- What is PAN Card 2.0?

- What are the Features in PAN 2.0?

- What are the Benefits of PAN 2.0?

- What is the Eligibility for PAN 2.0?

- What are the Required Documents for PAN 2.0?

- Upgrades or Changes from PAN Card to PAN 2.0

- What is the Process to Apply for PAN 2.0?

- How to Apply for PAN 2.0 Reprint Online with QR Code?

- How to Download PAN Card 2.0?

- What is the Difference Between PAN and PAN 2.0?

- Why Choose Visament for PAN Card 2.0

This PAN card 2.0 will help manage and access non-core PAN and TAN services, making PAN validation services paperless and easier to access from anywhere. It is also a major step in the government's Digital India programme.

What is PAN Card 2.0?

A PAN card is a permanent account number card. It is proof of identity with the Income Tax Department. The Government of India introduced the PAN card 2.0, which is an upgraded version of the Permanent Account Number (PAN) card with a QR code. The PAN 2.0 project was approved by the Cabinet Committee on Economic Affairs (CCEA) of the Income Tax Department with a Financial Outlay of INR 1,435 crore on 25 November 2024. It is an e-governance project aimed at making taxpayer registration services easier through the digital transformation of the old PAN card to PAN 2.0.

The PAN 2.0 project is making India's vision a reality by enabling PAN to integrate with the digital systems of government agencies. PAN 2.0 also enhances the security of individual information and focuses on effective and complete resolution.

Note: NSDL Portal, e-Filing Portal, and UTIITSL Portal are different portals that provide PAN-related services, but in the PAN 2.0 Project, all PAN services are available on a single portal of the Income Tax Department.

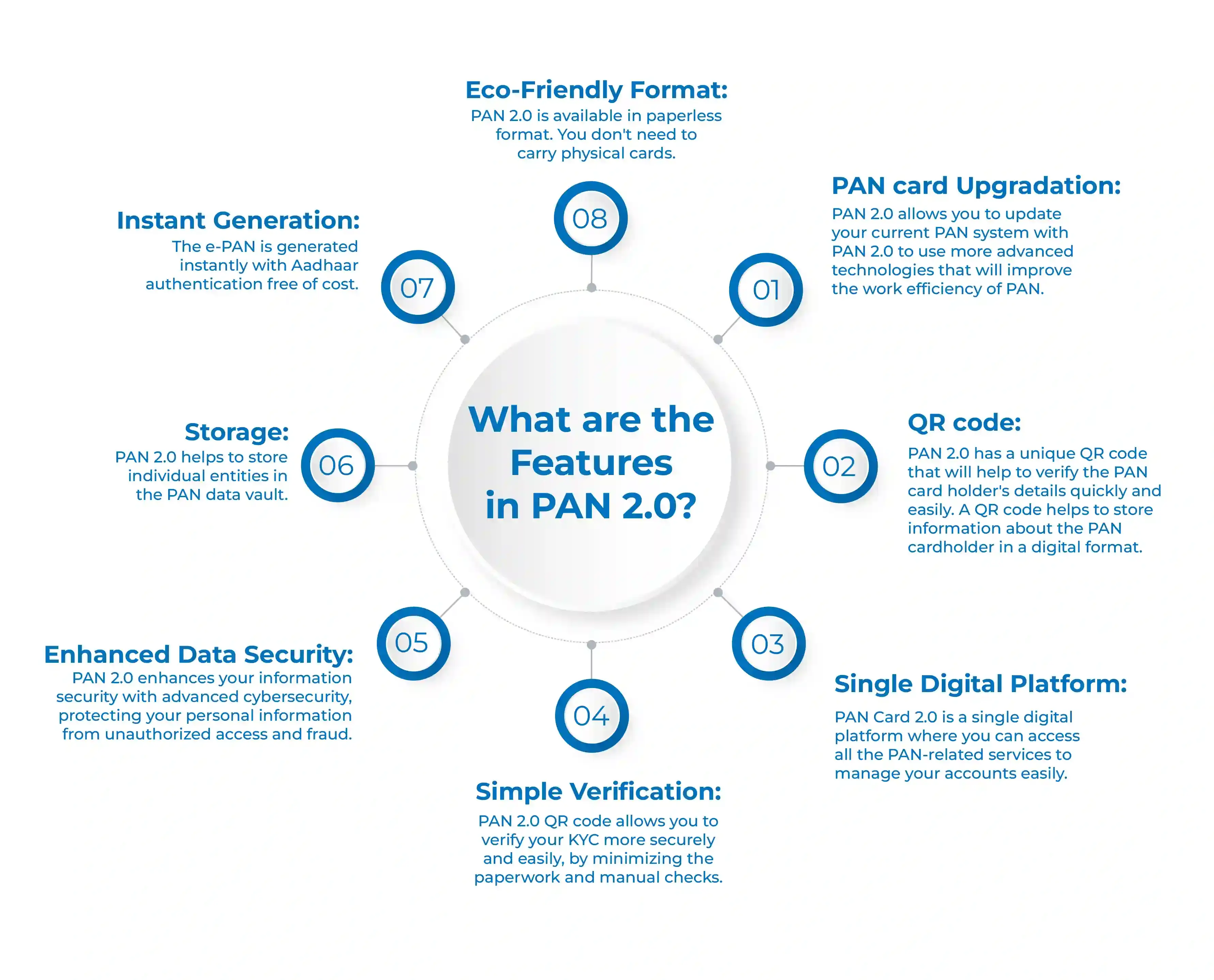

What are the Features in PAN 2.0?

Having a PAN card 2.0 gives you unique features like.

- PAN card Upgradation: PAN 2.0 allows you to update your current PAN system with PAN 2.0 to use more advanced technologies that will improve the work efficiency of PAN.

- QR code: PAN 2.0 has a unique QR code that will help to verify the PAN card holder's details quickly and easily. A QR code helps to store information about the PAN cardholder in a digital format.

- Single Digital Platform: PAN Card 2.0 is a single digital platform where you can access all the PAN-related services to manage your accounts easily.

- Simple Verification: PAN 2.0 QR code allows you to verify your KYC more securely and easily, by minimizing the paperwork and manual checks.

- Enhanced Data Security: PAN 2.0 enhances your information security with advanced cybersecurity, protecting your personal information from unauthorized access and fraud.

- Storage: PAN 2.0 helps to store individual entities in the PAN data vault.

- Instant Generation: The e-PAN is generated instantly with Aadhaar authentication free of cost.

- Eco-Friendly Format: PAN 2.0 is available in paperless format. You don't need to carry physical cards.

Stop worrying about delays. Apply now and get your PAN card on time with our expert service.

What are the Benefits of PAN 2.0?

Here are some of the benefits of having a new PAN card 2.0:

- More Security: PAN 2.0 provides a scanned QR code, which helps to protect the data of an individual. It also helps to prevent the use of duplicate or fake PAN cards. It has a QR code which can only be scanned using authorised software to read and see the information of the PAN card, and cannot be scanned with a normal application.

- Encrypted personal information: PAN 2.0 has encrypted information, which is stored in a QR code on the PAN card. This information includes your name, date of birth, Aadhaar card, and PAN number to prevent fraud.

- Eco-Friendly Card: PAN 2.0 is an online process that does not have any paperwork. So it is an eco-friendly format card, for which you don't have to carry a physical card, or don't need to print.

- Worldwide accessible: You can get your PAN card 2.0 from anywhere around the world. For example, OCIs and NRIs can apply for an e-PAN online from anywhere.

- Easy Verification Process: PAN 2.0 QR code makes the KYC verification more secure and easier without any paperwork process.

What is the Eligibility for PAN 2.0?

To apply for a PAN card 2.0, you need to meet some eligibility criteria given below

- You must be an Old PAN cardholder to apply for a new PAN 2.0.

- If you are an existing PAN cardholder, then you can apply for a PAN card 2.0 online.

- You need to provide proof of address, identity, and date of birth.

What are the Required Documents for PAN 2.0?

For a smooth PAN 2.0, you need to submit some of the following documents.

Proof of Identity

- Aadhar card

- Passport

- Driving License

- Voter ID

Proof of Address

- Last 3 months' Bank statement

- Rent Agreement

- Last 3 months' utility bill

- Aadhar card with current address

Proof of Date of Birth

- School Leaving-Certificate

- Passport

- Birth Certificate

Upgrades or Changes from PAN Card to PAN 2.0

PAN card 2.0 is an advanced PAN compared to the existing one. It has a major feature, which is a QR code that contains all the information of a PAN cardholder like the cardholder's name, parents’ names, photo, signature, and date of birth. This makes the work easier by quick verification with QR code scans.

Updating the existing PAN card to PAN 2.0 is an easy taxpayer registration with a paperless verification by a safe digital system. However, this will not make your existing PAN card invalid. People can apply for an update to their existing PAN card.

See the detailed process to change or update PAN card to PAN card 2.0 online from the NSDL and UTIITSL websites.

Say goodbye to paperwork stress! Hassle-free OCI card application for NRIs.

Apply NowWhat is the Process to Apply for PAN 2.0?

If you have an old PAN holder and want to change or update your PAN card, then follow these steps to apply for a PAN change from PAN card to PAN 2.0.

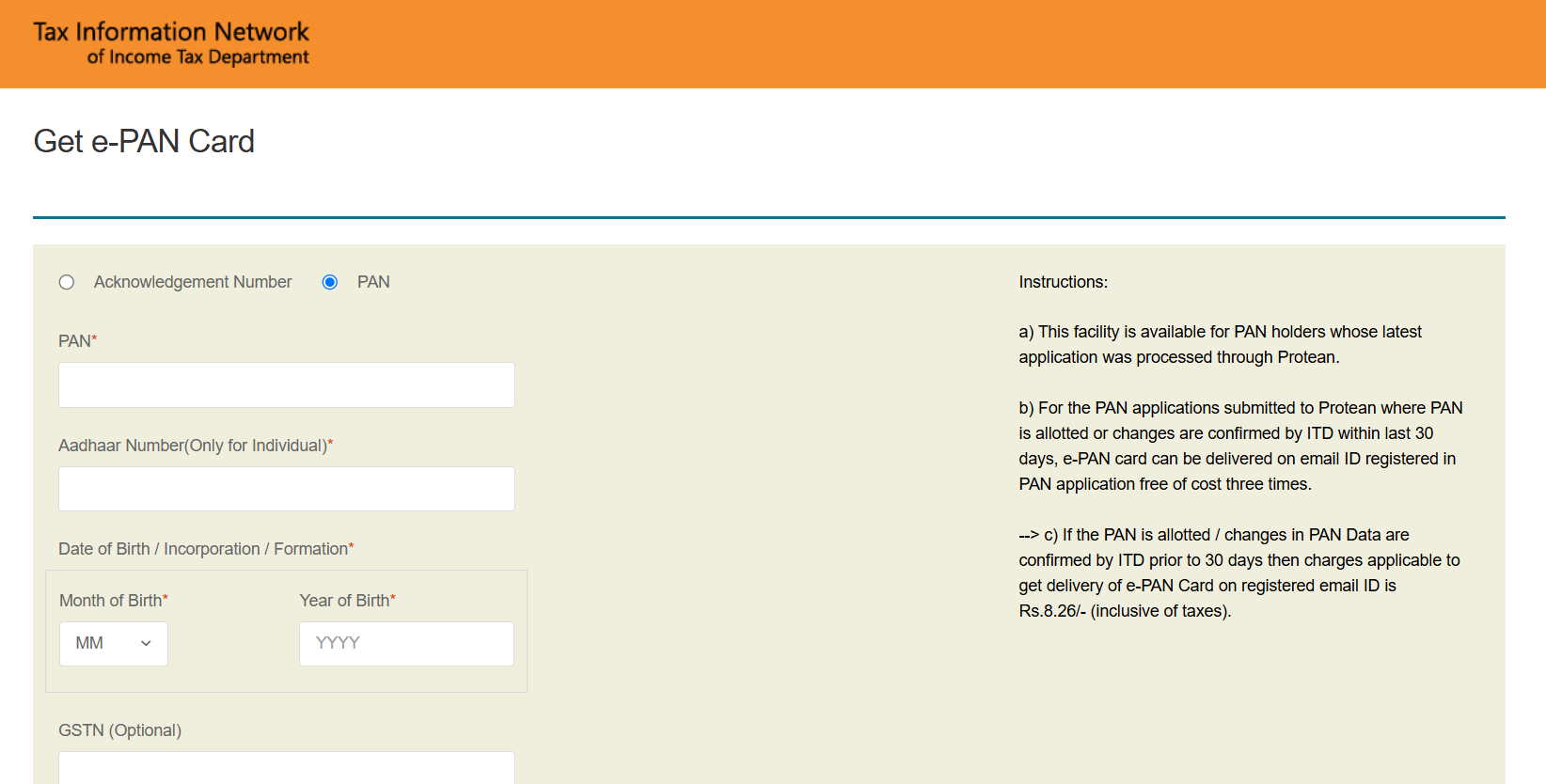

How to Apply PAN 2.0 Online from the NSDL Website?

Here is the simple process to apply for a new PAN 2.0 through the NSDL website

Step 1: Visit the official NSDL website.

Step 2: Enter your PAN number, Aadhaar number, and Date of birth.

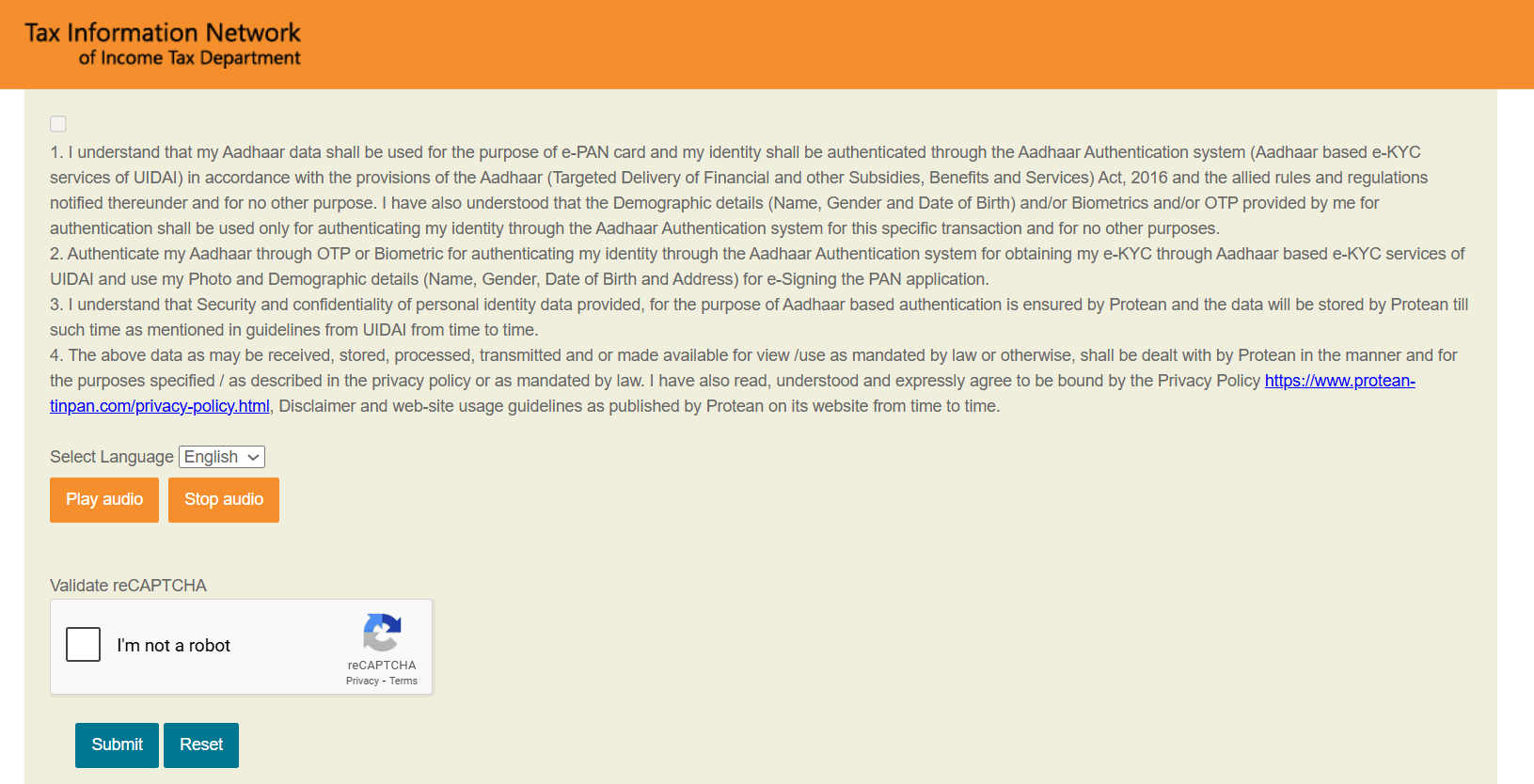

Step 3: Next, verify your information by ticking all the checkboxes and clicking the Submit button.

Step 4: Select your one-time password (OTP) method and enter it within 10 minutes.

Step 5: After entering your OTP, agree to all the terms and conditions. It is free of cost if you apply for a PAN 2.0 and request a PAN issuance within 30 days. After 30 days, you have to pay INR 8.26, including GST.

Step 6: You will get your e-PAN to your registered email ID after 30 minutes of payment.

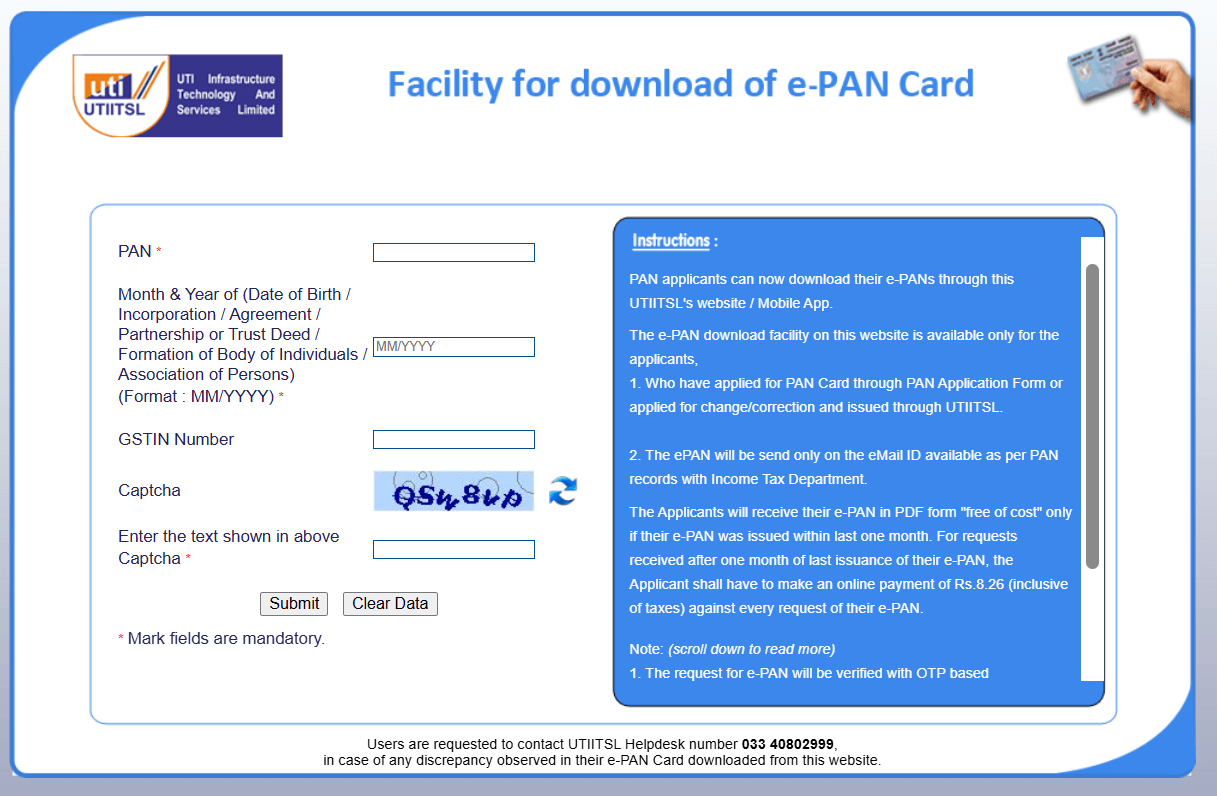

How to Apply PAN 2.0 Online from UTIITSL Website?

Here is the process to apply for PAN 2.0 easily from the UTIITSL website:

Step 1: First, you need to visit the official UTIITSL e-PAN portal.

Step 2: Please fill in all the details required for your PAN 2.0, such as PAN number, date of birth, and captcha code.

Step 3: After entering all the details, confirm your email ID, and update your email if you haven't registered yet.

Step 4:Applying for e-PAN is free of cost if you apply within 30 days of PAN issuance. Afterwards, you need to pay INR 8.26 fees with GST.

Step 5: You will get your e-PAN card to your given email ID once your application is processed.

How to Apply for PAN 2.0 Reprint Online with QR Code?

Now, we will see the simple process to apply for a PAN 2.0 reprint with a QR code of the NSDL and UTIITSL website.

From NSDL Website

Follow the given process for PAN card 2.0. Apply online through the NSDL website.

Step 1: You need to go to the official website of NSDL.

Step 2: Fill in all the details, like the PAN number, date of birth, Aadhar number, and GST( If applicable).

Step 3: Check all the tickboxes and click submit.

Step 4: To verify the information, choose the OTP method and click on Generate OTP.

Step 5: Choose the mode of payment and pay the PAN 2.0 fees.

Step 6: After payment, you will get an acknowledgment slip, and you will get your reprinted PAN card within 15-20 working days at your given address.

From UTIITSL Website

Follow the process given below for re-printing PAN card 2.0. Apply online from UTIITSL.

Step 1: Go to the UTIITSL e-PAN portal.

Step 2: Fill in all the details such as PAN number, date of birth, Aadhar number, (GSTIN number if available), and captcha code, and click submit.

Step 3: Enter the OTP sent to your registered mobile number and pay the fees.

Step 4: Get your e-PAN card to your given email address.

How to Download PAN Card 2.0?

Follow these simple steps from NSDL and UTIITSL for PAN card 2.0 download.

Through the NSDL Website

Step 1: Go to the NSDL website.

Step 2: Fill in details like PAN number, Aadhar number, and date of birth.

Step 3: Tick all the checkboxes and click on submit.

Step 4: Choose the OTP method to verify all the information and enter it within 10 minutes.

Step 5: Choose the mode of payment and proceed to pay the fees.

Step 6: You will get your e-PAN to your registered email ID within 30 minutes of payment. You can click on the given link in the email ID for PAN card 2.0 download.

Through the UTIITSL Website

Step 1: Go to the official UTIITSL e-PAN portal.

Step 2: Enter all details like PAN number, date of birth, Captcha code, and submit them.

Step 3: Enter the OTP you received on your registered mobile number, and pay the fees.

Step 4: You will get your e-PAN card at your given email address, and you can download it from the given link.

What is the Difference Between PAN and PAN 2.0?

Here are some major differences between PAN and PAN 2.0.

| Features | PAN card | PAN 2.0 |

|---|---|---|

| QR Code | Don't have any QR code. | Have a QR Code for fast verification. |

| Method of Verification | Manual Verification. | By scanning the QR code. |

| PAN Card Format | Traditional Plastic card with PAN number. | PAN card with QR code displaying information. |

| Security features | Photograph and Signatures. | QR code that can only be read through authorised software. |

| Avaliability | Only in Physical form. | Can be available in Physical and e-PAN. |

| Fees | You need to pay applicable fees. | You don't need to pay any fees. |

| Purpose | used in Filing ITRs and financial transactions. | Same as PAN card. |

| Processing Time | Takes a long time for the PAN card process | You get the e-PAN card within a few minutes to your given email ID. |

| Environmental Impact | It is a paper-based process, which harms the environment. | Fully digital online process, which doesn't contain paperwork. |

Why Choose Visament for PAN Card 2.0

Update your existing PAN card to the new PAN 2.0 to utilize the digital QR code PAN with enhanced security. Visament provides you with secure and fast PAN card services, including updates, corrections, Aadhaar-PAN linking, and online PAN validations, with skilled and experienced professionals who are available 24/7 to assist you and address your queries. Get your PAN 2.0 version now to enjoy advanced features.

Frequently Asked Questions

Go to the e-filling portal> login >Under the profile section on the Dashboard. Choose the link Aadhar to PAN option. Click on Link Aadhar.

PAN 2.0 is an e-government project to make the PAN card more advanced and to upgrade it. It will help TAN and PAN services and make the application process paperless and secure. It has a unique QR code that will make verification quick and easy.

To upgrade your old PAN card to PAN 2.0, you need to visit the NSDL or UTIITSL e-PAN portal and enter all the details like name, date of birth, PAN number, and captcha. Then you have to verify your information by checking all the boxes and choose the mentodf to receive OTP and enter it in under 10 minutes, and after aggreging to terms you will be redirected to payemt page where you have to pay fees, but if you have applied for an PAN within 30 days then you don't have to pay any fees and if after 30 days then you need to give INR 8.26 including GST, and you will get your e-PAN in your registered email address.

PAN 2.0 is a project of the Income Tax Department, approved by the CCEA, which aims to enhance the taxpayer registration process through advanced technology-driven PAN and TAN services, providing a Paperless process with a secure system. It differs from their existing PAN card because old PAN cards require a paperwork process and don't have an e-PAN. However, PAN 2.0 is a fully digital process, without a single piece of paperwork, and also contains a QR code that protects it from unwanted threats, such as duplicate or fake PAN cards.

Go to the Income tax e-filling portal> Click on 'Verify' your PAN, and enter your PAN number, full name, date of birth, and mobile number. Upon receiving OTP, your PAN details can be checked.

In the current situation, citizens need to update their PAN card to PAN 2.0 for easy and secure identification through the QR code, which ordinary applications or scanners cannot read.

The QR code enables PAN 2.0 to collect an individual's personal information more easily, and it provides high-level encryption security for individual information. To access and read the QR code, you will need authorised software, which cannot be easily available.

You can check your PAN 2.0 status through the income tax e-filing website and click on the 'Verify PAN status'. Then, enter your PAN number, date of birth, and mobile number, and click 'Continue'. Enter the OTP sent to your mobile, and your PAN card status will be displayed on your screen.

_1741090499.png)

_1741090655.png)