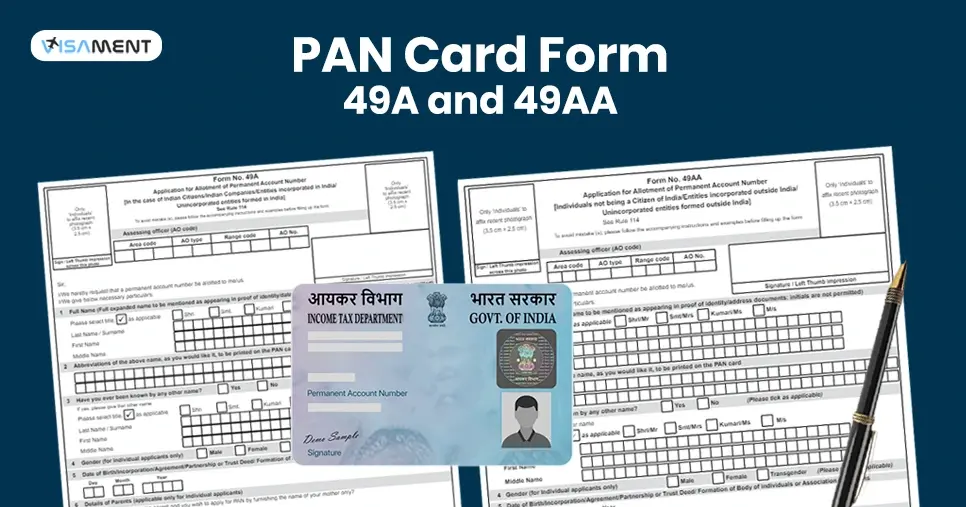

A Permanent Account Number (PAN) is a 10-digit alphanumeric number issued by the Indian government to all individuals or non-individual entities that earn income to pay taxes and avail government subsidies. It not only helps you open a bank account, but also one of the essential documents to carry out financial transactions in India, and to get it, there are certain procedures. The PAN card Form 49A and 49AA is an application form used to obtain a PAN card in India. Want to apply for PAN card? So you have to fill out Form 49a and Form 49aa. But are you confused between both forms? Which form do you have to fill out? Then you are at the right place. In this blog, we will know everything about both forms, so let's start reading.

What Is PAN Card Form 49A?

Having a PAN card in India is important for all earning individuals and non-individual entities. The PAN card Form 49A is for all Indian citizens, entities incorporated in India, NRIs, and other unincorporated entities that are formed in India. By filling out this form, they can obtain a PAN card in India and avail of the government subsidies.

This is all about the PAN card Form 49A and who can fill out this form. Now, moving ahead, let's know about the Form 49AA.

What Is PAN Card Form 49AA?

Foreign residents and entities incorporated outside India but functioning in India are also eligible to obtain a PAN card. It includes Persons of Indian Origin (PIO), foreign companies working in India, Overseas Citizen of India (OCI), and residents of a foreign nation. These people need to fill out the PAN card Form 49AA to obtain a PAN card in India.

This is what the PAN card Form 49AA is used for, and who can apply for the card. Moving further, let's know the structure of the PAN card Form 49A and 49AA in detail.

Stop worrying about delays. Apply now and get your PAN card on time with our expert service.

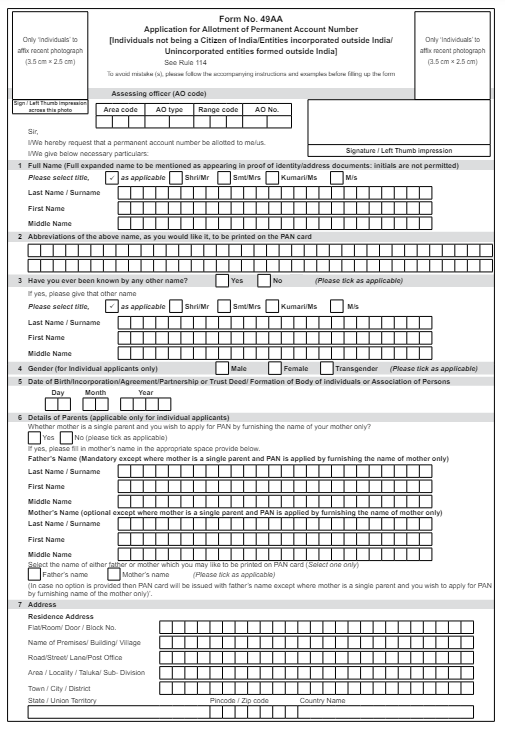

Structure of PAN Card Form 49A and 49AA

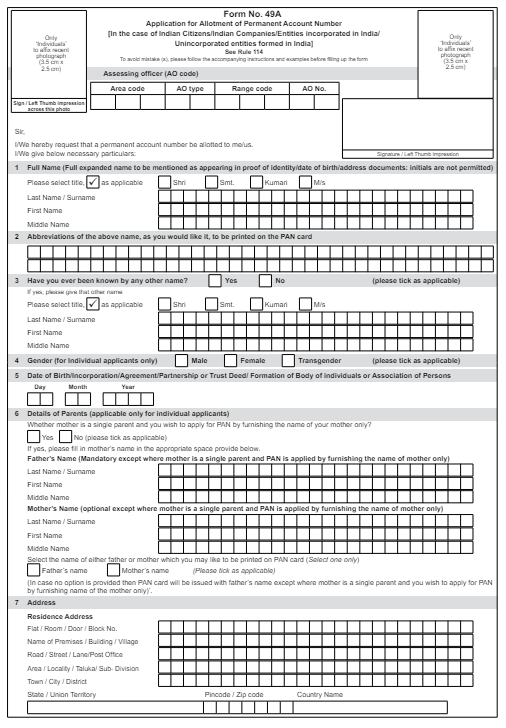

The structure of both PAN card forms, i.e., Form 49A and 49AA, is the same. Applicants filing out the PAN application form should provide the basic information vital for the KYC process. Given below are the necessary components that individuals need to fill out in the form:

- Full Name of the Individual: Here, you need to mention your full name, including your first, middle, and last name, and marital status. However, for the first and last names, you cannot use abbreviations.

- Abbreviation of the Name: In the PAN card, if you want your shortened name, fill out the abbreviation. The mentioned abbreviations will then be shown on the card.

- Other Names: If you have other names and known by them, mention the details of them also. It also includes your first, last, and surname.

- Gender: From the available options on the form, choose your gender.

- Date of Birth: In this, the applicant needs to mention his/her date of birth. In addition, it should match the submitted documents and the birth certificate. In the case of firms and organizations, you should mention the agreement date, trust deed, incorporation, or partnership deed as applicable.

- Parent's Name: It is compulsory in the PAN card application to mention the full name of your father, including his first, last, and surname. Mentioning the name of a mother is optional unless she is a single parent. You can choose in the application form whose name you want on your PAN card.

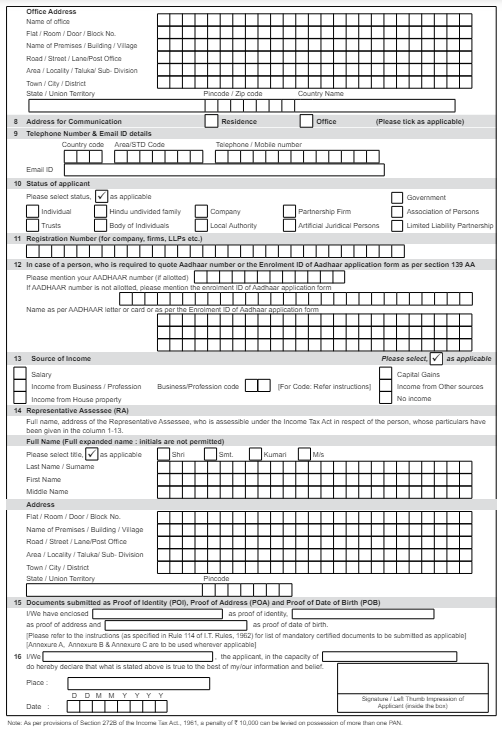

- Address: In this part of the form, you need to mention your residential and office address. While filling out the address, the applicant needs to be extra careful and should provide the correct details.

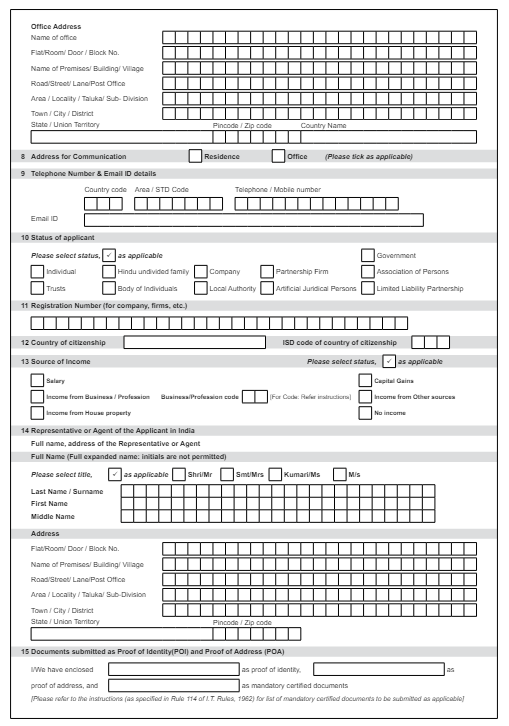

- Communication Address: Select an address, either your residential or office address, to fill in as the correspondence address. It will be used as your communication point.

- Email ID and Contact Number: Here, you need to mention your mobile number, telephone number, email address, country code, and state code.

- Applicant's Status: In this, you need to mention whether you are an individual, a partnership firm, a company, or a member of HUF.

- Registration Details: This section of the application form is only for entities such as LLPs, companies, firms, and more. HUFs and individuals do not need to fill out this part of the application.

- Aadhaar Number: The following section is only available in Form 49A. In this section, Indian residents need to fill in the information as stated on their Aadhaar card.

- Citizenship Country and ISD Code: This section is only in the Form 49AA. Here, foreign citizens should mention their country where they are residence and the ISD code of their country.

- AO Code: At the top of the form, you can find the tax jurisdiction code under which you fall. You can get this code from the PAN centres, the NSDL website, or the Income Tax Office.

- Sources of Income: In this section, you need to mention your source of income from which you earn money. If you do not have any source of income, then you can leave this section blank.

- Representative Assessee: Mention the name and address of the person or agent who legally represents you as per the Income Tax Act of India.

- Documents Submitted: Here, you have to list down all the documents you have submitted with your PAN card application.

Here is what the PAN card Form 49A and 49AA includes. From the Protean website, you can download both forms. Moving ahead, let's know how to fill out these forms.

How to Fill PAN Card Form 49A and 49AA?

While filling out the PAN card Form 49A and 49AA, you need to follow some specific rules. Though filling out an application form may look simple, several regulations need to be followed to prevent rejection. Considering this, the following are the things you need to consider while filling out the forms:

- General Rules: The PAN card application form is filled out in English, whether online or offline. It should be filled out in block letters with each box containing only one character. For filling out the form, use black ink. Additionally, it is advisable to avoid liquid ink pens and use ballpoint pens.

- Photo: Provide two high-quality passport-size color photographs as they will be visible on your card. While filing the form offline, do not staple the photograph.

- Thumb/Signature Impression: On the photograph attached to the left corner of your PAN application, the applicant needs to provide his/her left-hand thumb impression or a signature. The applicant should leave a thumb impression or sign the form in such a manner that it can be seen on the form as well as on the photograph.

- AO Code Details: The AO code information, such as Area Code, Range Code, AO Type, and AO number, should be filled out by the applicant. He/she can obtain this information from the PAN card centres or the Income Tax Office.

- Accuracy of the Provided Information: It is vital to mention accurate information while filling out the PAN application form. Providing erroneous or inaccurate details can result in application rejection.

- Contact Information: If the applicant is a foreign resident, he/she need to provide the ISD code for their mobile number along with the country name and ZIP code.

These are some of the regulations you need to consider while filling out the PAN card Form 49A and 49AA. Moving further, let's look at the sample of both PAN card forms.

Sample of PAN Card Form

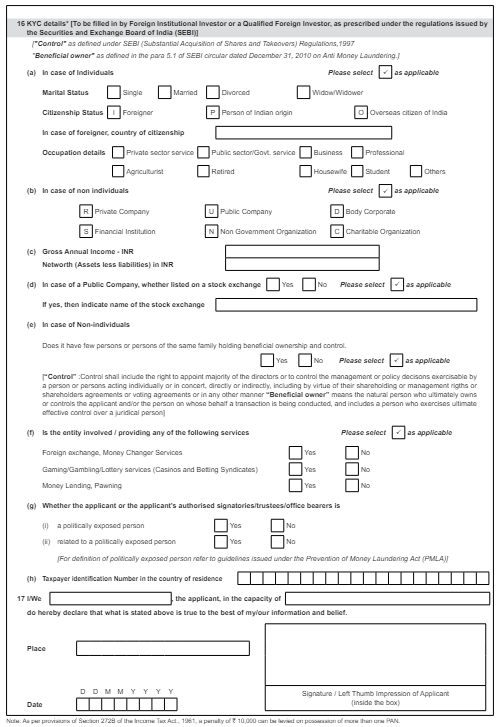

Sample of PAN Card Form 49A:

Sample of PAN Card Form 49AA:

This is how the PAN card form 49A and 49AA looks. Now, moving ahead, let's know how to apply for both PAN application forms.

How to Apply for PAN Card Form 49A and 49AA?

There are two ways by which you can fill out the PAN card form 49A and 49AA, i.e., online and offline. Now, let's know how you can apply for a PAN card online and offline.

Online PAN Application Process

Here is how you can apply for the PAN card online using the following steps:

- Go to the official site of UTIITSL or the NSDL website.

- Choose PAN card Form 49A if you are an Indian citizen, a company, or an NRI, or select the PAN card Form 49AA if you are a foreign citizen or company.

- Fill out all the information in the form accurately and choose the mode of receiving the PAN card.

- Upload all the required documents and pay the mentioned fees using the available online payment options.

- Submit your online PAN application. After submission, you will receive an acknowledgment number that further helps you in application tracking.

- Send the required documents by post or courier to the UTIITSL or NSDL office.

Offline PAN Application Process

To apply for a PAN card offline, follow the steps:

- From the Income Tax website or the Protean website, download the 'Form 49A or Form 49AA as per your PAN application.

- Fill out the PAN application form with accurate information.

- Attach your passport-size color photographs and signature to the PAN application.

- To your nearest PAN application centre, submit your application along with the requested documents.

- Pay the stated PAN application fee.

- After the payment, you will receive an acknowledgement number that will further assist in your application tracking.

This is how you can apply for PAN card online or offline, as per your choice. After the application submission and document verification, within 15 days, you will get your PAN card. Moving further, let's know the documents required for Forms 49A and 49AA for the PAN card.

Say goodbye to paperwork stress! Hassle-free PAN card application for NRIs.

Apply NowDocuments Required for PAN Card Form 49A and 49AA

An applicant needs to attach the following documents while filling out the PAN card Form 49A and 49AA for verification:

- Identity Proof: For an ID proof, you can send a copy of any of the following, such as a passport, Aadhaar card, driving license, voter ID, or more.

- Address Proof: This could be anything from a water bill, passport, electricity bill, Aadhaar card, or any other document that mentions your address.

- Date of Birth Proof: For your date of birth proof, you can provide a copy of your birth certificate, Voter ID, marksheet, Aadhaar card, etc.

Apply for Your PAN Card Simply with Visament

In India, a PAN card is a vital document for any individual with a regular income source and for all businesses to run their business smoothly. According to your application type, you can choose from the PAN card Form 49A and 49AA. Also, it becomes essential to carefully apply for the card. In case you have any confusion about the PAN card application form or about the process, contact Visament, and get your card without any issue. We have a team of experts who have years of experience in this field and provide guidance at every step of the process. So why struggle when you have the option? Connect with us today and simply apply for your PAN card.

Helping Lumers streamline their workflow and deliver faster

My Friends Recommended the Visament Website

I don't know where to apply from the PAN card form 49A, then my friend recommended me the Visament website. I applied through it by filling out the online application form with all the documents and fees, and I got my PAN card in just a few days after applying.

I Can Get Information About the 49a and 49a Forms

Visament helped me to know about the PAN card forms 49A and 49AA. Now I know the importance of both PAN card forms, and I thank all the Visament and its team for providing such great information.

Visament Provided Details About Form 49a

I don't know anything about the PAN card form 49A, but after visiting the Visament website, I know all the information about the PAN card application. I'm impressed by the great information from the Visament and its team.

Cleared All My Problems With PAN Card Agents

I had some problems related to the application process for the PAN card application, so I have sought help from the PAN card agents, and they solved my problems in just a few minutes. Such instant responsive support services.

I Have Applied for a PAN Card Application

I am not able to apply for the PAN card, then my dad suggested I apply online through the Visament website by filling out the Application form 49A and 49AA with all the documents and fees. It was an easy and simple application process.

Visament Has a Fast Application Processing

Visament helped me to get my PAN card quickly with its fast application processing, which also saves me time. I will look forward to applying for more PAN card services through the Visament website.

Filled Out My PAN Application Online

I have applied for a PAN card application through the Visament website, for which I have filled out an application and submitted it online. It was a simple application process that could be understood by every person.

Submitted All Documents for PAN Card

I have filled a PAN card application form 49A and 49AA, for which I have successfully submitted government-issued ID proof, proof of address, birth certificate for date of birth proof, and many other valuable documents for the smooth application process.

Error-free PAN Card Application Through Visament

I have applied for an Online PAN card application through the Visament website. The Visament PAN card consultants are so polite and friendly with me, and they make sure that I don't have any problems in the PAN card application process.

Visament Has a Simple PAN Card Application

One of the simplest PAN card application processes I have ever seen at the Visament website. I'm impressed by the excellent services from the online Visament website. want to give a 5/5 star rating.

Visament Has Affordable PAN Card Fees

Visament has low and affordable fees for the PAN card application. I have filled out an application form 49A with all the documents for getting my PAN card. If I compared it with the other websites, Then It has affordable fees for the PAN card application with low service charges.

Visament Agents ae Active and Helpful

The Visament PAN card agents helped me in the whole application process. From the online application filling to the application submission, one of the best decisions I have ever made for my PAN card application.

Visament Has a Professional Assistance

If anyone wants to apply for a PAN card, then I will recommend them the Visament website, which has a simple application process and has professional assistance that will help in the smooth application process.

Visament Agents Guided Me

I need help to fill out my PAN card application form 49aa, for which Visament PAN card agents have arrived instantly, and they guided me to fill out a hassle-free application, and helped me to submit it at the Visament website.

I Get All the PAN Card Application Updates

I get all the updates and notifications related to my PAN card application through the Visament website via my email. I liked this service of the Visament website and recommended all my friends about the safe and secure Visament website.

Visament Has Affordable PAN Card Fees

Visament has low and affordable fees for the PAN card application. I have filled out an application form 49A with all the documents for getting my PAN card. If I compared it with the other websites, Then It has affordable fees for the PAN card application with low service charges.

Visament Agents ae Active and Helpful

The Visament PAN card agents helped me in the whole application process. From the online application filling to the application submission, one of the best decisions I have ever made for my PAN card application.

Visament Has a Professional Assistance

If anyone wants to apply for a PAN card, then I will recommend them the Visament website, which has a simple application process and has professional assistance that will help in the smooth application process.

Visament Agents Guided Me

I need help to fill out my PAN card application form 49aa, for which Visament PAN card agents have arrived instantly, and they guided me to fill out a hassle-free application, and helped me to submit it at the Visament website.

I Get All the PAN Card Application Updates

I get all the updates and notifications related to my PAN card application through the Visament website via my email. I liked this service of the Visament website and recommended all my friends about the safe and secure Visament website.

Frequently Asked Questions

There are two options available to fill out the PAN application form, i.e., online and offline. For online application, you can visit the NSDL or UTIITSL website, and there you can fill out the application form. After that, along with the application form, submit the requested documents and pay the application fee. For offline, download the PAN application form from the Income Tax website or the Protean website. After that, fill out the form with the correct information and gather the required documents. Courier them to your nearby PAN card center and pay the fee. Within 15 days after the application submission and document verification, you will receive your card.

The only difference between the PAN card Form 49A and 49AA is the applicants. Form 49A is for Indian citizens, entities incorporated in India, NRIs, and any other unincorporated entity. While Form 49AA is for foreign residents in India, Overseas Citizen of India (OCI), Person of Indian Origin (PIO), and companies incorporated outside India but functioning in India.

No, you cannot skip the AO code for the PAN card. This code assists you in identifying your income tax jurisdiction. The AO or Assessing Officer verifies your ITR to ensure that the income, tax, and deductions are correct or not. Additionally, each income tax jurisdiction has its 'AO code.' So, if you want to obtain a PAN card, you need an AO code.

You can apply for a Form 49A online and offline. For the online process, visit the UTIITSL or NSDL website. Then select the form time, fill out the application form, choose the mode of receiving the card, and upload the required documents. After that, pay the PAN card fee and, within the given processing time, receive your card. For the offline procedure, download the Form 49A from the Income Tax website or the Protean website. Fill out the PAN application form with correct information. After that, courier your PAN application and other requested documents to your nearby PAN center and pay the fee. Within 15 days after the document verification, you will get your PAN card.

The required documents for applying for the Form 49A include a copy of any of the following ID proof (passport, voter ID, or Aadhaar card), address proof (utility bill, electricity bill, Aadhaar card or more), and date of birth proof (birth certificate, voter ID, Aadhaar card, etc.).

For Indian residents, the PAN Card Form 49A fee is Rs 101, and for NRIs, the fee is Rs 1011, which includes the application and dispatch charges of Rs 857 and 18% GST of Rs 154.

Generally, the PAN card form 49A takes 15 days to process after the successful submission of the PAN application and document verification.

There is no difference between the NSDL and UTI PAN cards; both are used for the same purpose of identifying Indian taxpayers. The NSDL PAN refers to the PAN cards permitted by the National Securities Depository Limited, and the UTI PAN denotes the PAN card issued by the UTI Infrastructure Technology and Services Limited, another authorized PAN entity.

Well, there is nothing different between the NSDL and UTIITSL PAN card. Additionally, both are used for the same purpose. So, whether you apply from NSDL or UTIITSL does not matter, as both are good.

For owning duplicate or multiple PAN cards, a person needs to pay a fine of Rs 10,000. Under Section 272B of the Income Tax Act, the Indian government imposed this fine, which is meant to prevent owning multiple PAN cards by a person.

_1741090655.png)

_1741090839.png)