- What is a Duplicate PAN Card?

- How To Apply For a Duplicate PAN Card?

- When Do You Need To Apply For A Duplicate PAN Card?

- Who Can Apply For a Duplicate PAN Card?

- What Documents are Required for a Duplicate PAN Card?

- Fees for Applying for a Duplicate PAN Card

- How To Download Duplicate PAN Card?

- How to Surrender a Duplicate PAN Card

- Some Important Points Relating to Duplicate PAN Card

- Final Thoughts

In our practical lives, we all use the PAN card (Permanent Account Number) at some point, whether it's for opening a bank account or filing an ITR. In India, a PAN card is considered an essential document for carrying out financial transactions.

However, sometimes accidentally or unintentionally, you can lose or damage your PAN card. But did you know that you can apply for a duplicate PAN card with the same number? Yes, one can apply for a reprint of the PAN card using the TIN-NSDL portal online. The process is not complicated, but it requires proper understanding to avoid any delays or rejection.

Want to know more about the process to apply for a duplicate PAN card in detail? Please read on the blog and get your answers, but before that, let's first understand what a duplicate PAN card is.

What is a Duplicate PAN Card?

As its name suggests, a duplicate PAN card is a reissued version of your original PAN card, which is issued by the income tax department when you misplace, lose, or damage the original PAN card. Like your original PAN card, it will have the same PAN card number as it always has.

This was all about what a duplicate PAN card is. Moving further, let's know how you can apply for a reprint of your PAN card.

How To Apply For a Duplicate PAN Card?

As mentioned above, there are two ways you can apply for a duplicate PAN card, i.e., online and offline. Both the application processes are simple to use. Moving further, let's know about each of them in detail.

How to Apply for a Duplicate PAN Card Online?

You can apply for a duplicate PAN card online using the TIN-NSDL website. The online process saves you a lot of time by avoiding the need to visit the PAN card centre and completing the process from the convenience of your home. Here are the steps you need to follow to apply for a reprint of your PAN card online:

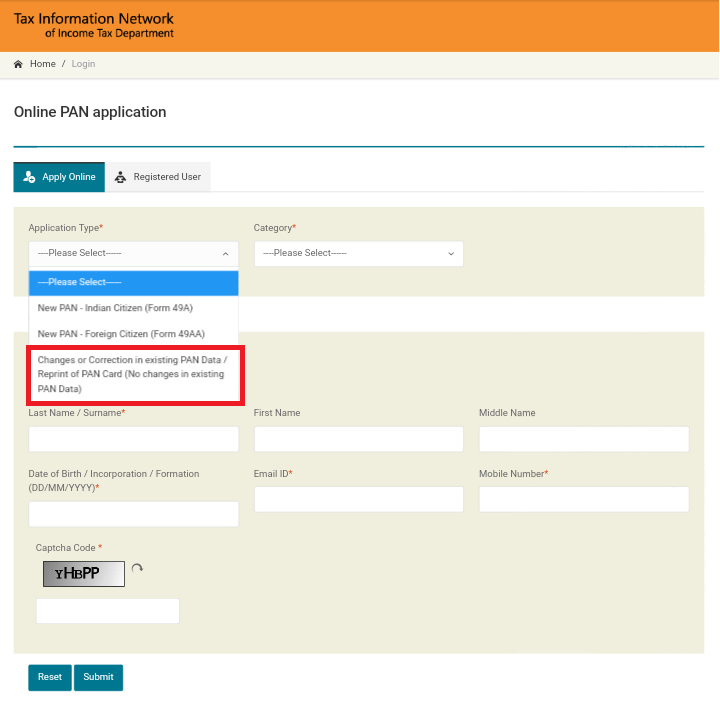

- Step 1: Go to the official TIN-NSDL website and choose Changes or correction in existing PAN data/ Reprint of PAN card (no changes in the existing card) as your application type.

- Step 2: Fill in the mandatory details and submit the form.

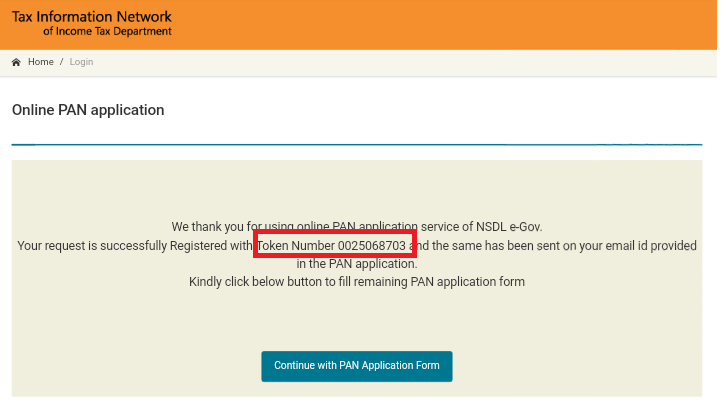

- Step 3: Once the submission is done, you will receive a token number on your registered email ID. Note down the token number to continue the application process and for future reference.

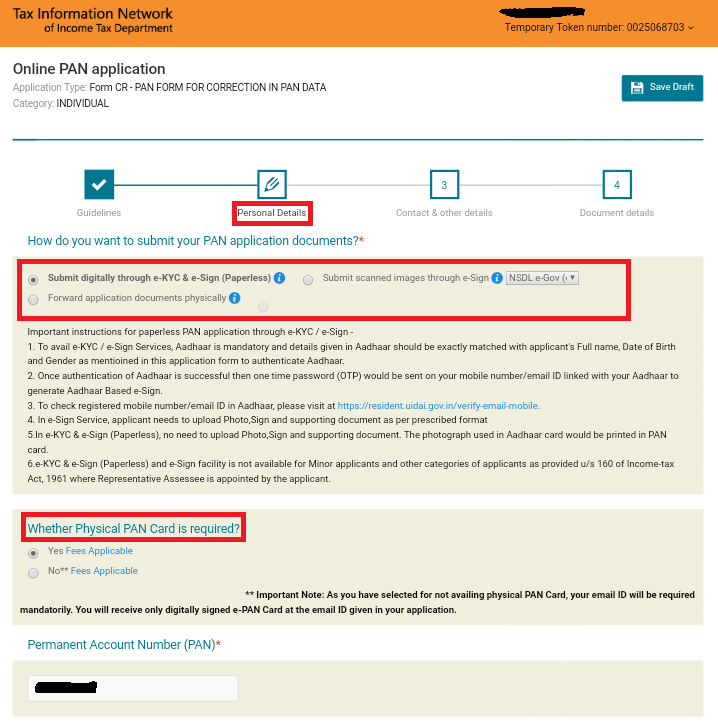

- Step 4: Go to the personal details page, fill out all the requested information correctly and choose the submission mode of your PAN application. Here you have three options that are as follows:

- Physically Forward Application Documents: To proceed, print the acknowledgment form generated after payment, sign it, and attach your passport-size photograph, along with copies of the other requested documents. Then, using a courier or post, send the documents to the address of NSDL Protean eGov Technologies Limited.

- Submit the Application Digitally through e-KYC & e-sign. To avail of this option, ensure you have your Aadhaar card with you and that your Aadhaar card details are mentioned in your duplicate PAN card application form. For information authentication of the provided details, you will receive an OTP on your Aadhaar-registered mobile number. In this scenario, you do not need to submit your photo, signature, or any other document with your application form. However, a digital signature (DSC) will be required during the final form submission.

- Submit Scanned Images through e-sign: In this option, you also need to have your Aadhaar card by your side. However, for this, you are also required to upload scanned images of your signature, photograph, and other mentioned documents.

- Step 5: After completing the selection mode of your application, you must choose between a physical PAN card and an e-PAN card. If you opt for an e-PAN card, you need to provide your valid email ID on which you want to receive your digitally signed e-PAN card.

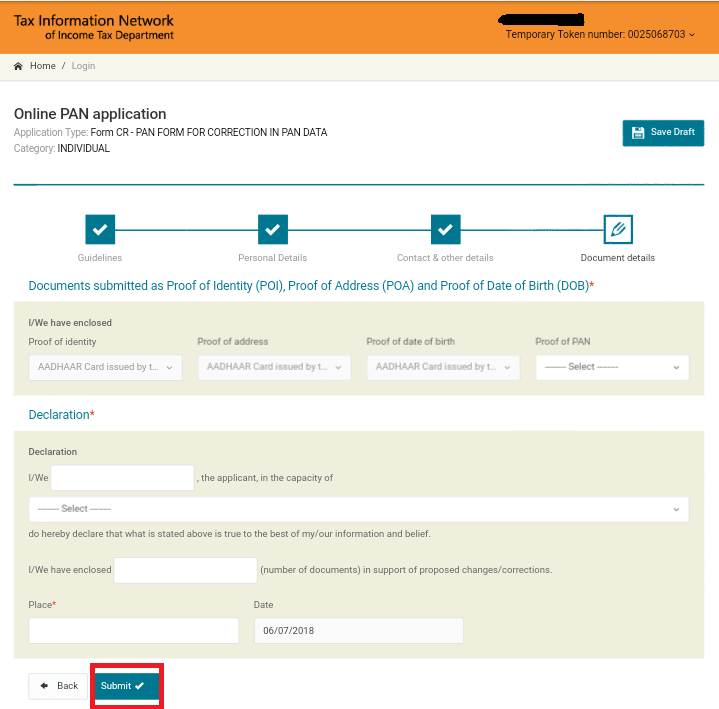

- Step 6: Now, fill out your contact and other details and document details, and submit your application form.

- Step 7: Upon submission of your application form, you will be redirected to the payment page, where you need to pay the fee for a duplicate PAN card. Once it is done successfully, you will receive an acknowledgment number. In case you opt for the physically forward application documents option, you need to take a printout of your acknowledgment form, attach your photograph, requested documents, and sign it and then through courier or post sent it on the mentioned address:

Income Tax PAN Services Unit,

Protean eGov Technologies Limited,

4th Floor, Sapphire Chambers,

Baner Road, Baner, Pune-411045. - Step 8: Using your 15-digit unique acknowledgment number, you can check the status of your duplicate PAN card application. Additionally, within 15-20 business days after the application services, you will receive your duplicate PAN card at the address or email ID you provided.

How to Apply for a Duplicate PAN Card Without Changes?

When you applied for your existing PAN card through the Instant e-PAN facility using the Income Tax e-filing portal or obtained the card using the new Protean website, you can get your duplicate PAN card (reprint of PAN card) without any changes and without uploading any documents by following the mentioned steps:

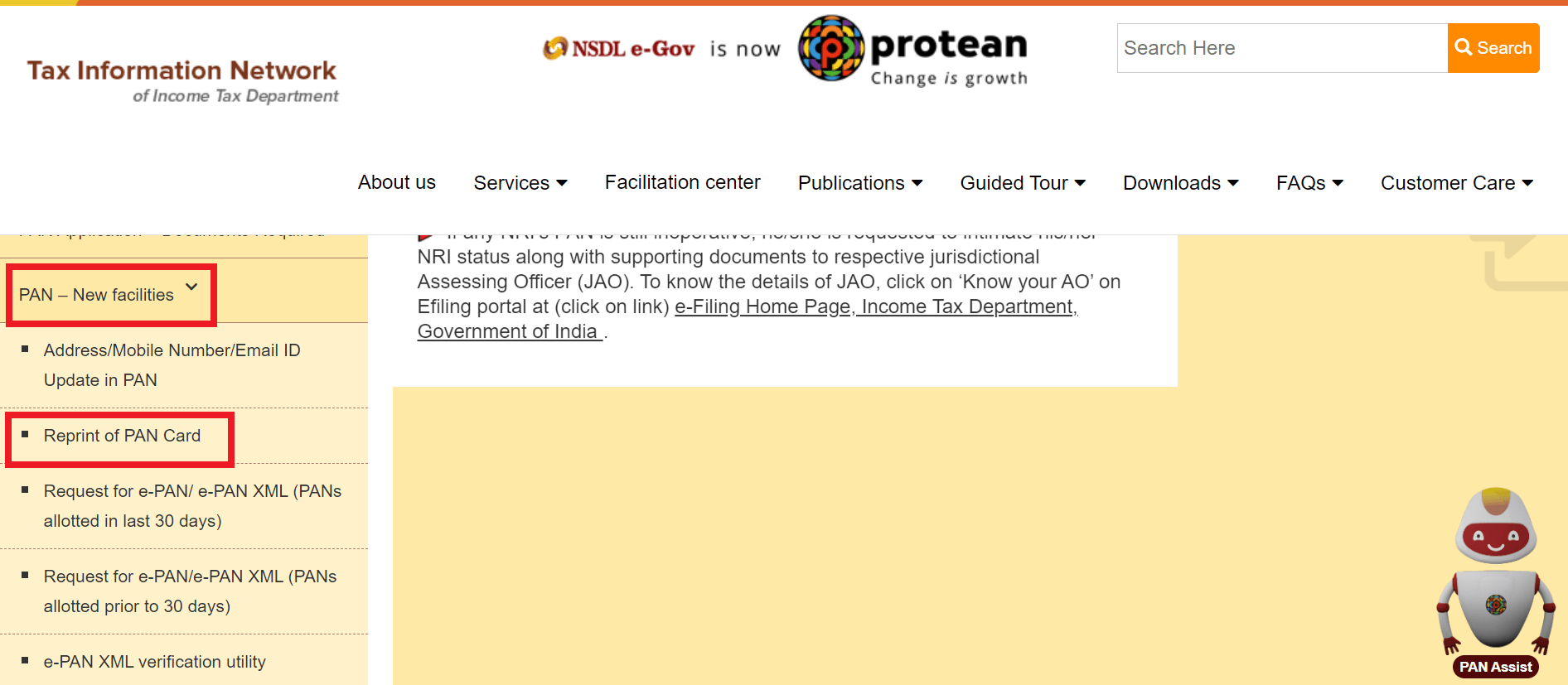

- Step 1: Go to the official Protean website.

- Step 2: On the left side menu, under the PAN- New Facilities heading, choose the Reprint of PAN card option.

- Step 3: Mention your PAN card number, Aadhaar card number, DOB, and GSTN (if applicable).

- Step 4: Tick the declaration, enter the stated captcha code, and submit the form.

- Step 5: Upon submission, you will be navigated to the payment page to pay the applicable duplicate PAN card fees. Once the payment is done successfully, you will receive an acknowledgment number.

- Step 6: Using your 15-digit acknowledgment number, you can check the status of your duplicate PAN card online.

How to Apply for a Duplicate PAN Card Offline?

Here is how you can apply for a duplicate PAN card offline:

- Step 1: Visit the TIN-NSDL website to download and take a printout of the form Request for new PAN card/ Changes or Correction in PAN Data.

- Step 2: Use a Black pen and mention all the details in the application form in BLOCK letters.

- Step 3: Mention your current 10-digit PAN number.

- Step 4: In case you are an individual, attach your passport-size, colored photograph, and cross-sign it. During the signature, ensure that you do not cover the face of the attached picture.

- Step 5: Now, fill out the remaining details in the form and sign the given boxes. However, as there are no changes in the PAN card details, do not tick mark any sections or boxes on the left margin.

- Step 6: Now send your application form along with all the requested documents to the NSDL facilitation center. Once you make the payment, you will get a unique 15-digit acknowledgment number.

- Step 7: For further action, the facilitation center sends your duplicate PAN card application to the Income Tax PAN services unit.

- Step 8: Using your acknowledgment number, you can check your application status. Within 15-20 working days after the department receives your application, you will receive your duplicate PAN card.

This is how you can apply for your duplicate PAN card online and offline. Moving ahead, let's know the common reasons to apply for a reprint of the PAN card.

When Do You Need To Apply For A Duplicate PAN Card?

For the following reasons, you need to apply for a duplicate PAN card:

- Misplacement: There are instances where individuals misplace their PAN card, leading to a search for their where abouts.

- Change in Details: When the signature or information on your existing PAN card needs to be changed or updated, with revised details, you should apply for a duplicate PAN card.

- Loss or Theft: It is a common occurrence to lose your PAN card, specifically when your purse or wallet gets stolen.

- Damage: In case there is any damage to your existing PAN card, you need to apply for a duplicate one.

These are the key reasons why you need to apply for a reprint of your PAN card. Moving ahead, let's know who is eligible to apply for the card.

Stop worrying about delays. Apply now and get your PAN card on time with our expert service.

Who Can Apply For a Duplicate PAN Card?

In India, several taxpayers exist, such as individuals, firms, Hindu Undivided Families (HUFs), and companies. However, it is vital to note that while individuals can apply for their duplicate PAN card on their own, taxpayers other than them, i.e., companies and HUFs, need to appoint a designated signatory person to submit the duplicate PAN card application. Confused? Here is the list of authorized signatories:

| Taxpayer Category | Authorized Signatory |

|---|---|

| Individual | Self |

| Hindu Undivided Family (HUF) | Karta of the HUF |

| Company | Any Director of the company |

| Limited Liability Partnership (LLP)/ Firm | Any partner of the LLP/ Firm |

| Association of Persons (AOP)/ Body of Individuals/ Artificial Juridical Person/ Local Authority | As stated in the incorporation deed, the authorized signatory |

These are people eligible to apply for a duplicate PAN card in India. Moving further, let's now review the documents required during the application process.

What Documents are Required for a Duplicate PAN Card?

These are the following documents that you need to submit along with your duplicate PAN card application:

- Proof of identity, such as your voter ID, Aadhaar card, driving license, ration card, passport, and more.

- Date of birth proof, like a passport, marksheet, voter ID, birth certificate, Aadhaar card, driving license, and more.

- Proof of address, such as a post office passbook, driving license, Aadhaar card, utility bills, voter ID, and more.

- Proof of damaged PAN card, such as a xerox copy of it

- Copy of FIR (in case of stolen or lost PAN card)

These are the documents generally required during the application submission for a duplicate PAN card. Furthermore, please inform us of the application fees charged during this process.

Fees for Applying for a Duplicate PAN Card

The table mentioned below showcases the fees charged by the Income Tax Department for issuing a duplicate PAN card:

| Mode of Duplicate PAN Card Application Submission | Mode of Dispatch of Duplicate PAN Card | Fees (Including GST) |

|---|---|---|

| Using the physical mode, duplicate PAN card application submitted online or offline | Physical PAN card dispatch in India | Rs. 107 |

| Physical PAN card dispatch outside India | Rs. 1,017 | |

| Through the paperless mode, I submitted a duplicate PAN card application | Physical PAN card dispatch in India | Rs. 101 |

| Physical PAN card dispatch outside India | Rs. 1,011 | |

| Duplicate PAN card without any changes in details | Physical PAN card dispatch in India | Rs. 50 |

| Reprint of PAN card | Physical PAN card dispatch outside India | Rs. 959 |

| Using the physical mode, submit a duplicate PAN application form online or offline | e-PAN card dispatched to the email ID | Rs. 72 |

| Through the paperless mode |

How To Download Duplicate PAN Card?

Follow the steps below to download a duplicate PAN card:

- Step 1: Visit the TIN-NSDL website.

- Step 2: Located at the top of the website page, click on the "download e-PAN/ e-PAN XML tab..

- Step 3: Now, move to the next page, and select any one of the options, i.e., PAN or Acknowledgment Number.

- Step 4: Enter the requested information, including the given captcha code, and then click the submit option.

- Step 5: After that, to receive OTP, choose any one option, i.e., mobile number, email ID, or both. Now, tick the declaration and click on the Generate OTP button.

- Step 6: Mention the received OTP and then click on the validate option.

- Step 7: Once you've done all these things, click on the Download PDF button.

In the PDF format, you will get your downloaded e-PAN card. The PDF is secure with a password, i.e., your DOB. Now, moving ahead, let's know the process to surrender a duplicate PAN card.

How to Surrender a Duplicate PAN Card

The Income Tax Department of India does not allow individuals and entities to hold two different PAN cards. Violating this rule can result in paying a penalty of INR 10,0000 under section 272B of the IT Act. However, in certain circumstances, a person may be eligible to obtain more than one PAN card. Follow the steps to surrender your duplicate or incorrect PAN card to the IT Department:

- Step 1: Write a letter to your nearby assessing officer to surrender your duplicate PAN card. In the letter, do not forget to mention the details of both your PAN cards.

- Step 2: In the letter, clearly mention which PAN card you want to submit and which PAN card you wish to keep by your side.

- Step 3: Next, hand over the letter to the assessing officer, and in return, they will provide you with an acknowledgment number. The acknowledgment number will serve as proof that your surrendered PAN card has been cancelled for use.

This is how you can surrender your duplicate PAN card. Moving further, let's look at the points to consider when applying for a duplicate PAN card.

Some Important Points Relating to Duplicate PAN Card

Instead of dealing with consequences, it is better to take precautions in advance. Considering this, here are some points that you should follow when applying for a duplicate PAN card. These are as follows:

- In case your PAN card is lost or stolen, before applying for a duplicate PAN card, it is important to first file an FIR at your nearby police station. Additionally, when submitting your duplicate PAN card application, attach a copy of your FIR along with other documents.

- When you are sending your PAN application acknowledgment via courier or post, you need to mention some details in front of the envelope, i.e., your acknowledgment number (***************)- application for correction or changes in PAN data or application for reprint of PAN.

- To avoid being conned, have information about the processing fee. For an Indian resident, the processing fee for a duplicate PAN card is Rs. 110, and for non-resident individuals, the cost for a duplicate PAN card is Rs. 1020.

These are the points you need to consider when applying for a duplicate PAN card to avoid any delays.

Final Thoughts

Within the financial and taxation system of India, a PAN card is a vital identification tool. If lost or damaged, the government allows individuals to apply for a duplicate PAN card online or offline. Here, the above blog was all about it. I hope that after reading it, you will have all the information. Furthermore, if you are looking for someone to help you with the PAN card application process, consider connecting with Visament. We are a team of experts who can help you obtain your PAN card without any delays. So, connect with today.

Frequently Asked Questions

In case your PAN card is lost, damaged, stolen, misplaced, or there are some changes or corrections in the existing PAN card, in these situations, you need to apply for a duplicate PAN card.

The fees for applying for a duplicate PAN card are Rs. 50 is it dispatched in India, and if the PAN card is dispatched outside India, the fee is Rs 959.

Although it is not compulsory to file an FIR for a lost PAN card, doing so will allow you to safeguard your PAN number from any illegitimate use.

Individuals, whether individuals, firms, limited liability partnerships (LLP), companies, HUFs, AOPs, local authorities, artificial juridicial persons, and bodies of individuals are eligible to apply for a duplicate PAN card.

Yes, if your PAN card is stolen or lost, it can be used for illegitimate transactions. Hence, it is advised to file a police complaint.

Yes, you can print your duplicate online. To do so, you first need to visit the Protean website and take a printout of your duplicate PAN card.

Yes, it is valid until you hold only one permanent address number.

If you lost your PAN card first, you need to file an FIR. Then, using the TIN-NSDL website, you can apply for a duplicate PAN card by submitting the form for 'request for new PAN card/ changes or correction in PAN data' along with the requested documents and a copy of file FIR.

PAN card reprint is the process of reprinting the existing PAN card when it is damaged or lost. It is also known as applying for a duplicate PAN card. For this, you only need to fill out the reprint application form and submit it. However, this can be done only when there are no changes in the details of the existing PAN card.

After submission of your PAN application, generally within 15-20 business days, you will receive your duplicate PAN card at your address mentioned in the application form.

_1741091057.png)