Investing in the real estate sector has always been beneficial for the NRI population. With the growing economy of India and price correction in the real estate sector, it has been a great opportunity for prospective buyers. According to the RB guidelines, if you are an NRI or have an OCI card, then you are eligible to buy residential or commercial properties in India. The NRIs purchase the properties for investment purposes and to settle back here after their retirement. You can also open NRI accounts in India to maintain the finances or the income generated from these investments, such as rental yield.

If you are an NRI and looking for options to invest in India, real estate is the best investment destination for you. In this guide, we have discussed all the important things that you should consider before buying a property in India. There are many things that you should keep in mind so that there will be no conflicts in the future regarding the property.

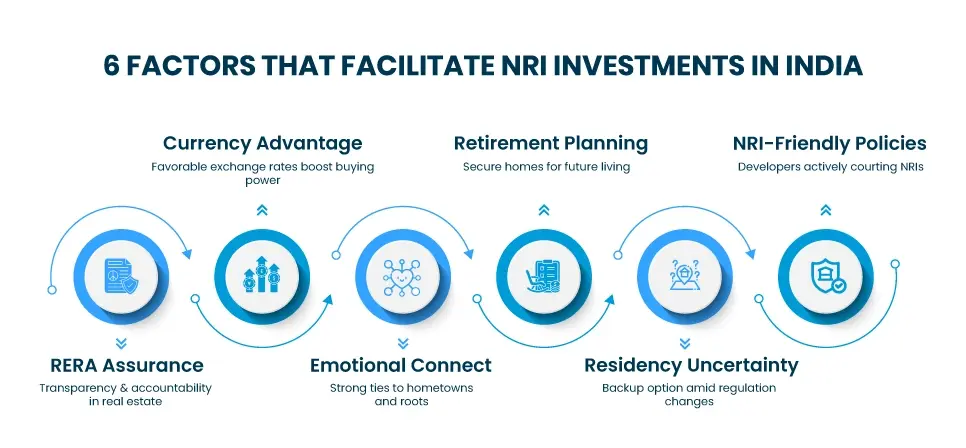

There are six factors that facilitate investment opportunities for NRIs in Indian real estate. They are evaluated here in this section below:

The full form of RERA is the Real Estate Regulation and Development Act. This act was introduced in 2016, and it has been encouraging NRIs to invest more and more in India since then. RERA has offered clarity in rules and regulations, as well as providing a stable pricing environment.

There are noticeable currency exchange rates in rupees and other currencies. The rupee depreciated by 14% in 2018 and became Rs 74 against a dollar. Not only the dollar, but it has also depreciated against the dirham and pound. This enables the NRIs to spend more and buy any property in India because it is cheaper for them. The leading property analysts have said that there is an increase of 15% in the inquiries about the real estate market.

NRIs have a special connection with their hometowns, and they are looking for opportunities to invest there. They are not only limited to the metro cities, but they are also moving forward to many towns and villages. Some of the famous places for investments are Kochi, Ahmedabad, Coimbatore, Trivandrum, Chandigarh, and Pune. NRIs are also investing in small cities like Nashik, Vadodara, Noida, Ghaziabad, etc.

Another reason for the investment is that they expect a good amount of rental yield from the property. The rental yield in non-metros is comparatively higher than in metros. NRIs also think of setting back to India, in their homes, so that while growing up their children can learn the indian culture and traditions., Some of them miss their family and friends, so they return to their hometown after a certain amount of time abroad.

There was a survey done, and nearly 70% of the people who participated said that they would want to settle in India after retirement. Senior living is a manifested factor by the developers to cater to this audience. The same survey says that 90% of the NRIs are interested in investing in the senior housing sector.

The rules and regulations for the visa have become very strict in countries like the UK, the US, and Australia. It has become very hard for skilled workers and tech geeks to settle in foreign countries. So, they keep having a backup plan to settle back in India in case the visa regulations keep being stringent in foreign countries.

Many builders are constructing projects mostly for the NRIs. The material used is of very high quality. The fixtures and tiles are also of top-notch quality, and they are made with all the modern amenities and features, such as large swimming pools, elevators, clubhouses, etc. The builders also provide the 3-D views of their projects to the NRIs to give them a correct idea of the property.

If you are an NRI or an OCI Card holder, then here are some of the guidelines that you should keep in mind before buying any property in India:

If you are also planning to buy a property in India, then you will need to open an NRI account if you don't already have one for managing your finances. Visit Visament for the best banking solutions. We have the expertise in providing the best services related to bank accounts, visas, passports, and much more. The entire process is hassle-free, and you can view the update on our website. Whether to open an NRE account or to open an NRO account, we cater to all directions and provide a tailored solution designed for you. You can also get online assistance from our website, which is available 24/7.

No, it is not allowed for NRIs to buy agricultural land in India directly. However, there are some exceptions, like getting it in inheritance or a gift from an indian resident. The Foreign Exchange Management Act does not allow the NRIs to purchase plantations, agricultural lands, or farmhouses.

There is a whole list of documents that are needed for an NRI if they want to buy property in India: Passport, Visa and Work Permit, OCI/PIO Card, Pan Card, Income Tax Returns, Bank Statements, Proof of Income, Foreign Remittance Certificate, Property Tax Receipts, Sale Deed/ Agreement, Power of Attorney, No Objection Certificate, Title Deeds, Encumbrance Certificate

Yes, an NRI can buy property in India without an Aadhaar card. NRIs don't need to have an Aadhaar card to make property transactions in India.

Yes, a PAN card is an important document that is needed to buy a property in India for an NRI

When any person buys a property from an NRI, the TDS is deducted at the rate of 12.5% plus the Surcharges and Cess on the amount of capital gain.

Yes, you can buy a property in India with an OCI card.

When you visit a website, it may store data about you using cookies and similar technologies. Cookies can be important for the basic operations of the website and for other purposes. You get the option of deactivating certain types of cookies, even so, doing that may affect your experience on the website.

It is required to permit the basic functionality of the website. You may not disable necessary cookies.

Used to provide advertising that matches you and your interests. May also be used to restrict the number of times you see an advertisement and estimate the effectiveness of an advertising campaign. The advertising networks place them after obtaining the operator’s permission.

Permits the website to recognize the choices you make (like your username, language, or the region you are in). Also provides more personalized and enhanced features. For instance, a website may inform you about the local weather reports or traffic news by storing the data about your location.

Aid the website operator to determine how the website performs, how visitors interact with the site, and whether there are any technical issues.