The PAN status indicates whether your Permanent Account Number (PAN) is active or not. It is a crucial document for tracking financial transactions. It can be inactive due to not liking PAN with Aadhar or a duplicate PAN card. An Indian person who owns a PAN card can check their status with their mobile number and or PAN number to see if it is active or inactive from the official Income Tax e-filing portal.

Here are the steps to help you check the status of your PAN card. Refer to the steps below to verify the active status of your PAN card.

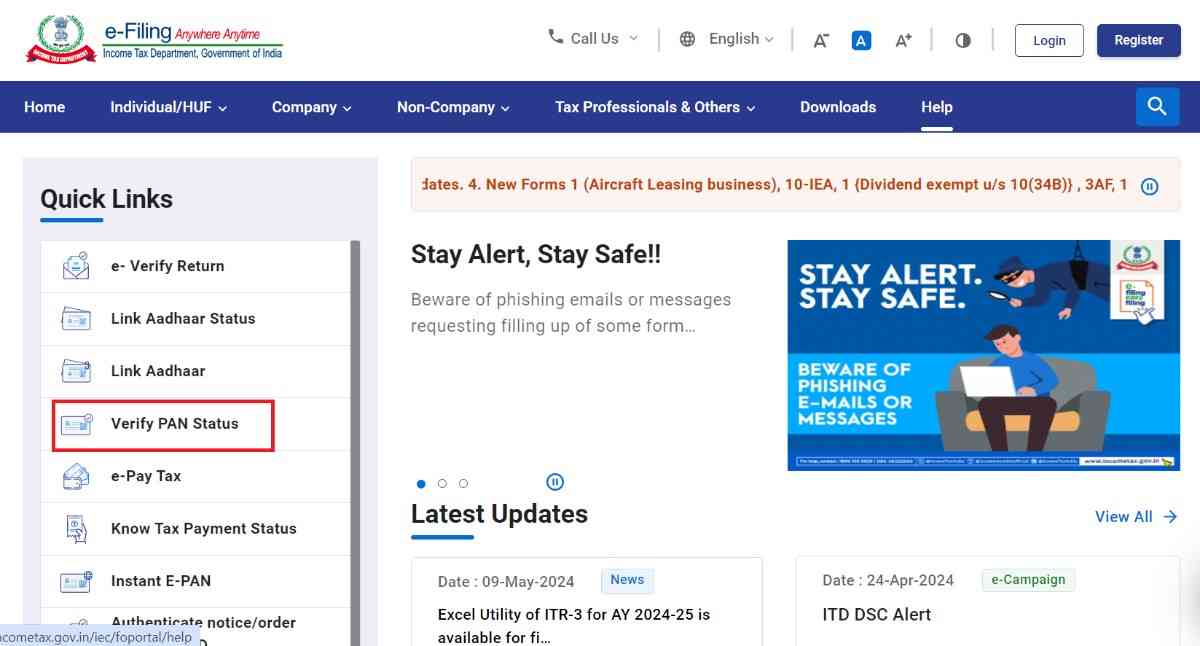

Step 1: You need to visit the Income Tax e-filing website to check your income tax status online.

Step 2: After going on the website, you need to select the 'Verify PAN status' option near the 'Quick Links' on the homepage.

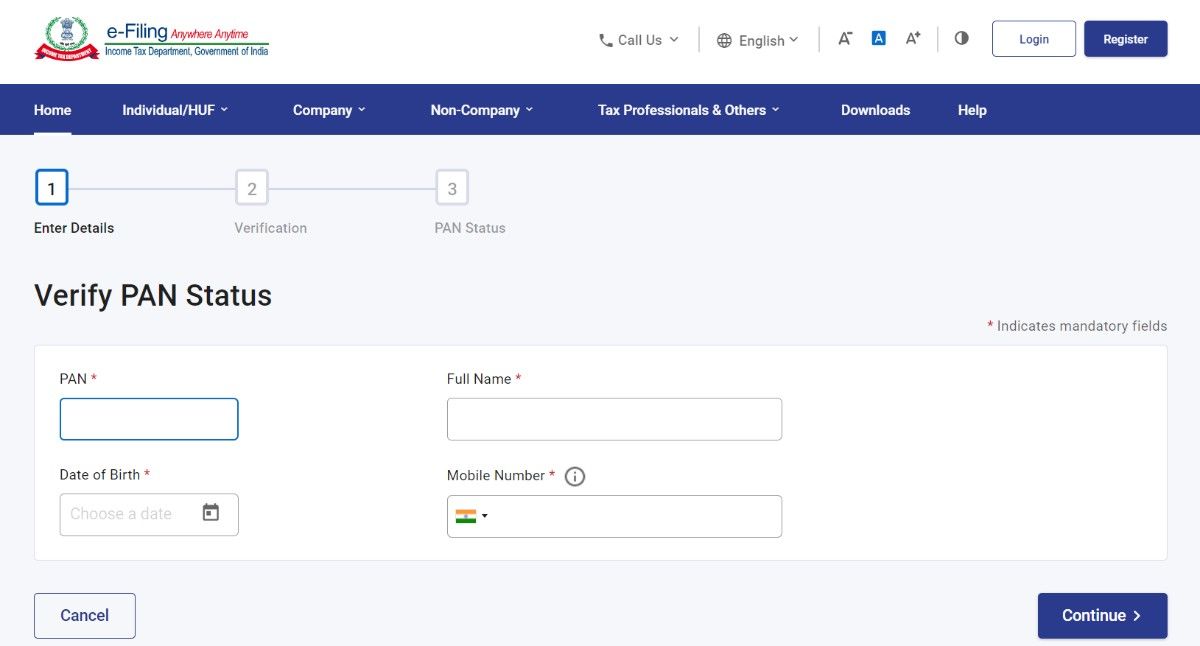

Step 3: Then you need to enter your PAN number, name, date of birth, and mobile number. Then click on the continue button.

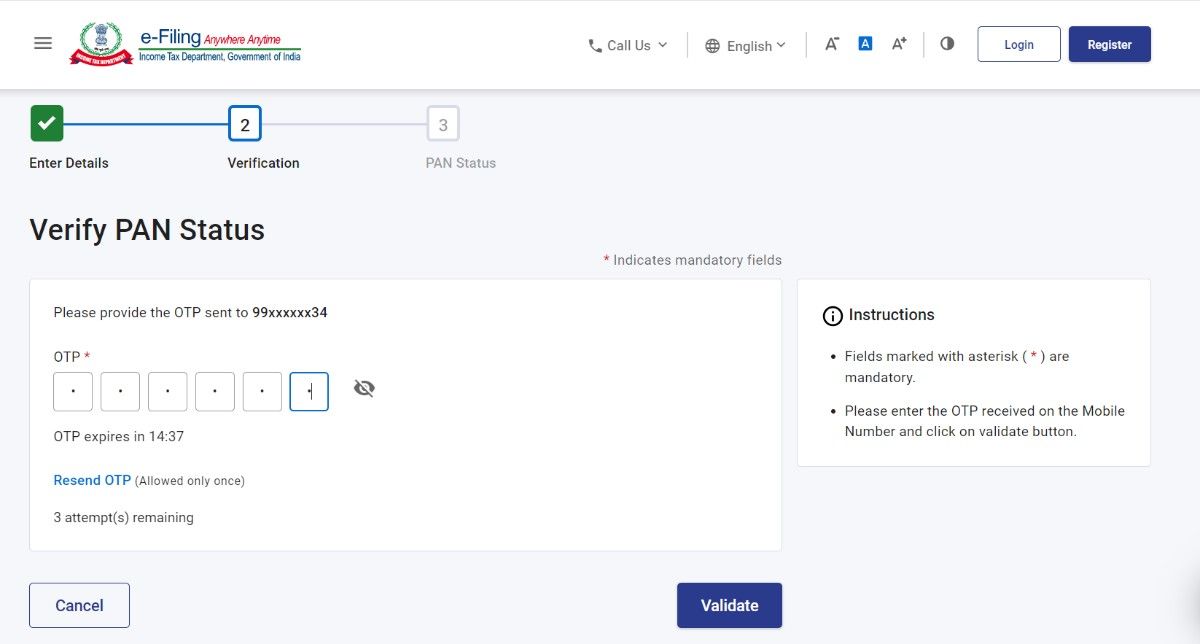

Step 4: After entering all the details, you will need to enter the OTP, which you will receive on your registered mobile number, and click the 'Validate' button.

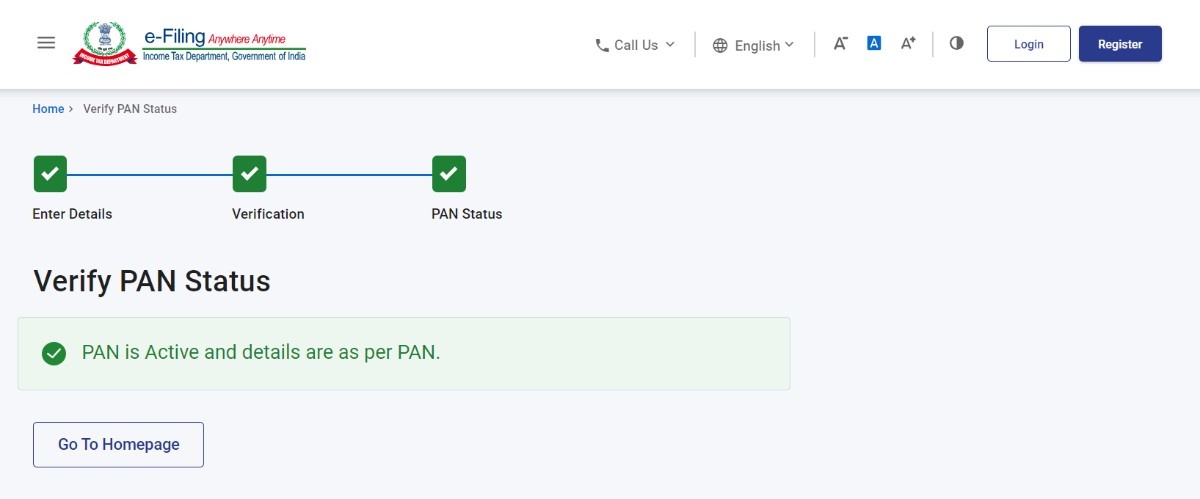

Step 5: After entering the OTP, your PAN card status will be displayed on the screen.

Here is what you cannot do if your PAN card is inactive.

Let's examine the reasons marked by the Income Tax Department for an inactive PAN number.

One of the most common reasons for the Permanent Account Number (PAN) is not linking PAN-Aadhaar. As per the latest guidelines by the Central Board of Direct Taxes (CBDT), all PAN cards need to be linked with their Aadhar card by 31 December 2025, and if they do not do so, then it will result in the deactivation of their PAN until they link their PAN number with an Aadhar card.

If a single person has more than one PAN card, then you cannot have your PAN active status because under section 139A of the Income Tax Act, if any person is found to have more than 1 PAN card, then his/her PAN will be deactivated.

Suppose any person is found to have a PAN card with fake or duplicated identity documents. In that case, their PAN card's active status will be removed, and they will be liable to pay fines under the Income Tax Act, which is a criminal offense. Having a PAN with fake IDs or with an identity of a non-existent person will be marked as invalid, and the PAN will be deactivated instantly.

Your PAN card status can also be inactive with incorrect personal information, like entering the wrong name or spelling mistakes, or the date of birth. If these mistakes are found in your PAN card, then it will be marked as invalid, and your PAN will be deactivated.

Note: PAN card linking with an Aadhar card is only applicable for Indian citizens, not for NRIs.

If your PAN card is inactive and not showing the PAN card active status, then you can send a letter to the Jurisdictional Assessing Officer (JAO) in the Income Tax Department requesting to activate your PAN card. Additionally, you need to add the following documents to your letter:

When the JAO receives your letter and is satisfied with it, you can then activate your PAN card, which will be helpful within 15-20 working days.

Here is the easy and simple process of linking your PAN card with your Aadhaar card. It also makes PAN active if your PAN is not linked and deactivated. So, follow the given steps to link your PAN with your Aadhaar easily.

Step 1: Go to the official website of the Income Tax e-filing website.

Step 2: Click on the 'e-Pay Tax' option and on the homepage under the 'Quick links'.

Step 3: Enter your valid 'Permanent Account Number' and your registered mobile number, and click on the continue button.

Step 4: Enter the OPT that you have received on your registered mobile number.

Step 5: Under the 'Income Tax' button, click on Proceed.

Step 6: Select your Assessment year, which is '2025-26 ', and type of payments 'Other Receipts(500)', and pay your penalties by clicking on the continue button.

Step 7: After making the payments, go to the homepage and click on the 'Link Aadhar' option below the 'Quick Links' button.

Step 8: Enter your PAN number and click on the 'Validate' option. Then enter all your details like name, mobile number. After entering all the details, click on the 'Link Aadhar' button.

Step 9: After that, you will receive an OTP on your registered mobile number. Enter the OTP and click on the 'Validate' option. Now you have sent a request to link your PAN card with an Aadhar card successfully to the UIDAI.

Here are some of the steps given below that will help you to check PAN card status linked with Aadhaar online.

Step 1: First, you need to visit the official website of the Income Tax e-filing website.

Step 2: Choose the option 'Link Aadhar Status' under the 'Quick Links' on the Homepage.

Step 3: You need to enter your PAN number and Aadhar card number, and click on the 'View link Aadhar status'.

Step 4: After clicking, you can check your PAN card status, which will be displayed on the screen.

If you have successfully linked your PAN card with an Aadhaar card, then you have to wait for approximately 30 days for the proper use of your PAN card.

This article explains how to verify whether your PAN card is active or not. Hope after reading this blog, all your confusions related to your PAN card get solved. If you have any queries related to your PAN or are seeking a reliable PAN card service, please connect with Visament. We have experienced PAN card agents on the Visament website who can resolve your queries within a few minutes.

If your PAN card is inactive, then you should write a letter to the Jurisdictional Assessing Officer (AO) in the Income Tax Department requesting to activate your PAN card status.

To check your PAN card status with your PAN number, you need to first visit the official website of the income tax e-filing website, then click on the Verify PAN status option in the quick links on the homepage, and enter your PAN number. After entering the PAN number, you will get an OTP enter the OTP to check the status of your PAN.

To check whether your PAN card is active or not, you need to visit the official Income Tax e-filing website, where you need to enter your PAN number or mobile number to check the status of your PAN.

Your Inactive PAN card will take approximately 30 working days to be activated.

You can check your PAN link status through the Income Tax e-filing website, where you need to click on the link aadhar option and enter your PAN and aadhar number to see the link status of your PAN and aadhar.

If your PAN card is deactivated or inactive, then you cannot apply for a credit card, or debit card, one a bank or cooperative account, or open a demat account, Cannot do more than 50,000 INR cash deposit or cannot pay more than 50,000 INR to any restaurant bill or hotel bill, for foreign travel and purchasing of a foreign goods.

To activate your e-PAN, you need to go to the official e-filing portal and click on the verify PAN option. After that, you need to verify your PAN by entering all the details like name, date of birth, mobile number, and clicking on continue. After this, you will get an OTP, and by entering the OTP, you can activate your e-PAN instantly.

Here are the reasons why your PAN card is not active: first, due to not linking PAN with aadhar, having multiple PAN cards, filing incorrect details, and applying with a fake identity or giving false documents for the PAN card.

When you visit a website, it may store data about you using cookies and similar technologies. Cookies can be important for the basic operations of the website and for other purposes. You get the option of deactivating certain types of cookies, even so, doing that may affect your experience on the website.

It is required to permit the basic functionality of the website. You may not disable necessary cookies.

Used to provide advertising that matches you and your interests. May also be used to restrict the number of times you see an advertisement and estimate the effectiveness of an advertising campaign. The advertising networks place them after obtaining the operator’s permission.

Permits the website to recognize the choices you make (like your username, language, or the region you are in). Also provides more personalized and enhanced features. For instance, a website may inform you about the local weather reports or traffic news by storing the data about your location.

Aid the website operator to determine how the website performs, how visitors interact with the site, and whether there are any technical issues.