e-PAN card online version of the existing physical PAN card, which the Income Tax Department approves for use for identity purposes, managing financial transactions, investments, buying property, or for tax purposes.

In this blog, we will explain what an e-PAN card is, the process for applying, downloading, and updating details in your e-PAN card.

What is an e-PAN Card?

An e-PAN card is a digital card that can be accessed from anywhere using online devices, such as mobile phones, laptops, and tablets. It is a virtual card used to manage tax-related transactions and services in India, and it is also eco-friendly due to its paperless process. e-PAN allows us to verify our information quickly and have secure and encrypted protection to protect our personal information from misuse. e-PAN allows users to access financial services worldwide and can also be used as an identity proof.

Instant e-PAN Card

You can get an Instant e-PAN card in just 10-15 minutes through the income tax website at no cost. To get an instant e-PAN card, you don't need to file an application or submit any documents. You have to enter your details on the official website, and after entering the OTP, you will get your e-PAN card.

Who Can Apply for the e-PAN Card

Here are some eligibility criteria to apply for the e-PAN Card:

- You must be an Indian citizen to apply for an ePAN.

- You have not previously held a PAN card.

- You have a valid Aadhar Card.

- Your mobile number should be linked to your Aadhaar card.

- Your Aadhaar card has been updated and should now have the correct details.

Stop worrying about delays. Apply now and get your PAN card on time with our expert service.

Apply for an e-PAN Card?

For e-PAN applications, you can choose either the NSDL website or the UTIITSL e-filing portal. Below are the detailed steps to apply for an e-PAN card.

Through the NSDL Website

Step 1: Go to the NSDL PAN online portal.

Step 2: Fill in all the required details in the PAN application form.

Step 3: Choose the e-PAN option, and do not get a physical PAN when filling the application form. Provide your Aadhar card details.

Step 4: Upload all the documents for your e-PAN card application.

Step 5: Pay the fees for e-PAN and get an acknowledgment number.

Step 6: You will receive your e-PAN into your registered email ID.

Through the UTIITSL Website

Step 1: Go to the UTIITSL e-PAN portal.

Step 2: Select the e-PAN option for getting an e-PAN and not a physical PAN Card.

Step 3: Fill in all your details and provide an accurate Aadhar card number.

Step 4: Upload all the documents for your e-PAN application.

Step 5: You will get a 15-digit acknowledgment number on your registered mobile number.

Step 6: You can check your e-PAN application status by the given application number.

Step 7: e-PAN will be sent to your registered email address within 10-15 minutes.

From Income Tax e-Filling Portal

Here are the steps for e-PAN card apply through the Income tax e-filing portal.

Step 1: Visit the official Income Tax e-Filling Portal.

Step 2: Choose the 'Instant e-PAN' option.

Step 3: Fill in all the details with your Aadhar number.

Step 4: Enter the OTP given on your registered mobile number, and click on submit.

Step 5: You will get your e-PAN card to your registered email ID.

Download e-PAN Card

There are many ways to download your e-PAN card through various methods like acknowledgment number, NSDL website, UTIITSL portal, and from the Income Tax of India website. Given below is the detailed step-by-step process to download your e-PAN card.

From NSDL Portal

Follow the given steps for e-PAN download from the NSDL website.

Step 1: Go to the NSDL portal.

Step 2: Enter all the valid details like PAN number, Aadhar card, date of birth, and Captcha.

Step 3: After clicking submit, you can download your e-PAN card.

From UTIITSL Portal

Download e-PAN card from the UTIITSL portal by following the simple steps given below:

Step 1: Visit the official website of UTIITSL.

Step 2: Fill out all the details like date of birth, captcha.

Step 3: Select the option to receive OPT through mobile or email.

Step 4: Enter the OPT sent to your registered email or mobile number.

Step 5: You need to pay fees of 8.26 INR if you download your e-PAN after 30 days of issuance.

Step 6: After the payment process, you can easily download your e-PAN card PDF.

Through Income Tax e-Filling Portal

Step 1: Visit the official page of the Income Tax e-filing portal.

Step 2: Click on the 'Instant e-PAN' below the 'Our Services' section on the homepage.

Step 3: Choose 'Check status/download PAN' and enter your valid Aadhar number.

Step 4: Enter the OTP sent to your registered mobile number.

Step 5: After OTP validation, you can download your e-PAN card.

Have questions? Our experts guide you through every step of the PAN process – no confusion, no delays.

Consult an Expert Todaye-PAN Card Password

It is a password that you will need to open your e-PAN PDF. The e-PAN password includes the date of birth in the 'DDMMYYYY' format. After entering the e-PAN card password, you can open your PDF and see your e-PAN card.

Check the Status of Your e-PAN Card

To check your PAN status, you can visit the official websites like NSDL, the Income Tax e-filing portal, or the UTIITSL portal. You can check the status of your PAN using the acknowledgment number, Aadhar number, mobile number, and name. Here is the detailed step-by-step process to check your e-PAN status.

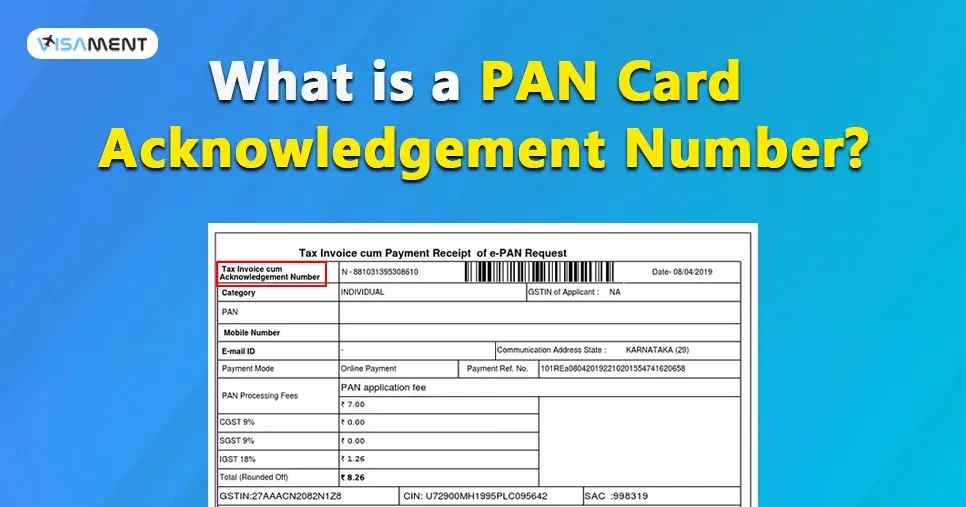

Through the Acknowledgment Number

Step 1: You need to visit the official website of UTIITSL.

Step 2: Enter all the necessary details like acknowledgment number or PAN application number with CAPTCHA code, then click on submit.

Step 3: After submitting, you will get your e-PAN card application status on your screen.

By using Aadhar Number

Step 1: Go to the official website of the Income Tax e-filing portal.

Step 2: Click on 'Instant e-PAN' below the quick links.

Step 3: Select the option 'Check status/ Download PAN'.

Step 4: Enter your valid Aadhar number, and click continue.

Step 5: Enter the OTP sent to your registered mobile number linked with your Aadhar card.

Step 6: After validating OTP, click submit and get the e-PAN card status.

By Using Mobile Number

Step 1: Send an SMS to 57575 with the 15-digit acknowledgment number from your registered mobile number.

Step 2: You will get an SMS of your e-PAN card status to your registered mobile number.

Check Your Status through WhatsApp

Step 1: Send a 'Hi' message through your WhatsApp to 8096078080.

Step 2: Select 'Services' and choose the option 'Status of Application'.

Step 3: Select your PAN and write your 15-digit acknowledgment number.

Step 4: After you enter your 15-digit acknowledgment number, you will get your e-PAN card status on your WhatsApp.

Check Your e-PAN Card Status by Name

Step 1:Go to the Tin-NSDL website.

Step 2: Select 'PAN', and choose the option 'New/Change Request' below the 'Application Type' option.

Step 3: Choose the option 'Name' and enter your last name, first name, and middle name with date of birth, and click submit.

Step 4: After clicking submit, you will get your e-PAN status.

e-PAN Card Print Process

You can get a physical copy of your PAN card through the NSDL or UTIITSL website by entering the details of your PAN card. If you request to print your e-PAN card, you will receive a copy of the physical PAN card at the address you provided. Given below is the simple process for re-print of PAN card

Step 1: Go to the NSDL website or UTIITSL website.

Step 2: Fill in all the required details, including your PAN number, Aadhaar number, date of birth, GSTIN (if applicable), and captcha code.

Step 3: Enter the OTP sent to your registered mobile number.

Step 4: Pay the fees and click 'Submit'.

Step 5: You will receive your physical PAN card at the address provided.

e-PAN Card Fees

If you are filling out an application for an instant e-PAN, you don't have to pay any fee because it is provided free of cost. However, if you are applying for an e-PAN through the NSDL or UTIITSL portal, you will need to pay fees to obtain your e-PAN card. Here is the list of fees for applying for an e-PAN through the NSDL and UTIITSL.

- For the e-PAN dispatch to the email ID and submission at TIN facilitation centers, PAN centers, or through a physical mode of document submission, you need to pay an INR 72 fee, including taxes.

- For the e-PAN dispatched to the email ID through an online and paperless mode, you need to pay INR 66, including taxes.

How to Update Details in Your e-PAN Card?

To update/corrections in your PAN card, follow the given steps below:

Step 1: You need to go to the e-filing portal.

Step 2: Click on 'Instant e-PAN.

Step 3: Click on 'e-PAN, and click update.

Step 4: Enter your 12-digit Aadhar number, tick the 'checkboxes', and click continue.

Step 5: After entering your Aadhar number, you will get a 6-digit OTP on your registered Aadhar number.

Step 6: Click continue, select the details to update, and click on the checkboxes. (You can update only the following details, like Photo, name, date of birth, mobile number, email ID, and address.)

Step 7: Click on confirm after selecting the details.

Step 8: Then you have successfully updated your information, and you will also get an acknowledgment number by which you can track your PAN card status.

Why Choose Visament for e-PAN Card

The e-PAN card is an important document for the individual. It is used in various financial and tax-related activities in India. You can also enjoy a faster and more convenient way to manage your financial transactions and investments by applying for an e-PAN through the Visament website. We offer a fast and secure process for the PAN card application. If you have any questions or queries related to the PAN card, then you can contact our fast and skilled experts 24/7.

Frequently Asked Questions

Yes, an e-PAN card is valid and helps in managing and doing financial transactions, banking, and investments, filing ITRs, and is similar to a physical PAN card. You can download the e-PAN card through the various government websites like NSDL, UTIITSL, and the Income Tax e-filing website.

If you are applying from an NSDL or UTIITSL website, then you need to pay INR 72 if your e-PAN is dispatched at TIN facilitation centers or PAN centers through a physical mode, and if your e-PAN is dispatched online through a paperless mode, then you have to pay a fee of INR 66, including taxes.

A e-PAN is a digital PAN card that can be accessed online through a mobile phone or, laptop. whereas, a PAN card is a physical printed PAN which you can get at your residential address. Both the PAN cards have the same work to help do financial transactions and activities in Indian-like investments, banking services, and filing ITRs.

If you are applying for an Instant e-PAN, then you will get your PAN card within 10-15 minutes from the income tax website using your Aadhar card.

You can use your e-PAN card for doing financial transactions, banking services, filing ITRs, and making investments.

A person who is are indian resident, does not hold a PAN card, has a valid Aadhar card, a mobile number linked with Aadhar card, and has an updated aadhar with all correct details, is eligible to apply for an instant e-PAN facility.

You can download your e-PAN through the NSDL or UTIITSL website by entering all the details like acknowledgment number, PAN number, and date of birth. Then you need to enter the OTP sent to your registered mobile number and click download e-PAN.

Yes, if you have lost your physical PAN card, then you can re-print your physical PAN through the NSDL or UTIITSL website, and without a physical PAN, you are still able to use your PAN card services.

To download your PAN card online, you can visit the NSDL or UTIITSL website by entering the necessary details such as acknowledgment number, PAN number, date of birth, etc, then enter the OTP sent to your registered mobile number, then you pay the fees, and after clicking on submit, you will get your e-PAN card.

Yes, you can download your PAN card using your Aadhar card from the income tax e-filing portal. You just have to click on 'Check status/Download PAN' and then, after entering your Aadhar number and OTP, you can download your e-PAN easily.

Yes, you can download a PAN card without a PAN number by using an aadhar number, date of birth. Through the NSDL or UTIITSL website.

Yes, you can download your PAN card without your PAN number through the NSDL, UTIITSL, and income tax e-filling portal by using your aadhar card, date of birth.

_1741091057.png)

_1741090655.png)