Want to apply for a PAN card from Qatar, but finding it difficult? No worries, we are here with a comprehensive guide that will help you in applying for a PAN card from Qatar. PAN card is a very important legal document which is required for both Indian nationals and foreigners, if they want to engage in Financial activities in India.

Read this blog to gain knowledge about the entire process for PAN card application in Qatar. We have also recommended a trusted platform to seek expert guidance in the end.

Key Takeaways

- It is necessary to obtain a PAN card for engaging in financial activities in India.

- Indians need to fill Form 49A, and Foreigners need to fill Form 49AA to obtain a PAN card.

- Processing time is around 15-20 working days.

- If transactions are above $50,000, then obtaining a PAN Card is legally compulsory.

PAN Card in Qatar

The full form of PAN Card is Permanent Account Number Card, and it is assigned by the Indian Income Tax Department. It is a legally compulsory document for all Indian Individuals and entities who fall under the taxable category.

If a foreign person or entity from Qatar wants to conduct financial activities in India, then they need to obtain this document. It contains a unique digital code, which also works as an identification document.

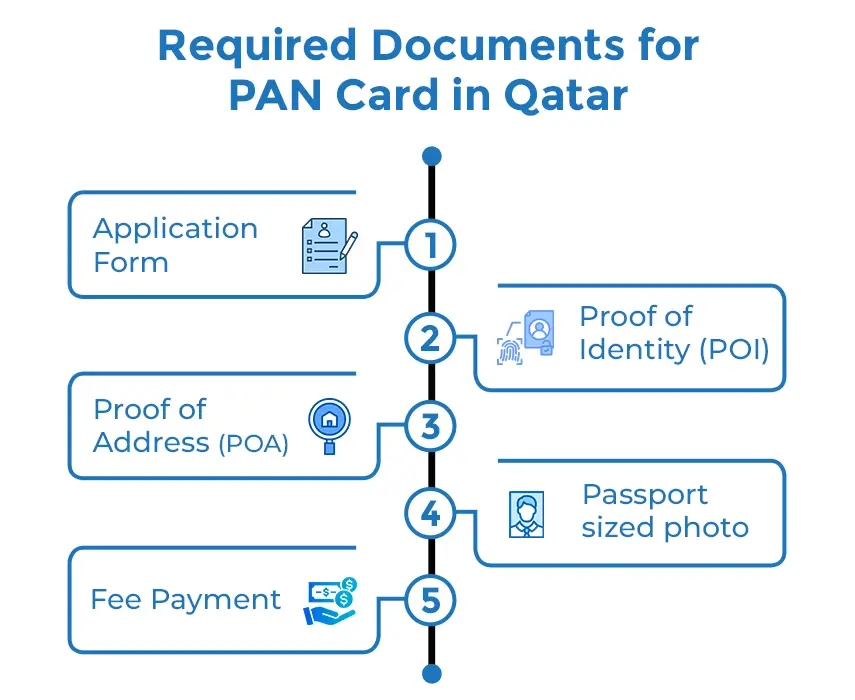

PAN Card Required Documents in Qatar

While you apply for a PAN Card from Qatar, you should keep all the required documents handy. Here are these:

- Application Form

- Make sure you keep a completed and filled application form for the PAN card application.

- Proof of Identity (POI)

- A self-attested passport copy

- A self-attested copy of Qatar Residence Permit (QID)

- Proof of Address (POA)

- Your bank statement, which contains your Qatar address. It should have been issued in the past 3 months.

- Proof of Address (POA) also includes the Qatar ID Card containing your present address.

- Two required-sized photographs

- You need two passport-sized, recent photographs with a white background.

- Paste these photos in the application form at their required spaces.

- Fee Payment

- You need to pay the application fee by using a demand draft or debit/credit card.

- You should check the NSDL website for the current prices, as the fee is subject to change.

PAN Card Application Processing Time in Qatar

After you have submitted all the required documents, your PAN card will be processed in the next 15 to 20 business days. In case you need the PAN card urgently, then nowadays, the Indian Government has added the Fast Track option on its website. You can use this option to get the PAN card in less than two working days, but you need to pay an extra amount for this.

PAN Card for NRIs Living in Qatar

For all the NRIs and PIOs, a PAN card is a very necessary document. For all the financial transactions above $50,000, they need a PAN card. It is important for all the NRIs and PIOs who have a taxable income in India to hold this important document. This is the identification card for them to get identified by the Income Tax Department of India.

How to Apply for a PAN Card in Qatar?

If you are living in Qatar but want to operate a business in India or just want a PAN card to engage in Indian affairs, apply for a PAN card. If you are an NRI, then you need to fill out the Form 49A to obtain a PAN card, and if you are a foreigner, then you need to fill out the Form 49AA. You may find the process of applying it from there a little complex. You need to submit many documents, and the information should be filled out correctly in the Form.

To eliminate all the complexities, you can just visit Visament. Here we have a team of experts who can help you out with applying for a PAN card. You will get 24/7 support from our professionals. We provide fast approvals as the applications submitted by ur experts are error-free. The fee is also affordable; you need to pay $100 to obtain a PAN card from the comfort of your home.

Frequently Asked Questions

If you are applying from the government websites, then, for foreign addresses like Qatar, the cost for obtaining a Physical card is INR 1,017 and INR 66 for the e-PAN.

Yes, you can apply for a PAN card as a foreign citizen in India if you are engaged in any type of financial business transactions or commercial activities here.

Yes, Qatar is a tax-free country for all individuals. There is no income tax applicable to the salaries, wages, and personal income of individuals. It applies to the citizens as well as the foreigners working there.

Only the individuals and entities who are engaged in taxable commercial activities get their Tax Identification Number. You can obtain your TIN from the General Tax Authority (GTA). You need to register yourself on the online tax portal Dhareeba.

A Permanent Account Number (PAN) is an identification number allotted uniquely to each individual, and it is issued by the Indian Income Tax Department. In Qatar, it is necessary for entities and individuals to have a PAN card if they want to engage in any kind of financial transactions in India.

Yes, a TIN (Tax Identification Number) is available for people in Qatar. It is only available to those individuals and businesses who have taxable income and pay taxes.