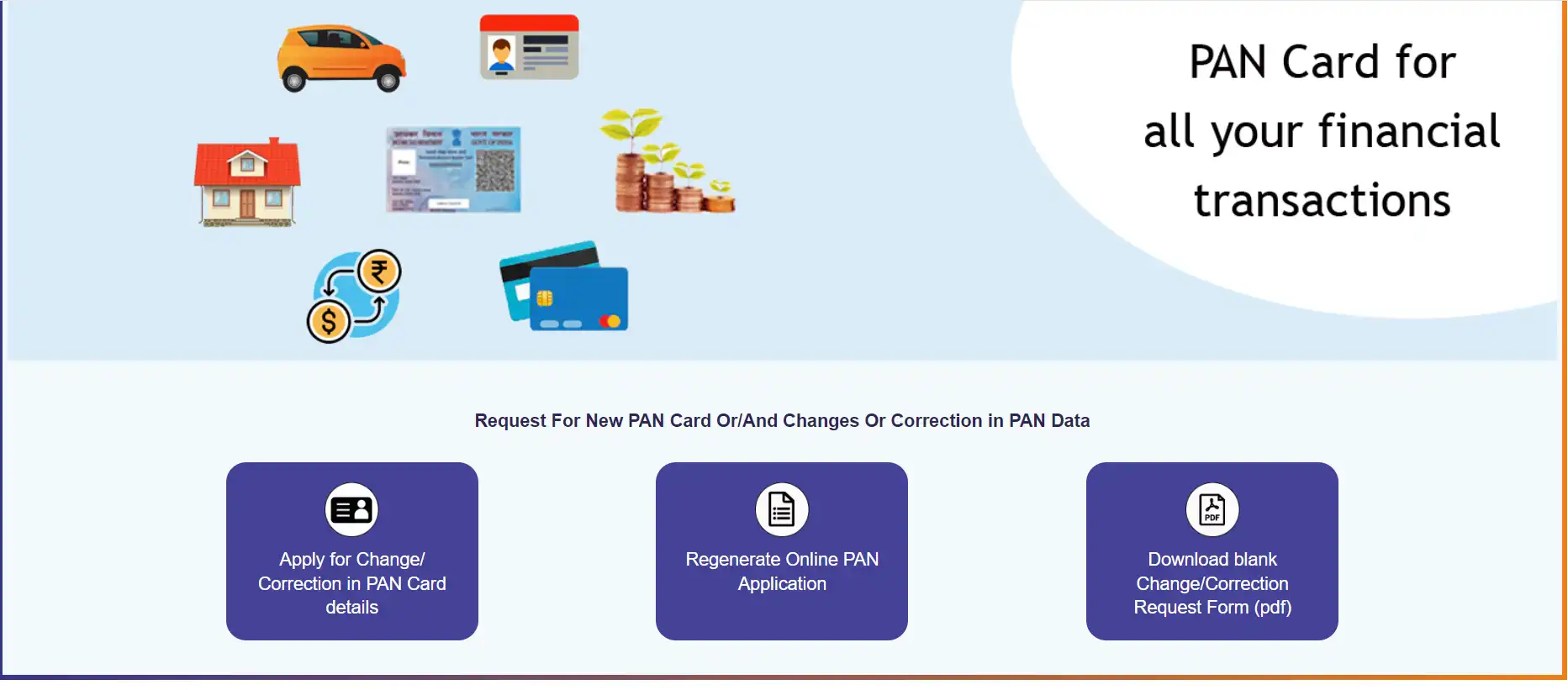

Now, click on the 'Apply for change/correction in PAN card details' tab.

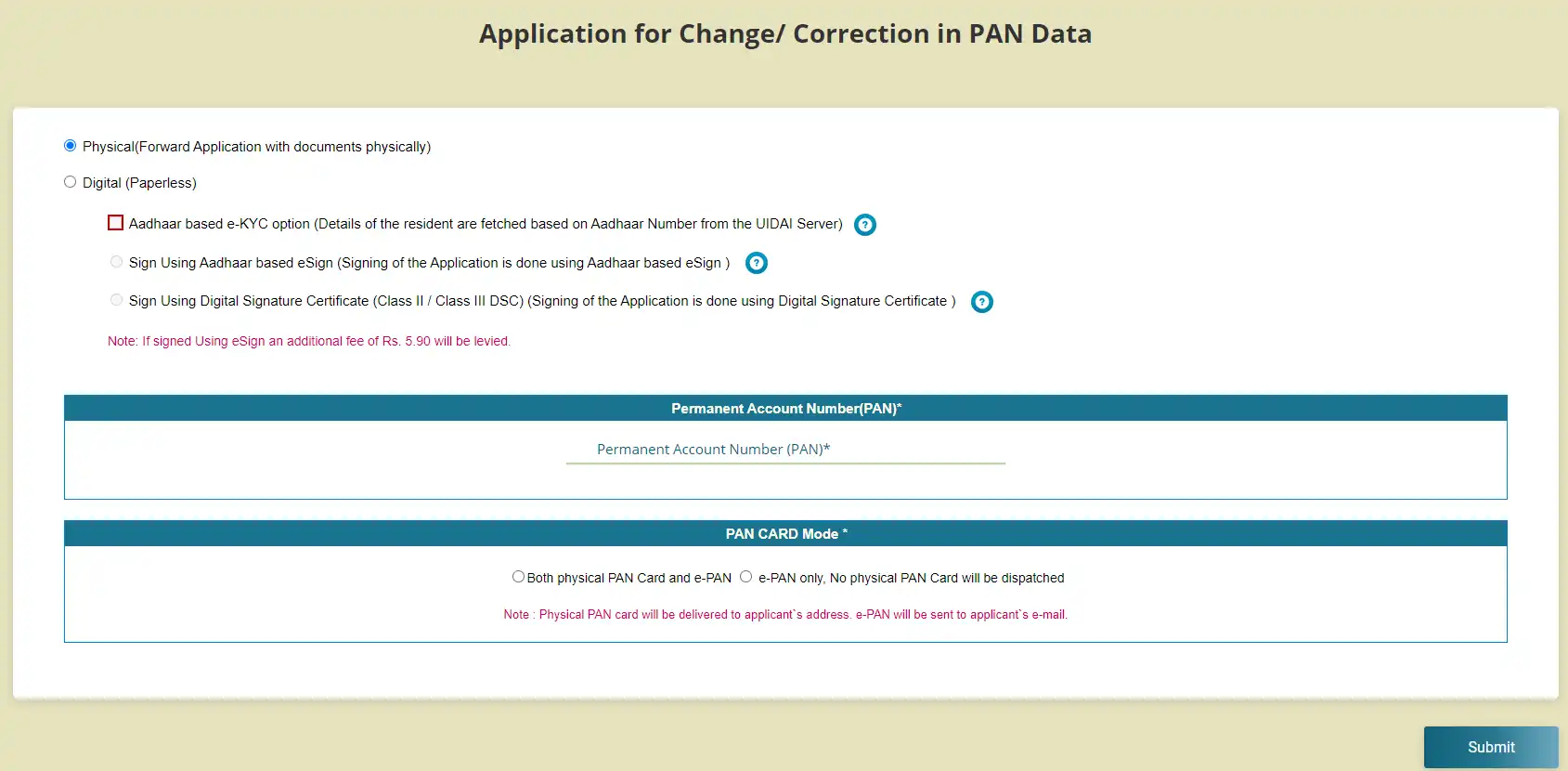

Choose the document submission mode, mention your PAN number, choose the PAN card mode, and click on the "submit" option.

Once you register the PAN card correction/ update request on the site, you will get a reference number. Then click on ok.

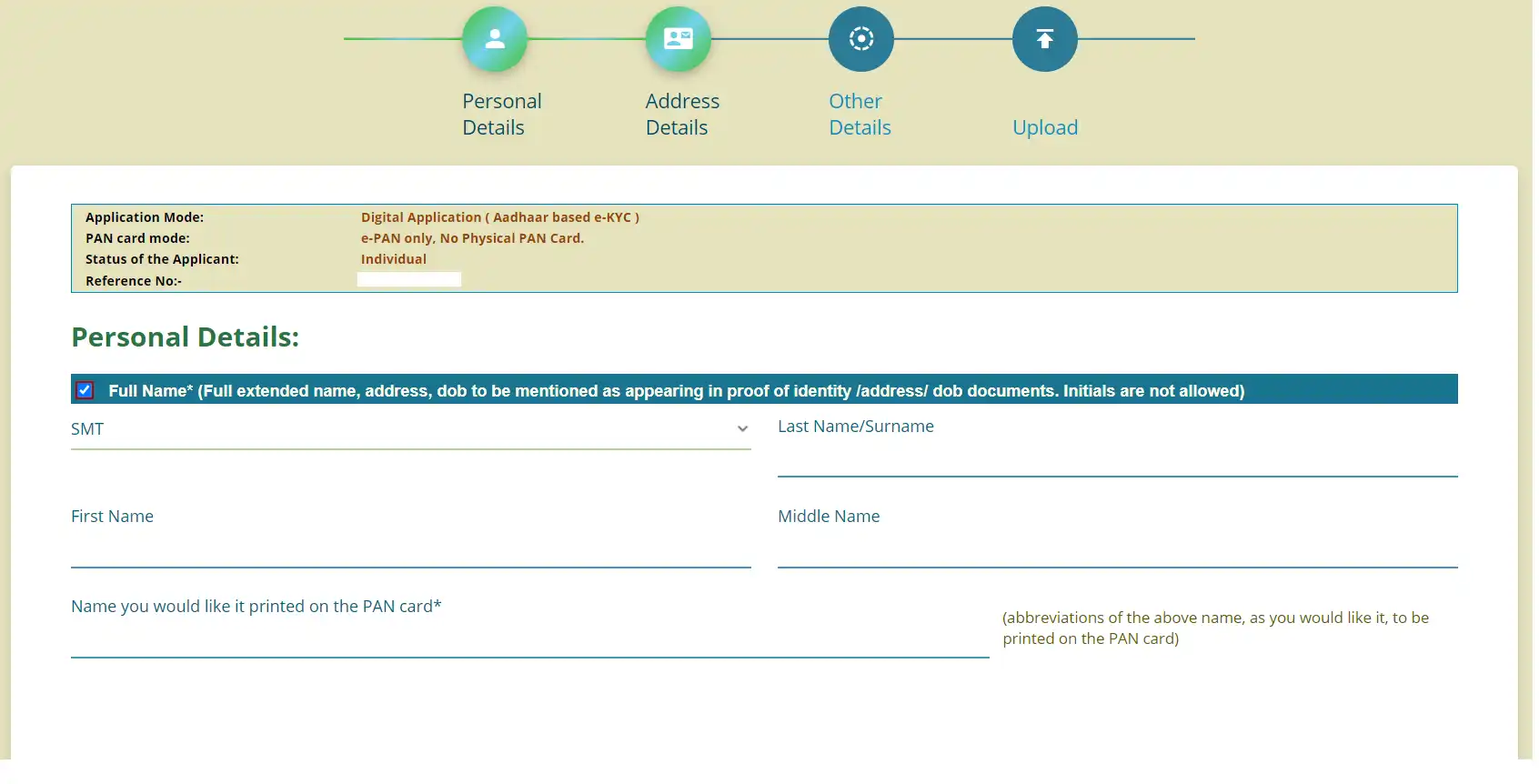

Click on the fields that you need to be corrected or updated on your PAN card. After that, mention the correct or updated personal information. Once you mention all the information, click on the "next step."

As per your Aadhaar card, your address will be updated. Now, mention your contact information and click on the 'next step.'

Mention your PAN number and verification. Then click on the 'next step' option.

Upload the documents on the site, then click on the "submit" option.

Once you upload all the documents, verify all the mentioned information and click on the 'make payment' option.

Choose the online payment options from the available ones and pay the applicable fee. After the successful payment, you will receive the payment confirmation message. Take a printout of the form.

You will get your updated PAN card within 15 days. When your PAN card is ready to be dispatched to your registered mobile number, you will get a text message.

This is how using both websites, you can apply for a PAN card update online. Moving ahead, let's know the offline process to update or make corrections in your existing PAN card.

Note: If you select the "Physical (Forward Application with documents physically)" option in Step 4, you will need to print the form, attach the documents with your signature, and mail it to any of the UTIITSL offices that are closest to you.

If you follow the steps below, then the PAN card correction/ update process will also become simple and hassle-free. So, let's know about them:

This is how you can apply for the PAN card correction online. Although the process is quite complex in comparison to the online process but if you follow the above-mentioned steps, it becomes easy. Moving further, let's know the documents required for updating or making corrections in your PAN card.

With a completed PAN card application, there are several different documents needed when you opt for a PAN card update. Based on the requirements of the cardholders, the document changes. To give you an idea, here is a list of several documents needed to change the name in a PAN Card for different categories.

Here is the list of the following documents needed to change the name in a PAN card:

| ID Proof | Date of Birth Proof | Address Proof |

|---|---|---|

| Aadhaar Card | Government-issued ID card | Electric bill |

| Driving license | Birth certificate | Tax assessment documents |

| Ration card | Marksheets | Aadhaar card |

| Voter ID | Passport | Mobile/ water/ gas bill |

| Pensioner's card | Driving license | Voter ID |

| Arm's license | Aadhaar card | Passport |

| Passport | Pensioner's card | Domicile certificate by the Central Government |

| Any other government-issued ID | Voter ID | Driving license |

Apart from these documents, the HUF also needs to provide an affidavit from the family head that mentions their name, their father's name, and their home address.

These are the following documents required for making changes in a PAN card of a company:

| Company Type | Documents |

|---|---|

| Trust | Trust deed |

| Limited Liability Partnership | LLP issued Registration Certificate |

| Company | Registration certificate |

| Partnership | Partnership deed |

Additionally, companies that have foreign registration offices, along with the registration certificate issued by the Indian officials, should provide the taxpayer certificate.

Here are the documents required in case of foreign citizens who need changes in their existing PAN card:

| ID Proof | Address Proof |

|---|---|

| OCI Card | OCI card |

| Passport | PIO card |

| PIO Card | Passport |

| Bank account statements |

Identification card of the taxpayer

|

| Visa | - |

| FRO issued a registration certificate | - |

| Identification card of the taxpayer | - |

Apart from all these, the following documents are also needed, as per the circumstances of an individual:

These are the documents that you need to submit when you apply for PAN card correction/ update as per the PAN card category type. Now, moving ahead, let's know the fees for making changes in a PAN card.

The PAN card correction/ update fees differ if you applied online or offline. Here are the PAN card correction fees for applying online:

| Document Submission Mode of PAN Application | Particulars | PAN Card Fees (inclusive of applicable taxes |

|---|---|---|

| Application submitted using the physical documentation mode for a physical PAN card | For a physical PAN card in India | INR 107 |

| For a physical PAN card outside India | INR 107 | |

| Application submitted through paperless mode for the dispatching physical PAN card | For a physical PAN card in India | INR 101 |

| For a physical PAN card outside India | INR 1011 | |

| Application submitted using a physical mode for the e-PAN card | e-PAN card sent to the applicant's email ID | INR 72 |

| Application submitted using paperless mode for the e-PAN card | e-PAN card sent to the applicant's email ID | INR 66 |

| Request for re-print of submitted PAN card | For a physical PAN card in India | INR 50 |

| Request for re-print of the submitted PAN card through a separate online link with no changes | For a physical PAN card outside India | INR 959 |

These were the fees for PAN card correction or updation online. Additionally, for PAN card correction offline, you need to pay INR 100 for dispatching the PAN card in India, and if you want to dispatch the updated card outside India, you need to pay an additional fee of Rs. 910. Moving further, let's know how to track PAN card application status.

Once you fill out the PAN card application form, submit the required documents, and make the payment, you will get an acknowledgment slip. It contains a 15-digit unique number. Through this, you can simply track your PAN card correction/ update application status using the NSDL website. Apart from this, you can also use the application tracking tool of Visament to check your PAN application. It is available on our site and provides you with reliable results.

This is how you can check the status of your PAN card correction/ update application. Now, moving further, let's know the general reasons for updating the card.

There are several reasons why people apply for a PAN card name change. To provide you with an idea of this, here are some of the key reasons for applying for the card correction/ update:

PAN card is considered one of the important documents in India. It is because through this card, the IT Department of India assesses the tax liability of individuals and companies and prevents tax evasion. When you apply for this, there are chances of discrepancies with the information you mentioned. Hence, it is essential to have an idea of the PAN card correction/ update process. In this blog, we have shared all the information about it. If you still have any confusion or need assistance with your PAN card update application, connect with Visament. We have a team of experts who can help you in applying for a new PAN card or making changes to your existing one. In addition, we do offer personalized guidance with quality service. So, why wait? Contact us today and let's apply for your PAN application together without any hassle.

You can change the address in your PAN card by filling out the application form and submitting it either online or offline, along with the requested documents relevant to the proof of your address change and the applicable card update fee.

You can update your PAN card online using the UTIITSL portal or the NSDL portal. For this, you need to visit any of these sites, fill out the application form online, submit the required documents, and pay the applicable fee.

To correct your name in the PAN card, you need to visit the official site of UTIITSL or the NSDL portal. Fill out the application form with correct information, submit the mentioned documents, and pay the fees. Within the given processing time, you will get your updated PAN card.

To change the date of birth in your PAN card, first, you need to visit any of the websites, i.e., NSDL or UTIITSL portal. Then choose the 'change/correction in PAN card details' and mention the PAN card number, fill out the other asked details, and submit it. After that, mention the requested details, enter the updated or changed DOB, upload the documents, and pay the fee. Once you make the payment, you will get an acknowledgment number. Through this, you can track your PAN card application status. With this, within the given processing time, you will get your updated PAN card.

In case you do not get your PAN card after 15 days of its submission, using your acknowledgment number provided after paying the PAN card fee, you can check your application status and see whether your card is being processed or issued. Apart from this, you can also contact the helpline number of the NSDL e-Gov- 020-27218080 or the helpline number of UTIITSL 913340802999 to inquire about the PAN card status.

You can download the updated PAN card using the NSDL or UTIITSL website where you applied for PAN card correction. After visiting the site, click on the "download e-PAN/ e-PAN XML' option. Then mention the PAN number, your DOB, and GSTIN if applicable, and the Captcha code, then submit it. Your e-PAN card will get downloaded, or the download link will be sent to your email ID.

As proof of a PAN card, you can submit any of the following documents: a copy of your PAN card or a copy of the allotment letter of your PAN card.

To update or change the photo on your PAN card, you need to fill out the PAN card updation/ correction application form from the official site of UTIITSL or NSDL and upload your passport-size photo.

Anyone who holds a valid PAN card and wants to make corrections or changes in their existing PAN card can apply for it. However, to make changes to the card, they need to have proof of it by their side.

By post, it generally takes 15 business days to get the updated PAN card to your address. However, this processing time may vary due to several factors such as individual circumstances, errors or mistakes in the application, or increased volume of applications.

The PAN card correction fee varies depending on the method you select to receive it. If you applied for a physical PAN card or e-PAN card, the fee varies from INR 50 to INR 1017.

If you make the updation or correction in your PAN card using the UTIITSL website, then to know the application status, you need to visit the site. Through the UTIITSL track status page, you can know the application status of your updated PAN card. In case you updated your PAN card from the NSDL website, then through the NSDL e-gov track status page, you can check your application status. In both sites, to know the current status of your PAN card correction or updation application, you need to mention your acknowledgment number, DOB, PAN number, and captcha code.

When you visit a website, it may store data about you using cookies and similar technologies. Cookies can be important for the basic operations of the website and for other purposes. You get the option of deactivating certain types of cookies, even so, doing that may affect your experience on the website.

It is required to permit the basic functionality of the website. You may not disable necessary cookies.

Used to provide advertising that matches you and your interests. May also be used to restrict the number of times you see an advertisement and estimate the effectiveness of an advertising campaign. The advertising networks place them after obtaining the operator’s permission.

Permits the website to recognize the choices you make (like your username, language, or the region you are in). Also provides more personalized and enhanced features. For instance, a website may inform you about the local weather reports or traffic news by storing the data about your location.

Aid the website operator to determine how the website performs, how visitors interact with the site, and whether there are any technical issues.