- What is a Business PAN Card?

- Who Needs a Business PAN Card?

- Step-by-Step Process to Apply for a Business PAN Card Online

- Offline Procedure to Apply for a Business PAN Card

- Documents Needed for Business PAN Card for an Indian Company

- Documents Needed for Business PAN Card for a Foreign Company

- Why is a Business PAN Card Important

- General Mistakes to Avoid While Applying for a Business PAN Card

Planning to start a business in India? Whether you are registering for a private company, LLP, or a partnership firm, one non-negotiable factor is to get a business PAN card. This card works as your company's tax identity and is essential for financial operations like opening a bank account, filing returns, or following government regulations.

This blog guide has everything you need to know to apply for a business PAN card in 2025, including documentation, step-by-step instructions, and fees.

What is a Business PAN Card?

A unique 10-digit alphanumeric identifier allocated by the Income Tax Department to businesses, trusts, partnerships, LLPs, and organizations. As individuals have PAN cards, firms too have a PAN Card for their Business operations to run their business operations here in India legally.

At the start, you can use your personal PAN card if you are running a sole proprietorship. However, once you come out as a private limited company, LLP, or even a partnership, having a business PAN card becomes mandatory.

Who Needs a Business PAN Card?

It is mandatory to have a business PAN card if you fall under these:

- Limited Liability Partnership (LLP)

- Private Limited Company

- One-Person Company (OPC)

- Partnership Firm

- Society, Association of Persons (AOP), or Trust

- Foreign Company operating in India (Foreign Company PAN Card)

Whether you need a business PAN card for NRI or an Indian having a PAN card for business is crucial before you start with any financial transactions.

- No embassy visits required

- Eligibility check & document guidance

- Instant application submission

Step-by-Step Process to Apply for a Business PAN Card Online

Step 1: Go to the official website of NSDL and select Form 49A/Form 49AA from the dropdown menu of ‘Application Type’. For foreign businesses, you can fill out Form 49AA for issuing a Foreign Company PAN Card.

Step 2: Select ‘Company’ as the PAN category from the next dropdown menu.

Step 3: You need to enter all the relevant details asked for there.

Step 4: After filling out your details, enter the Captcha Code, and a token number will be sent to your registered email address.

Step 5: To process further, enter your company's registration number.

Step 6: Now, you have to enter your company's income source. To do so, you have to first select the 'income from business/profession' from the dropdown menu and then select the type of business—the source of income of your company.

Step 7: Now, in the PAN database, enter the official address for the process of communication. All other details will be filled in beforehand, and to proceed further, click on the next button.

Step 8: Enter the code for the Assessing Officer (AO) selected based on the area jurisdiction of your location. Now, further click on the option of ‘Indian Citizen’ and then choose ‘State’ and ‘City.’ You can now move to the documentation page

Step 9: The declaration must be marked. Enter your association with the company(Authorized Signatory\Director) and then apply for the company’s PAN. The application form is now ready to be submitted. Once done. Upload the scanned copies of all the documents.

Step 10: For the final step, review all the information filled in the form and then submit it.

Step 11: You can complete the payment process using any payment mode, such as Demand Draft, Debit Card, Credit Card, or Net Banking.

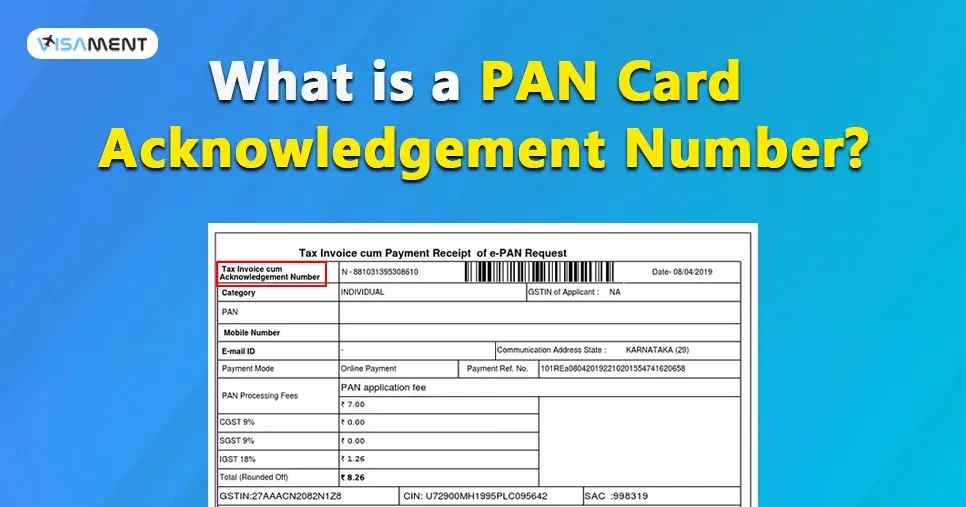

Once you have made the payment, an acknowledgment receipt related to it will be issued to you for tracking the business PAN card status.

This receipt then should be signed and sent to the NSDL office with a copy of the registration certificate (RC) and a demand draft (DD), if there's any.

Offline Procedure to Apply for a Business PAN Card

Apart from the online process, you can also try to apply for the card offline:

- For the first step, go to the NSDL e-Gov website and download 'Form 49A'.

- Please print out a hard copy of the form, fill it out, attach your recent passport-size photo, and sign the application.

- You need to submit the completed form along with all the necessary documents to your local PAN center.

- Pay the fees for the PAN card.

- Once you submit your PAN card, you will be given an acknowledgement number that you can use to see the status of your application.

Once your application is received at the NSDL/UTIITSL department, they will typically issue your PAN card in approximately 15 days.

Documents Needed for Business PAN Card for an Indian Company

- A government identification card (Aadhaar card or any other) and an address proof

- Certificate of incorporation copy

- A copy of an NOC, also known as a no-objection certificate, issued by the Ministry of Corporate Affairs.

Have questions? Our experts guide you through every step of the PAN application process – no confusion, no delays.

Consult an Expert TodayDocuments Needed for Business PAN Card for a Foreign Company

- A registration certificate issued by the Indian administration to set up a business in India.

- A registration certificate from the native country attested by an Apostille, along with the Indian Embassy, the High Commission, or by an official from overseas branches of registered Indian scheduled banks.

- To pay the fee to the tax department, you need to have a bank draft. Also, it is important to make the payment in Indian currency.

Why is a Business PAN Card Important

Here is why every enterprise needs a business PAN card:

- It is mandatory to file income tax returns.

- It is needed to open a current bank account.

- It is required for GST registration.

- Keep up with the TDS rules.

- It acts as proof of identity for monetary transactions.

Holding a different Business PAN Card number lets you establish credibility and run a clean accounting, segregating personal transactions from business ones.

General Mistakes to Avoid While Applying for a Business PAN Card

- Submitting unfinished documents

- Spelling mistakes

- Incorrect selection of the type of business entity in the PAN card application

- Not submitting foreign documents correctly while applying for a Foreign Company PAN Card

A little error could delay the process of your original business PAN card, so pay keen attention to all the information you are filling in!

Frequently Asked Questions

The business PAN card fees structure is: INR 101 (with GST) for Indians and foreign citizens it costs around INR 1011.

To get a PAN card for the business you need to visit the NSDL website, select the application type and category, provide company details, mention the assessing office code, upload documents for proof of identity, and enter details of authorized signatory or partner.

No, you cannot use your individual PAN card for business. A business PAN card is needed to run the financial transaction legally.

No, business PAN and personal PAN are not the same. The business PAN card, unlike the individual PAN card.

Yes, PAN is mandatory for registration with GST.

Any organization or individual who wants to start a business in India should mandatorily apply for a business PAN card.

_1741090499.png)

_1741091057.png)