An NRI account refers to accounts opened by an NRI or a PIO. There are several types of NRI accounts that a person can opt for. Being an NRI residing or working abroad, opening an NRI savings account in India is a good idea. However, when opening an NRI account there are several required NRI account documents. In this blog, we will learn about all the documents required for an NRI account. Before moving with the documents. Let's understand what is an NRI account and why you need an NRI account.

What Is An NRI Account?

NRI accounts can be owned by an NRI (Non-Residential Indian). PIO (Person of Indian origin), or OCI (Overseas Citizen of India). It helps you take care of the financial needs of your family living in India. Make investments in the Indian market. An NRI account solves money management and expenditure problems as well. It comes with several tax and transactional benefits. Some of the leading banks in India offer NRI account openings for NRI living in the USA.

An NRI can open three types of accounts in India. NRE accounts, NRO accounts, and FCNR accounts. Opening an NRI account requires you to meet some specific eligibility criteria. However, it may vary depending on the type of the NRI account.

Know More About The Types Of An NRI Account

It is important to learn about the types of NRI accounts. Before we discuss the documents required for an NRI account. There are mainly three types of NRI bank accounts. Such as NRE accounts, NRO accounts, and FCNR accounts.

NRE Accounts

NRE stands for Non-Resident External Account. This account helps to manage the foreign income which is earned outside India. NRE Accounts are a good choice for investment purposes across India. The money in this account is held in Indian rupees (INR). After conversion, the balance in the account is fully transferable. A person gets the option of opening savings, current accounts, or fixed deposits.

One benefit of an NRE account is that no tax is included. On any interest amount earned from the money kept in these accounts. Joint accounts can be open with a relative who is a citizen and resident of India.

NRO Accounts

It is similar to an NRE account and stands for Non-Resident Ordinary account (NRO). It allows the account holder to store any amount in Indian currency. However, it only permits storage of the income that is generated from within India. In short, any amount that is earn from your country of residence will not be allow for an NRO account.

NRO Accounts can also be open in current, savings, or fixed deposit account forms. When a person migrates to some other country to seek residence and work. They should get their residential account converted into an NRO account.

The source of earnings can be rent, dividends, pensions, and more. The balance can transferred up to 1 million USD per annum. The interest earned on the account balance is fully transferable. This account is liable to taxation as per the Indian laws. A person can also open a joint account with an Indian resident or an NRI.

We offer OCI, Visa, and Passport application services along with other services. Our team will make sure to get your dreams fulfilled by filling out an error-free application for you.

FCNR Accounts

FCNR stands for Foreign Currency Non-Resident Account. An FCNR account is not similar to an NRE or an NRO account. It allows an NRI or PIO to deposit any earnings that they make abroad. Also, to store the earnings in the currency of their country of residence. One benefit of an FCNR account is that any amount deposited in this account is exempt from tax. It can also be store in that state so long as the account holder maintains their NRI status.

An FCNR account is chosen by NRI who are looking to have an account similar to Fixed Deposit accounts in India. It provides tax benefits on the interest income and joint accounts can also be open but only with an NRI. It is important to consider the changing exchange rates for these accounts. Such accounts allow fixed deposits but only with a minimum maturity period of 1 year up to 5 years.

A person can make deposits in any of the nine currencies that are decide by the RBI for FCNR accounts. It includes USD, GBP, EUR, AUD, and CAD.

Keep in mind that all these accounts are for Indians residing abroad. They have different use cases. The process of opening these accounts. May also vary based on the county and the financial institution. Also, the documents required for NRI accounts in the USA will vary.

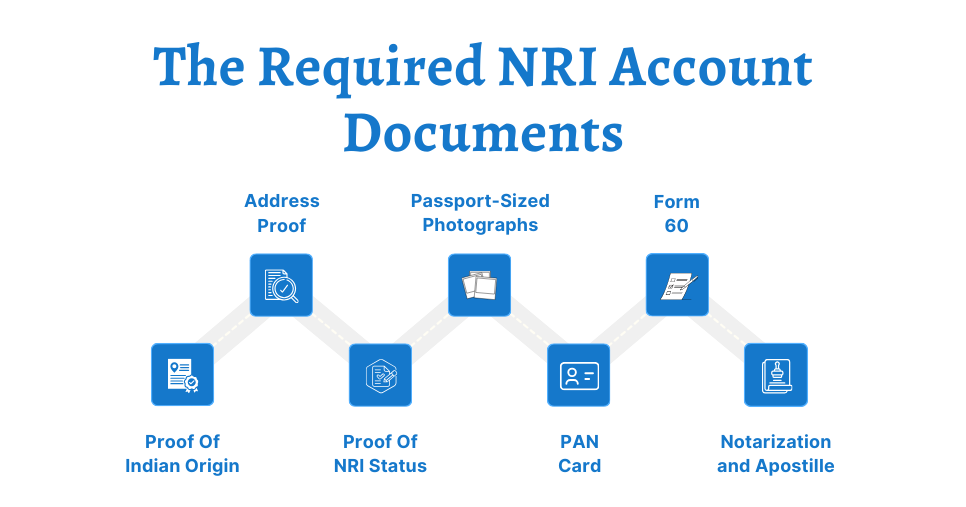

What Are The Required NRI Account Documents?

When you open an NRI account, you need to complete the KYC process. Know your customer (KYC) is a mandatory process and is require to be done by every customer. You need to have certain documents prepared in advance. Including the NRI account opening form. You can download the pdf of your NRI account opening form from the official bank website. The documents may vary a little from one bank to another. Below is a list of the NRI account documents that are widely accepted:

Proof Of Indian Origin

Proof of Indian origin is require to prove your Indian origin. A passport and visa can be use as proof of your Indian origin.

A passport serves as the primary proof of your identity, citizenship, and NRI status. A visa confirms your legal status as an NRI. So, always make sure that your visa and passport are valid and updated. A PIO or OCI card may be require as additional proof of your NRI status and Indian origin.

Address Proof

These are the NRI account documents needed to verify your foreign residence. Utility bills, bank statements, or rental agreements are generally used as address proof. Provide any one of the following to prove a foreign address:

- Tax receipt of property or municipal.

- Lease or rent agreement or a registered tenancy.

- A letter/certificate/ID issued by a foreign college or university.

- A certificate from the employer confirming your overseas address

- A passport issued in a foreign jurisdiction having an overseas address

- A driving license issued in a foreign jurisdiction having an overseas address

- A national ID issued by the government containing an address in the country of residence

- An original and latest overseas bank account statements having overseas address. It must not be more than 2 months old.

- A utility bill (Electricity, water, gas, telephone, post-paid, mobile) in the customer's name. It must not be more than two months old.

- Allotment letter of accommodation. It is issue by the State or Central government, statutory/regulatory bodies. Public sector undertakings, scheduled commercial banks, or financial institutions. Also, Listed companies, leave, and license agreements with such employers allot official accommodation.

- Proof Of NRI Status

- A residential certificate which you can get from the tax authorities. Of your current residential country.

- An overseas employment certificate/work permit that is based on your residence country. You might have got a certificate showing your employment status abroad.

- Passport-Sized Photographs

You need to submit your passport-sized photographs. The photograph must meet the specified guidelines of the bank where they wish to open an NRI account. The photographs are require by the bank for official purposes. During the NRI account opening process.

PAN Card

PAN (Permanent Account Number) is one of the important NRI account opening documents. It is require for transaction and taxation purposes all over India. So, when opening an NRI account, submitting a copy of the PAN card is important.

Form 60

In case you don't have a PAN card, you may have to apply for one or fill out Form 60. It is a declaration of the non-availability of a PAN card. When you open an FCNR account, you will have to fill out a specific account opening form. It will be provided by the bank for the chosen foreign currency.

Notarization and Apostille

In some situations, the authorities may have to verify the authenticity. Validity of the NRI account documents. Such as, if you give someone else the power of attorney over your NRI account. If any legal document or affidavit involves then your bank might need to verify documents.

Notarization means verifying the authenticity. By a notary public of a document or signature. It means a legally authorized public officer verifies the documents. It is require to prevent fraud and to ensure the legality of the documents.

Apostille is a specific form of authentication. That is recognized under the Hague Convention of 1961. To get an apostille, you need to get help from the Ministry Of External Affairs (MEA). Its authorized branches are in India.

All the photocopies of the proofs must be attested. The above set of documents must be attested by a certain official. Below is a list of the officials:

- Judge

- Court magistrate

- Notary public abroad

- Indian embassy or consulate general from your country of residence

- An official from overseas bank branches having relationships with Indian banks

- An official from overseas scheduled commercial bank branches registered in India.

What Are Some Tips For NRI Account Documents Preparation?

Gathering and managing all the NRI account opening documents can be stressful. However, if you properly organize and plan. You can experience a smooth and hassle-free banking experience. Below are some tips to ensure that you have all the documents required for NRI accounts. Prepared in advance to use them when required:

Organizing the Documents

Once you have gathered all the documents required for opening an NRI account. Must organize them. Organize each document by their categories like address, identity, or account type. This way you can easily access any document whenever they are require.

Using Digital Copies

Using digital copies of the documents can be a good idea as they are easily accessing and shared. Also, they have very little risk of theft and loss of data. Keeping regular backups helps in keeping the data secure and safe. So, always consider digitizing all your important documents. Remember to keep a check for the expiry of the document to avoid losing data.

Naming The Documents

The documents that you submit must be named correctly as they will be collected. Consider naming your documents in detail and mention the date and account type as well. It reduces the chance of documents getting misplaced or lost. It also helps in creating a well-organized and easily accessible set of documents. Review your documents frequently. Update if there are any changes in the information.

Keep The Physical Copies Safely

Even though digital copies solve most of the purposes. Some financial transactions may require the use of physical copies. It is important to keep the original documents safe and secure as they are not replaceable. You can store them in a safe place, fireproof safe, or even in a bank locker.

Avoid Storing Extra Documents

Do not forget to keep reviewing the documents regularly. Also, ensure to delete the documents that are outdated or have extra copies. Only keep the documents that you need. It will help you avoid confusion. This will prevent the documents from being messy or cluttered.

Ask For Professional Support

It is advisable to consult a professional like a legal or a financial advisor. When opening an NRI account. They will assist you by giving tips to stay ordered and informed while opening the account. They will also help you manage the documents required for NRI accounts. Assist with regulatory compliances as well.

Conclusion

An NRI account helps to maintain a financial stronghold in their origin country. Opening an NRI bank account offers you several benefits. Keep in mind that the three types of NRI accounts have different terms and conditions. Each type serves different monetary requirements. You need to make sure that you have all the documents required for an NRI account. To enjoy a hassle-free accounting opening process. Provide all the required documents to avail of the benefits of an NRI account in the USA.

Frequently Asked Questions

To open an NRI account, you need to submit ID proof, a copy of your valid visa, work permit, or OCI, address proof, PAN card or Form 60, Photographs, Proof of Indian origin, utility bills, etc.

Yes, you can open an NRI account from the USA. Several banks like DBS, HDFC, ICICI, and Bank of Baroda offer NRI account opening services. You can open an account in any of these banks. However, make sure to seek professional advice if you are a permanent resident of the US.

To open an NRI account, one has to fulfill certain criteria and submit some required NRI account documents. You need to qualify as an NRI, PIO, or OCI to open an NRI account. Also, you must spend a minimum of 182 days outside India in the preceding fiscal year. You need to be 18 years or older to open an NRI account.

Yes, you can open an NRI account online with several banks. It includes SBI, Yes Bank, ICICI Bank, Axis Bank, South India Bank, Bank of Baroda, etc. You need to fill out an online application form on the bank’s official website to open an NRI account online.

_1742386512.webp)